Everyone likes to talk about their winners.

But very few care to discuss their losers.

Yet, if there’s one secret Jason Bond has taught me, it’s that we can learn just as much from our losers, if not more.

I bring this up, because I recently got smoked in an options trade in – Zoom Communications (ZM).

You see, I failed the basic risk management skills that I talk about in my free Masterclass.

Sometimes even I need a reminder of the basics

I’m going to rundown what went wrong here. That way, you can avoid some costly mistakes in the future.

Story Arc

Zoom Media came into prominence as folks started working from home. The company enabled businesses to teleconference from their computers without heavy amounts of equipment.

If you’ve ever done the old Cisco cameras and televisions in a big conference room – it’s kind of like that but online.

Droves of people flocked to their service as they offered free limited use meetings, which was ideal for ad-hoc needs. Bigger companies signed up in droves as they needed a way to connect their employees.

Zoom was only too happy to offer up their program to folks around the globe. That led to a historic run on a company that only made $0.09 per share (although that’s more than most IPOs).

The Setup

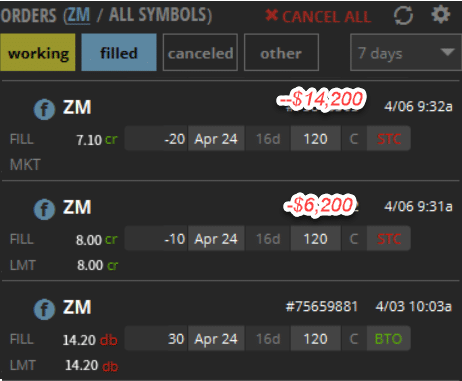

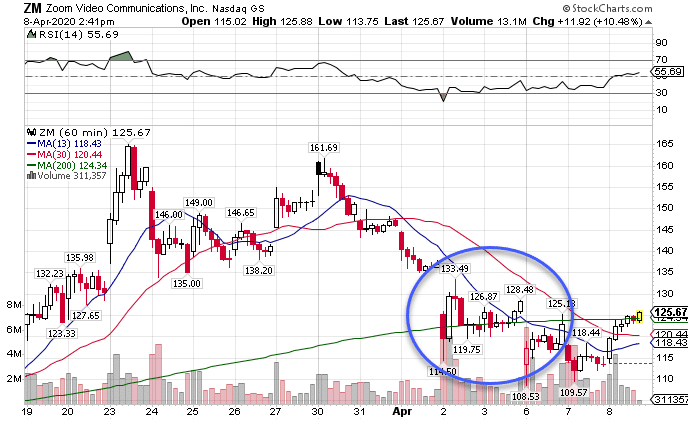

After a meteoric rise, Zoom pulled back to the 200-period moving average on the hourly chart, a key indicator I talk about in my Masterclass. This often acts as support, especially for stocks in a bullish uptrend.

ZM Hourly Chart

I didn’t enter the trade immediately. Instead, I wanted confirmation the support would hold. So, I waited until the 4th before pulling the trigger.

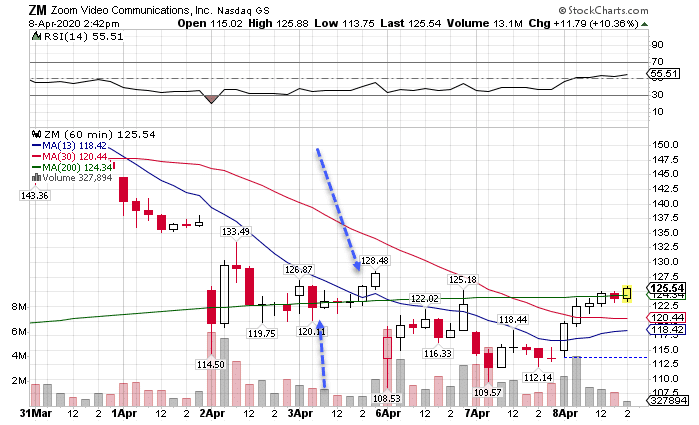

Now, let’s get into more of the specifics around the entry and exit. In the chart, the left arrow shows the initial entry point when I bought the options.

ZM Hourly Chart

Good news is that I played the setup correctly. My analysis was strong, and I waited for confirmation.

When I entered the trade, the stock was just above $120. By the end of the day, the price jumped to nearly $130. The options that I bought for $14.20 were worth up around $16.50. If I had closed the trade right there, I would have made about $7,000.

Instead, I carried the entire position through the weekend. It just so happened that Zoom got whacked on news of hacking issues with their app. That cut my options by over half their value from the Friday close.

Assessing The Mistakes

One of the key ingredients to successful trading is risk management. I harp on this in nearly everything I teach. This is the single biggest difference between an amateur and a professional trader.

In this case, I failed to adhere to my own advice. One of the easiest ways to ensure you hold onto profits is to lock them in early.

A great technique I often talk about is scaling out of trades. This involves exiting the position at multiple points and is a tool used by professional traders around the world.

None of us know exactly how far a stock will run. However, you want to have some way of maximizing your potential. Scaling out of trades does that. You trade of trying to pick off the top or bottom with capturing better than average profits along the way.

So, how would I have applied this to the Zoom trade?

For starters, I should have taken off a portion of the trade on Friday at a profit. That would have let me capture some cash going into the weekend. Even if the stock dropped on Monday, I wouldn’t have taken such a large hit.

Second, and in conjunction with the first point, I should have taken off more than normal when locking in profits. Volatility plagues this market. Weekends create more event risk than simply holding overnight. Therefore, if I normally took off half, I’d want to take off 75%.

Now let’s consider what would have happened if I had done either of these and then exited the trade Monday with the remainder at $8.00.

- With 50% of the trade-off on Friday at $16.50, I would have only lost $5,850.

- Taking 75% off would have walked away with $950.

That’s the power of risk management. Instead of a $20,000 loss, I could have turned a profit! Now, what would I potentially give up if the options went to $28 on Monday? $26,450. That seems like a lot. However, capital preservation is the name of the game, especially in this market environment.

Join Me For My Free Masterclass

While we’re all stuck at home, do yourself a favor. Get a free education with my upcoming masterclass. I’ll be discussing some of the very concepts I went over in this newsletter.