-$40.32.

That’s what crude oil traded at its lowest point this week.

Never in all of history has crude oil traded below $0 per barrel.

Yet, here we are days later with crude oil again barely trading above $13 a barrel… While the market shrugs it off like…

My inbox is flooding with email requests from Total Alpha traders asking me what this means and how it can be traded.

Ask and you shall receive!

I’m going to explain to you not just what’s happening in the crude futures markets, but what’s playing out in the real world.

Not only will you impress your friends on your new-found knowledge of the crude markets but you’ll also be positioned to profit on the next wave.

How crude trades

First, you should know that crude oil only trades as a futures contract. They’re basically like options except that you have to take delivery of the good, there is no choice in the matter.

Futures contracts trade in different expiration cycles. With crude oil, there are monthly expirations. When you get 5 days from expiration, you’ll experience what’s known as a roll. That’s where traders close their current month position and open a new one in the next month.

So, while the initial headlines were eye-popping, when we moved into June’s contract, oil jumped above $20 – at least for a little while. It’s also worth noting that a lot of the pressure put on the roll is because of large ETFs that are forced to sell the current month and buy the next month.

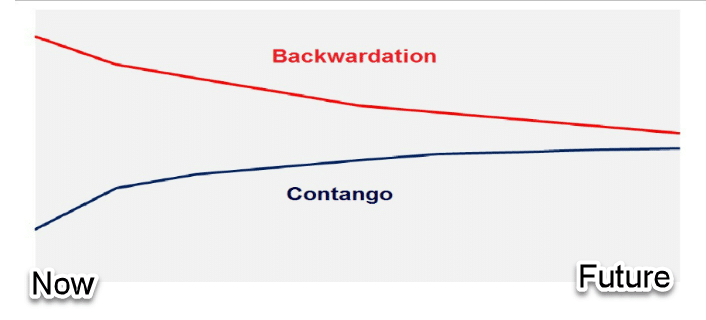

Typically, oil trades in a curve known as ‘Contango.’ Not to be confused with the Tango performed gracefully by Arnold Schwarzenegger and Jamie Lee Curtis in True Lies, Contango is a condition for most non-perishable goods where the further out you go, the more a contract costs.

This makes sense when you think about the costs of storing a product like crude oil. On the flip side, perishable goods like Milk trade in the opposite condition known as backwardation.

That’s why ETFs like USO and UNG lose value over time. When they roll from one month to the next, it always costs money.

How this played out in the real world

So, back to negative crude prices. There’s a lot of nuances about delivery and settlement in Cushing, Oklahoma that isn’t worth getting into. Suffice to say, drillers pushed their oil into storage as fast as possible to make sure they got it in before the lid closed.

Once it closes, there isn’t room for oil anymore. That basically means drillers shut off the production (AKA Shut in) and quite literally dump oil.

Most producers need $30 a barrel to breakeven, which we were far below before this. So, it’s reasonable to assume that not just in the U.S., but globally, any drillers not well-capitalized are going bankrupt fast.

On the flip side, you have what some traders are hoping is akin to the ‘greatest oil contango trade’ in history. Back before Iraq invaded Kuwait in the ‘90s, Phibro (oil trading arm of Salomon Brothers) bought a bunch of oil and loaded tankers with it. When prices shot through the roof on the invasion, they made massive returns. The guy running it bought an old-century castle in Germany from it!

Right now you have massive money buying up storage tankers and anything else they can get their hands on. They want to fill it with cheap crude and sit until it turns back to normal prices. It could take a while, but it could be a huge return.

Financial market impact

Now, we’ll probably see some companies shut down production entirely, which could also lead to a decline in natural gas stocks.

More than likely, we’ll see lots of little guys go out of business. And guess who’s going to be there to clean up the mess?

The big players with big pocketbooks. I’m talking Chevron (CVX), Exxon Mobile (XOM), etc. They have huge war chests to not just withstand the downturn but make a fortune on acquisitions.ews

Yes, these are names that I’m looking at for my Jeff Bishops Portfolio Accelerator.

Will they turn around tomorrow? Probably not. A large amount of this decline in oil is being driven by a lack of demand with the lockdown. But, as the world gets back to normal over the next few years, these guys will make buku bucks off this.

Does this set up trades for us? Not really. There’s a lot of money swinging for the fences here. Funds are going under. This carnage needs to clear some before it’s worth setting foot in the space. However, longer-term, the big integrated oil plays will create massive value even if we continue on the path towards renewable energy.

Lastly, I should mention the geopolitical implications here. Places like Russia, Venezuela, Saudi Arabia, and others rely heavily on oil revenues to fund their states. While they can run deficits for a while, they don’t have the luxury of being the defacto currency for the world as well as a diverse economy.

So, if this lasts long enough, things are going to go south in those places. They can’t get much worse in Venezuela, though anything’s possible. However, as we saw in the last decade, the Middle East is ripe for civil unrest. The Arab Spring started with one person self-emulating in Tunisia. If these large states can’t support their social programs, big problems will arise quickly.

Take advantage of these values

You don’t need a lot of skill to make money off these companies, just good timing. That’s why I created my Portfolio Accelerator. Creating generational wealth goes beyond trading. You need to learn to set money aside for the long-haul.

With my Portfolio Accelerator, you get access to my personal investment portfolio along with tons of information and insights into how and why I’m in each position. It’s not just enough to drop money into your 401K these days and hope for the best. You have an opportunity to take charge of your future.

Click here to learn more about Jeff Bishop’s Portfolio Accelerator.