Banks didn’t give investors a lot to cheer about this earnings week.

Most of them saw profits slashed by 40%, 50%, or even more.

In other words…

Buckle up, cause we’re in for a rough ride!

But overall, the market has moved from completely oversold to way overbought.

Do you:

- Start chasing stocks up

- Develop a plan to short

- Or just trade what you see

I know it’s tricky.

And while I don’t have a crystal ball, I’m not afraid to tell you what I’m doing with my money.

Here’s what I’m looking at specifically, and what I’m plotting on my next move.

Energy is bad…and it’s going to get worse

It was billed as a historic agreement. Even President Trump got involved. In the face of plunging demand and an overabundance of supply, OPEC curtailed production by the largest amount in history.

A lot of traders are wondering why energy prices continue to decline. Shouldn’t the agreement mean an improved outlook?

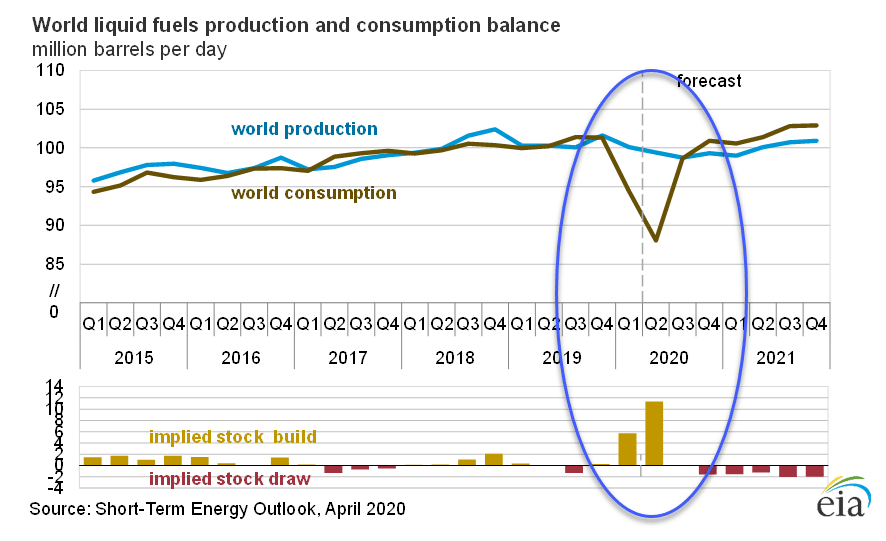

The problem is that production doesn’t suddenly come offline. In fact, you won’t see meaningful reductions until the 3rd to 4th quarter of this year. You can see the government information below how drastic the disparity is for the second quarter of this year.

In the interim, there is a real risk of running out of storage capacity. That includes regular and variable storage such as transportation tankers.

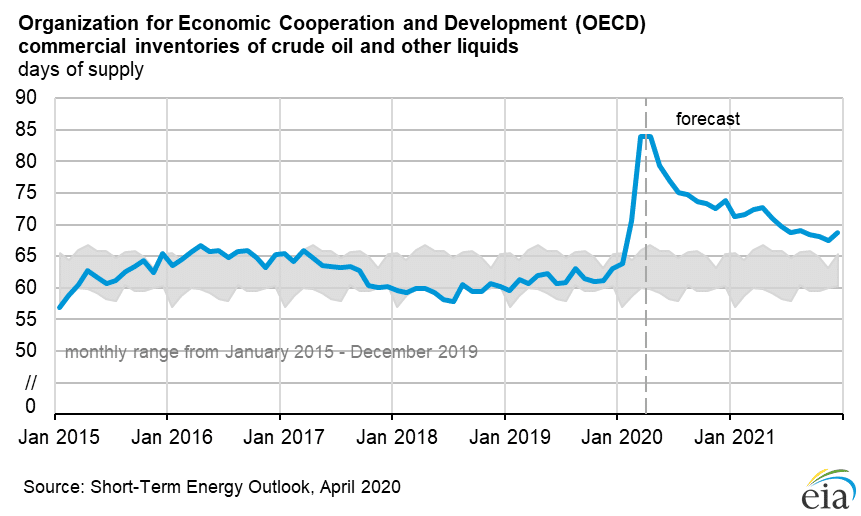

To give you an idea of how big the build is, take a look at the inventory forecast.

Some independent analysts fear that we’ll run out of space by mid-May. That could cause a host of issues that we haven’t seen in our lifetime.

