A long time ago, on a trading platform far far away, I thought it would be a great idea to buy options right before earnings.

Let’s just say I learned my lesson the hard way.

It’s one of the rookie mistakes traders make, and today I want to help you avoid it.

In fact, it recently came up in an Ask Me Anything series from Emilio. You can check out my video answer below.

I get a lot of new traders in Total Alpha that don’t understand how options trade around earnings.

But that is all about to change after I explain to you the ins and outs of trading options during earnings.

After we’re finished you’ll realize that the juice is not worth the squeeze.

Options & Earnings

If you get nothing else from this article, it should be this – option premiums rise into earnings and fall immediately thereafter in the vast majority of instances.

Now, let’s understand why this happens.

Option prices come from three components – time until expiration, the distance of the strike to the current price, and implied volatility.

The first two of these are pretty easy to understand. The longer you have until expiration, the costlier the option. As you get closer to expiration, the time decay component speeds up at an exponential rate.

Distance to the strike changes as the stock moves around over time.

The third component is the one I want to focus on – implied volatility.

Implied volatility is the annualized percentage change expectation in share price. I say annualized because they may expect only a 1% move in the upcoming week, but annualized it might be 12%. As traders, we tend to discuss both.

What most people don’t realize is implied volatility is actually demand of options. The greater the demand, the higher the implied volatility, and the costlier options become.

Once you think about it, it intuitively makes sense why implied volatility rises into earnings and falls immediately afterward. Earnings typically provide information for investors to make their decisions. Otherwise, they don’t get much during the quarter.

However, traders really don’t know whether the stock will move higher or lower. So, we tend to see both calls and puts get more expensive.

Using Earnings To Your Advantage Part 1

There are two great ways to take advantage of this earnings nuance. The first is straightforward, the second not as simple.

Consider for a moment the facts we know – option prices rise into earnings and fall afterward, all things being equal.

So, if I want to go long puts or calls on any stock near earnings, I can use this to give me an edge.

Here’s how it works using Wayfair (W) as an example.

First, I start with an hourly chart setup.

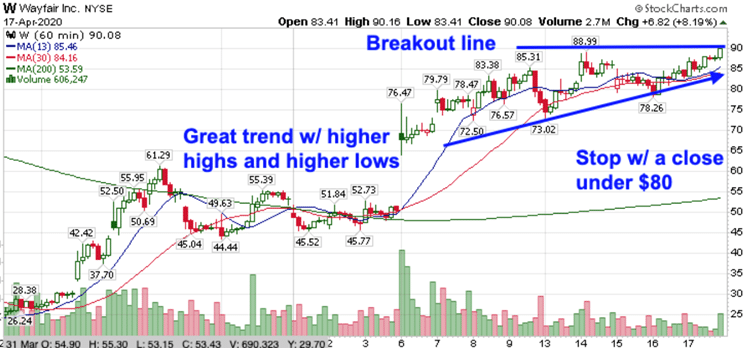

W Hourly Chart

For any trade I take, there has to be a setup underpinning the entire play. I won’t take a run into earnings by itself.

Now, this is a play on Wayfair (W), who has earnings coming up shortly. You can see how I identified my stop, with my target as either a symmetrical move higher, or roughly $100.

On May 5th, Wayfair will report it’s quarterly results. So, I want to pick an options contract that expires beyond May 5th.

Remember, I want to be out of the trade before earnings. However, I just want to use the increase in implied volatility to give me an edge.

So, as long as I pick options that expire after that date and exit the trade prior to earnings, I’ll be fine.

That way, as we get closer to earnings, implied volatility increases and so does the price of the option.

Using Earnings To Your Advantage Part 2

The second way to use earnings for options is a bit trickier and not something I typically do. However, it’s an interesting play worth talking about.

Before every earnings, you can determine what the implied move is based on the at-the-money options contracts. It’s a pretty simple formula.

- Take the closest at-the-money put and call option

- Add the two together

- Multiply by 85%

Now that you have this information, here comes the fun part (though it takes some work). You can look back and find the average move for the stock after earnings going back however many years you choose.

For example, let’s say that Apple moves 10% on average after earnings. However, the implied volatility expects a 20% move.

From there, you can create an options strategy that takes advantage of the likely overstatement of implied volatility versus what we’re likely to see. Normally, this involves selling out of the money options such as credit spreads or iron condors.

The Options Masterclass

One of the best ways to learn all the tricks with options is through my upcoming options Masterclass. You’ll get all my best tricks and tips I’ve accumulated through the years.