We’ve got a jam-packed week coming up with information flying at us from all angles.

Signs finally started to emerge of progress as New York’s new Coronavirus cases began to plateau day to day.

Looking across the pond to Italy, they’re finally seeing a meaningful decline in cases. Even Spain has begun talking about restarting the economy.

However, don’t start plopping cash down into stocks quite yet.

There’s still a lot of data we still need to cover before deciding on the best course of action.

For that, we start with the one place your money requires you to pay attention to – earnings.

Brother Can You Spare Some Change

Banks kickoff the most curious earnings season in history. We get our first insights into how far demand fell from the Coronavirus.

Jaime Dimon and other CEOs already set expectations for economic retrenchment worse than the Great Recession. Lending certainly fell outside of the government stimulus measures.

Three key areas will tell us a lot about the coming months. First, oil and gas loans.

Investors already know which banks hold more risk from fracking exposure.

What I really want to know is how bad things will get. Are we going to see 50% of drillers fold or has most of the clutter already been swept off the board?

Second, financial market stability. Nearly every recession or depression starts and ends with the banks in one way or another.

If CEOs start talking about tightening credit conditions or liquidity issues, that’s when we need to worry.

Finally, the consumer outlook. I don’t expect they’ll be able to offer much insight with so much unknown.

However, listen for clues about which sectors continue to spend despite the lockdown.

Country Roads, Take Me Home

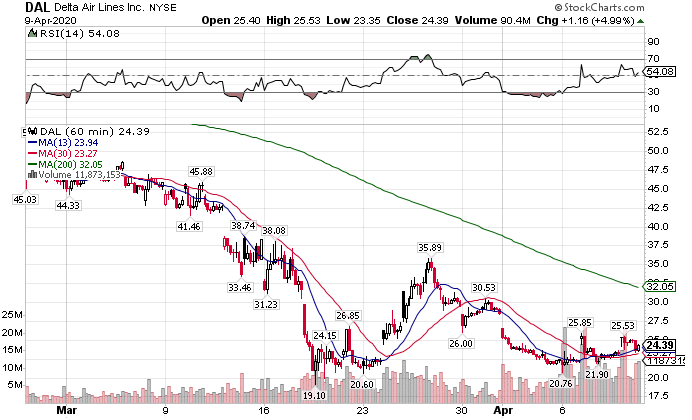

Two major transport companies give us our first look into main street. JB Hunt (JBHT) and Delta Airlines (DAL) offer a look at the bookends of the economy.

Delta is sure to be an interesting earnings call. Reports stated they are hemorrhaging $50m a day.

Their balance sheet and operations shine compared to United Airlines (UAL).

But, their exposure to international air travel hurts more than Southwest Airlines (LUV).

With the stock beaten up like every day is its first day at school, I want to know how they plan to survive.

Specifically, will they require government money, or can they exist on their own credit?

DAL Hourly Chart

If they can offer a pathway back to former glory, shares could surge higher.

At the other end, JB Hunt tells us exactly how our transportation network changed.

We already know that food distributors from Sysco (SYY) to Gordon Foods were forced to rethink their food supply chains.

I expect to get an idea of how much demand really increased through grocery stores.

That should give us a sense of whether they and consumer staple companies deserve richer multiples.

The Kids Can Hear You Fighting

Any rare moments of bipartisanship were fleeting at best.

As the paycheck protection program runs out of funding, Republican leaders quickly moved to shore up the program.

Yet, it appears they didn’t inform their Democratic colleagues beforehand. Democrats want to provide additional money for state and local governments and hospitals.

However, Republicans balked at the idea, refusing to broaden the scope beyond the PPP, wanting to save those negotiations for the phase four stimulus.

At least their cordiality is a step above the Brooks-Sumner affair of 1856, in which one Senator Brooks beat Senator Sumner to within an inch of his life using his walking cane…so that’s something.

The money will flow eventually regardless of any jawboning, and there will be funds for both sides, it’s inevitable.

Despite bluster at the federal level, the White House abdicated responsibility for managing the crisis to the states.

Any guidelines or lockdown from the executive branch hold very little sway in the direction of the country, including any councils to re-open the economy.

Instead, we’ll be left with a patchwork of regulations and tests that likely impedes the economic restart.

Even if restrictions at all levels were removed, a large segment of the population likely won’t wander outdoors until we have some extensive testing or vaccine implemented.

Data Delivery

We’ve got some key economic data coming out this week that’s sure to spark some dinner conversations.

March retail sales give us our first comprehensive look at the gravity of the slowdown.

I’ll be interested to see if there’s any life in the hardest-hit sectors. We’ll probably get a few surprises in here as well.

Jobless claims hold the hotspot Thursday. It’s unlikely that we still have captured the full extent of all the claims.

Many out-of-date state systems can’t keep up with the load, creating massive bottlenecks.

Not to be completely left out, we get a look at home buying data which is sure to be abysmal.

It’s got to be tough to shop for a new place when you’re locked in your old one.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Mar 4), COST (Mar 5)

Stocks I want to buy…

MJ (none), UNG (none), XLE (none), WDAY (May 26), TWLO (May 3), OLED (May 7), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), CVNA (May 13), CMG (Apr 22), NFLX (April 21), AMZN (Apr 23), UBER (Jun 4), GDX (none), ROKU (May 13), MTCH (May 5), TDOC (May 5), ZS, AYX, RH, WORK, IWM

This Week’s Calendar

Monday, April 13th

- None

- Major Earnings: Delta Airlines (DAL)

Tuesday, April 14th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Import Prices March

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: JB Hunt Transportation (JBHT), Fastenal Co (FAST), First Repub Bank (FRC), Johnson & Johnson (JNJ), JPMorgan Chase & Co (JPM), Wells Fargo & Company (WFC)

Wednesday, April 15th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – Retail Sales for March

- 8:30 AM EST – Empire Manufacturing for April

- 9:15 AM EST – Industrial Production & Capacity Utilization for March

- 10:00 AM EST – NAHB Housing Market Index for April

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Bank of America Corporation (BAC), Citigrp Inc (C), Goldman Sachs Grp (GS), PNC Finl Svcs Grp Inc (PNC), UnitedHealth Grp Inc (UNH), US Bancorp (USB), Bed Bath & Beyond (BBBY)

Thursday, April 16th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Housing Starts & Building Permits for March

- 8:30 AM EST – Philly Fed Survey for April

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Abbott Laboratories (ABT), Bank of New York Mellon Corp (BK), Blackrock Inc’A’ (BLK), KeyCorp (KEY), Rite Aid (RAD), United Airlines Hldgs Inc (UAL), Western Alliance Bancorp (WAL)

Friday, April 17th

- 10:00 AM EST – Leading Index for March

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Danaher Corp (DHR), Honeywell Intl (HON), Kansas City Southern (KSU), Regions Finl Corporation (RF), Schlumberger Ltd (SLB), State Street Corp (STT)