While some people fear volatility and wide swings in the market— I welcome them.

You see, for an options trader like myself, it allows me to get a bigger piece of the pie on my credit spreads.

Just yesterday, I closed out a fantastic $25,000 profit in Costco using a simple technique that I’ll be teaching you about today.

I saw that Costco was stuck in a trading range so I decided to implement an options strategy that takes advantage of that.

In this case, my weapon of choice was a strategy called the iron condor.

When you do it right, it allows you to capture more time decay and even reduce your risk.

To give you a well-rounded view, I created a comprehensive analysis video on the Costco trade. In it, I explain how I worked my way through the trade step by step.

Click here to watch trade recap video

Also, it’s worth mentioning, that I did not execute this trade in the traditional manner. In fact, you may have never heard of this approach.

But I’ll explain it to you here.

Back to basics

First, let’s go over how credit spreads are put together and how they can be used to form iron condors. Credit spreads are risk defined trades where you know exactly how much you can win and lose from the get-go.

Credit spreads come in two varieties; put and call credit spreads. Their structure is relatively simple. You sell an option contract at or out of the money on a stock. Then, you buy an offsetting option contract that is further out of the money.

Let’s use my Costco trade as an example.

In this trade, I had a put and a call credit spread to create an iron condor. Here’s how I structured the put credit side.

- I sold the $280 put on Costco expiring on April 3rd

- Then, I bought the $275 put expiring on April 3rd

- That paid me a credit of $1.60

In this trade, my maximum risk was the difference between the strike prices less the premium I received. With the width of the strikes being $5, the maximum I can lose would have been $3.40. My maximum profit potential was the $1.60 per contract I received.

Next, I added on a call credit spread as follows:

- I sold the $297.50 call expiring on April 3rd

- Then, I bought the $302.50 call expiring on April 3rd

- That paid me $0.95

Again, my maximum potential loss would have been $4.05, with a $5.00 distance between the strikes and a $0.95 credit. The maximum profit I could have received would have been the $0.95 credit.

In order to achieve maximum profit on either trade, I needed Costco to close outside of the strikes at expiration. That meant Costco needed to close above $280 and below $297.50.

Legging into the trade

As you might have suspected, once a trade has both a put credit spread and a call credit spread with the same expiration and same underlying symbol, you created an iron condor.

What’s cool about iron condors is that you cannot lose on both sides of the trade. If you lose on the put credit side, the call credit side expires worthless and visa versa.

Typically, when you put on an iron condor, you do it all at once. However, legging into the trade means that you put on in pieces. This works really well for stocks that like to trade in ranges like Costco.

Here’s what I mean.

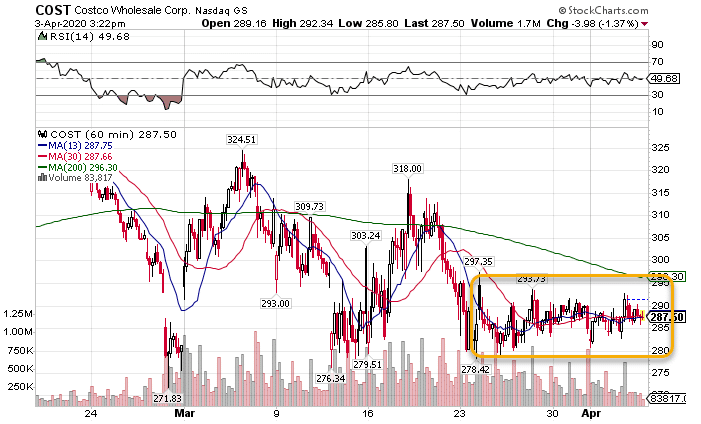

After markets settled out, Costco started trading in a pretty tight range.

COST Hourly Chart

I could certainly have just put the trade on around $285 and called it a day. However, by using the range from $275-$290, I was able to get a bigger credit than normal.

For most iron condor trades, I try to collect 1/3rd the width of the wings as a credit. In this case, I received $2.55, over half the distance between the strikes. That meant I would make $2.55 per contract with a potential risk of $2.45 per contract!

The obvious question is what do you do when the stock doesn’t trade to the other end of the range. In that case, I treat it the same way as any normal vertical spread.

For me, if the stock starts closing daily beyond the furthest strike, I simply close the trade. That keeps me from taking the maximum possible loss and lets me live another day.

A word of caution. The legging concept works best with stocks training in a sideways range. Trending stocks can be difficult as the support and resistance points constantly move.

Learn The Tools of the Trade

One of the best ways to get involved with this market is with my free masterclass. You not only learn the option techniques I use every day, but I reveal the lifecycle phases a stock goes through.

With most of us stuck at home, you don’t have an excuse not to attend my free masterclass.