There is something different that’s happening to the options market right now. And if you’re not aware of it, it could end up costing you a lot of money.

Optimal mechanics state that you want to sell options or spreads with expirations 30-45 days out. This maximizes your time decay and the probability of success.

Try that now, and you’re probably staring down at a winnowing portfolio.

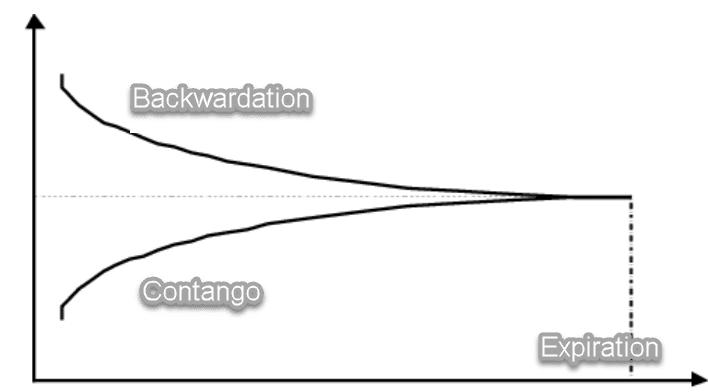

Traders hate uncertainty. That’s why we see volatility higher in later-dated months than in the near-term under normal conditions.

If you think about it, that makes sense. We never know what the future holds from earnings to black swan events.

However, the market is gripped with so much fear and panic, everyone is racing to protect their portfolios right now.

In other words, the market is telling us that investors expect things to calm down in the future.

You actually see this happen around earnings all the time! Earnings are big unknown events. Traders don’t know what will happen, so they bid up option contracts expiring just after their release.

Traders use the terms contango and backwardation to express these two different phenomena.

It is incredibly rare for backwardation to exist in the VIX and overall volatility, but that’s the world we live in right now.

I want to explain what this means for you, why this happens, how it changes the risk structure, and some strategy adjustments along with examples to not just save yourself some coin, but make a few along the way.

Why Near-Term Options Are So Expensive

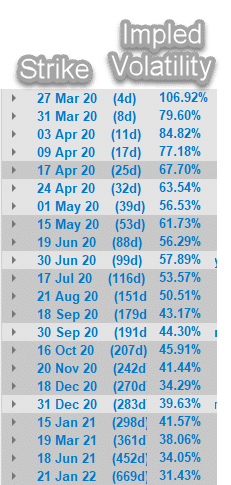

Take a look at a current option chain for the IWM:

IWM Implied Volatility

What you’re looking at is a list of all the expirations for the IWM going out of a couple years. Down the right side is the average implied volatility across all the options.

Here’s what’s unusual. See how the implied volatility gets lower as you go further out. That only changes around September.

So what’s causing this?

We’re seeing investors clamor for protection, buying up puts left and right on everything from the SPY to AAPL. They fear the current uncertainty but think it will clear itself up eventually.

That’s why short-dated options have higher implied volatility than longer-dated ones.. It signals investor panic.

However, this creates an excellent opportunity for Total Alpha Traders.

How time and risk changed

In the past few weeks, we’ve had 10% swings in the market in a single day! That’s extraordinary when you compare it to the 30% gain stocks made in all of 2019.

When you seek option expirations further out in time, you get paid more as a seller. However, instead of having natural declines in implied volatility working for you along with time decay, implied volatility works against you.

Think of it this way. Under normal conditions, options lose value over time both from time and volatility decay. As an option seller, you have both things working for you.

Right now, we have the exact opposite happening for volatility. You still get time decay working for you, but currently, volatility is working against you. That’s why going out further in time actually increases your risk in this environment.

This is how I’m playing the market

I’ll start by saying that the risk right now is to the downside. However, we can get face-melting rallies in the interim. So, I want to make sure that I create high probability situations for myself.

Right now, that means I’m selling credit spreads, strangles, and naked options far out-out-of-the money…but with shorter-dated expirations. Instead of 30-45 days out, I’m picking options with one to three-week expirations.

For some of the riskier options strategies like strangles and naked options, I’ll play it close to the vest, typically going out only a week or two. With implied volatility so high, I’m getting enough credit for these trades I don’t need to take on the extra risk.

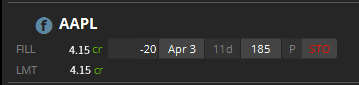

Here’s an example from yesterday. I sold AAPL puts that expire April 3rd (10 days away) at the $185 strike price for $4.15 in my Total Alpha Account.

That’s a massive credit. I’m getting paid 2.24% of the strike price for just two weeks. Plus, the stock is over 15% away from that strike.

Two things could hurt this trade. First, if implied volatility continues to rise, that would make the options more expensive. That’s possible but not very likely. With IV at record levels, odds favor an IV contraction.

Second, and most apparent, if Apple trades below $185 by more than $4.15 at expiration, I lose on the trade. The amount I lose depends on how far below $185 the stock goes.

This inversion will pass

Nothing lasts forever (though it may feel like it). At some point, the market will find a bottom. Even during the Great Recession, inversions in volatility righted themselves out often within a month.

It could take the entire summer to work through what we’re seeing now. The key is to be prepared for when it turns. That starts with knowing how to read the charts and look for the signals.

One place to acquire these skills is with my upcoming masterclass. You can register for free to learn how I look at the life cycles of stocks and trade options in my personal portfolio.