As oil prices plunge, U.S. frackers and drillers continue to burn cash. Different wells and companies have different prices they need to remain profitable. However, I can comfortably say that none of them can do it at current levels.

The worst part for these drilling companies is it isn’t likely to get better in the coming months. However, the ones with the big balance sheets stand to gain handsomely.

Your big players like ExXon Mobile (XOM), Chevron (CVX), etc. should have the money and credit lines to weather the storm. In fact, I expect some of them will go out and scoop up smaller players at pennies on the dollar.

That’s why I’m particularly interested in these companies over the long-term, especially for my investing portfolio.

You can sign up for my free investing newsletter by clicking here.

Outside of the long-term action, I wouldn’t touch this sector with a ten-foot pole. Instead, I’ve got my eye on one that’s been pretty sweet of late.

Biotech Breakout

It probably goes without saying that with a pandemic front and center, certain biotech companies stand to profit. Some are working the vaccines while others simply provide testing or even cotton swabs.

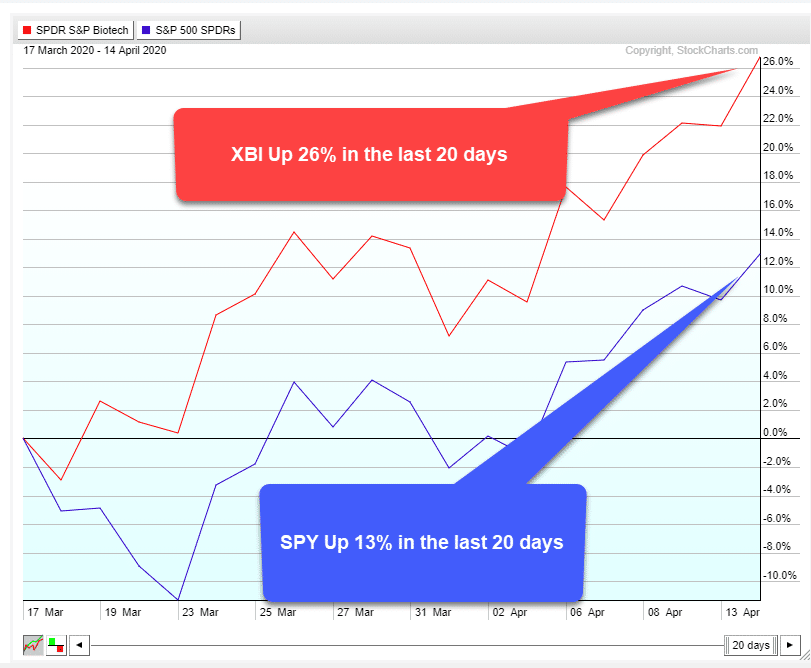

You can see the relative outperformance with the XBI Biotech ETF.

Just the other day I picked Amgen(AMGN) for my Bullseye Trade of the week. Let’s just say that one turned over a nice profit.

Click here to learn more about Bullseye Trades

One of the ways to line up your swing trades for maximum profits is to select names in sectors with relative outperformance (or underperformance if you’re going bearish). Beyond the biotech names, there’s a host of ‘stay-at-home’ names such as Netflix (NFLX), TeleDoc (TDOC), Zoom (ZM), and more.

Now, this area’s probably due for a pullback soon. However, I expect that any retracement it makes will be much more shallow than the overall market.

Sticking with liquid names and limited risk

There are a few times you want to be a bit more cautious than normal. This happens to be one of them.

We’ve already seen the market swallow up several hedge funds as well as high-flying stocks like Luckin Coffee (LK). There’s an extra risk to account for now that doesn’t typically exist.

For my Total Alpha trading, I’m doing two things. First, I’m sticking strictly with options. I want to both be an option seller and buyer of risk defined trades. This means I know exactly how much I could potentially lose on any given trade before I enter.

Second, I’m sticking with big names that trade lots of volume. When stocks whip around, we often see wider bid/ask spreads for option contracts. That gives the market makers a bigger advantage over the average trader.

By sticking with stocks that trade plenty of volume throughout the day, I reduce the chances of these fat cats stealing any more of my money than they have to.

If you’ve never traded options before or aren’t sure if they’re right for you, then you’re in luck!

In my free Masterclass, I go over not just option basics but some other insights that you can use in today’s market.