$500 million…or 9 tons if you like.

In an effort to save its nation, Venezuela raided its vaults to pay Iran for assistance it desperately needed to prop up the failing petrostate.

That goes to show you the lengths people are willing to go to get their hands on the precious metal.

But that’s not the end of the story.

Demand is skyrocketing for the hard candy…and I know where it’s going and the best options strategies to trade it.

Don’t worry if you’ve never traded an option before. I created the Ultimate Beginner’s Guide to Options Trading – a free, in-depth training video to get you started.

Even if you’re a seasoned trader, you’ll find valuable information in these segments.

Click here to watch Ultimate Beginner’s Guide to Options Trading training video

Now that you’re caught up on what you need to know, let’s go over the forecast and strategies to play gold.

All-Time highs within reach

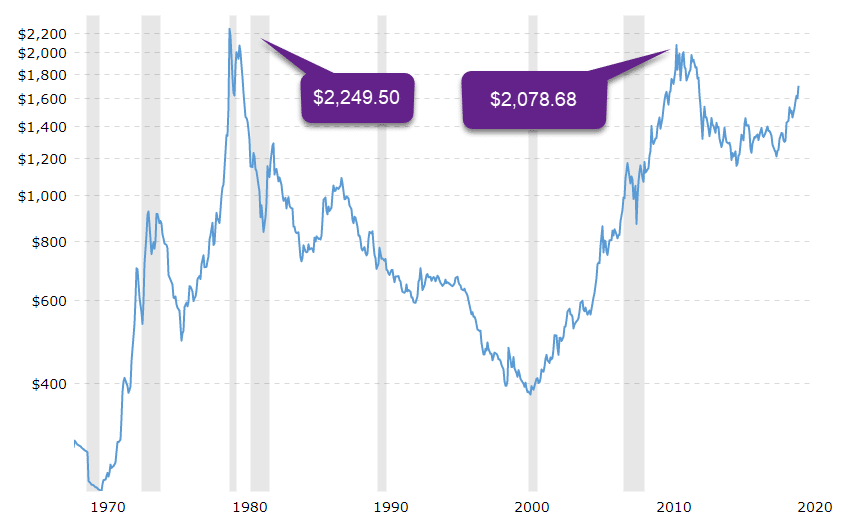

Back in 2011, gold hit record highs of $2,078.68. Technically, it wasn’t the highest gold had ever been. That record was set back in January 1980, when spot gold prices reached $2,249.50.

Gold spot price over time

The run from 2000 to 2011 was actually pretty remarkable. From 1980 until 2000, price slid from the all-time highs to just below $400 an ounce. From 2000 to 2011, price quintupled as it rose to over $2,000 an ounce.

Since then, price pulled back to just below $1,200 an ounce. Yet, the clearly bullish consolidation pattern never broke down.

Now, we’re clearly pushing off of a double bottom in gold that looks like it wants to challenge the all-time highs.

Guess what?

It’ll probably blow through them!

GLD ETF best play on the precious metal

Recently, I wrote a newsletter about how there’s been a disconnect between gold futures and gold spot prices. The crux of it is there isn’t enough physical gold in the right places to cover the contracts being issues.

In actuality, there’s probably not enough gold in the world to cover all the contracts if everyone took delivery.

What I did note was the popular gold ETF GLD was backed by a fair amount of physical gold being held in the main trading area in London. That makes it connected more to the spot prices of gold rather than futures.

Now, both have a real possibility of volatility from poor plumbing. In that same article, I noted problems with both the futures market and spot. However, when these arise, they can create opportunities to go long gold at lower prices.

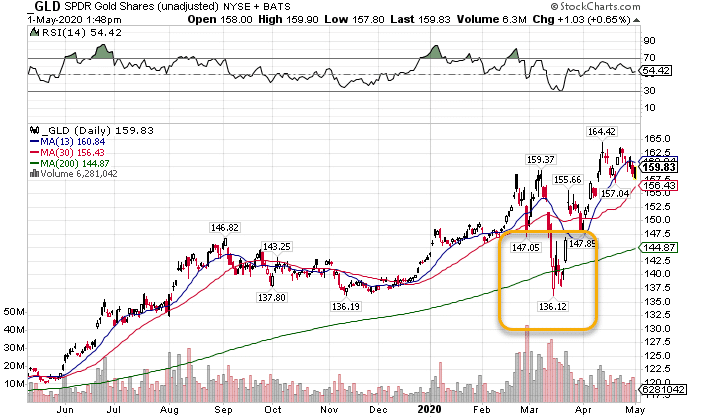

At the end of March, when markets were in freefall, forced liquidations caused GLD to plummed down to the 200-day moving average. For gold bugs, that turned out to be a gift.

GLD Daily Chart

When I look at the potential market uncertainties and garbage yields in bonds, I’m not surprised that gold saw the run it did. With an already bullish multi-year look, I expect it will not only challenge but take out the old all-time highs.

So, how do I plan on capturing this trade?

Put credit spreads off the best risk/reward

One of my favorite ways to collect money over the long term is by selling option premium. However, I don’t like the undefined risk of naked options. That’s why I cap them to create credit spreads.

If you’re not familiar with them, credit spreads are option strategies where you sell one option contract and buy another one further out-of-the-money to cap your risk. You can do them on both puts and calls.

Here’s an example I could take on GLD.

- Price currently trades at $159.

- I sell the $158 strike put contract that expires in 40 days for $2.00

- Then, I buy the $157 strike put contract that expires in 40 days for $1.75

- I collect a net $0.25 per option contract (multiplied by 100 shares of stock per contract).

The maximum profit I can make on the trade is $0.25 x 100 = $25 per spread. My maximum loss potential is the difference between the strikes less the credit I received. In this case that’s $158 – $157 – $0.25 = $0.75 x 100 = $75 per spread.

I like this trade for a few reasons. First, I know exactly how much I can win and lose at the very outset. Second, I don’t need to have the stock take off. As long as it stays above $158 by expiration, then I collect the maximum profit.

That’s important because gold could take years still to knock out the old-highs. So, I want a strategy that pays me while I wait.

Did you watch until the end of the training video?

If not, then you missed out on a chance to sign up for my free Options Masterclass.

But you’re in luck.