The Coronavirus stands at center stage, holding everyone’s attention. There are two questions we want answered:

- When will this end?

- What will be the total damage?

There is one single metric you should be watching – number of daily new cases in the United States.

Once that peaks and starts to decline, we will likely find a bottom in the market.

But how do we begin to answer the second question?

What the market craves is certainty. That’s why this week’s jump focuses on the areas to watch for answers to our second query.

Plus, I want to offer some tips on timing the market I’ve used these past two weeks in my Bullseye Weekly trades to hit some big winners.

It could work for you too.

There is plenty to cover, but first I want to talk about junk bonds and its utter collapse.

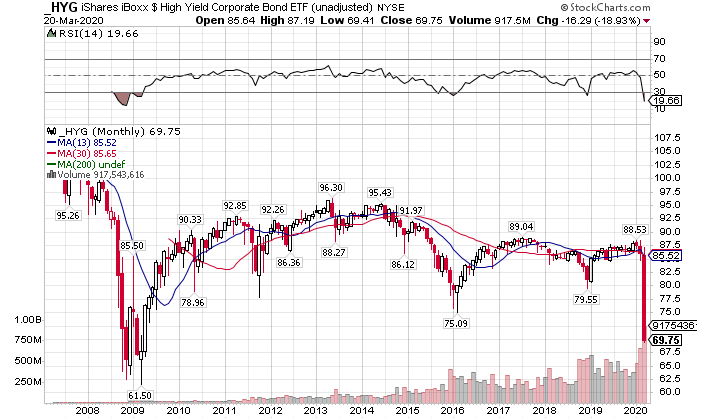

Junk Bond Collapse

If you look at the high yield debt market selloff, investors are saying they expect a lot of companies to go out of business. That’s a real possibility.

HYG Monthly Chart

We’ve had companies propped up by easy money and large quantities of debt for years now. Yes, the Fed can certainly keep this going.

However, I’m going to say this is a good thing. Clearing the deck of unprofitable companies leaves the ones left in a much better position to grow. They don’t have to fight for market share with players that have no business existing in the first place.

Pricing risk is an essential component of equity and debt markets. Finally getting back to a point where money isn’t thrown at every startup should increase both the quality and viability of the survivors.

Watch Jobs Like A Hawk

Weekly jobless claims come out every Thursday at 8:30 Eastern Standard Time. I’ll be keeping a close eye for this to peak and decline in the coming months.

Right now, estimates are a potential loss of several million jobs. The first look at that will show up in the unemployment claims. Granted, this may be stalled from shelter-in-place and curfew restrictions, so we may not see things show up for a month or two.

Along with the jobs numbers, keep an eye on service sector health reports. We all know that they are getting hit the hardest. What I want to see is the numbers bottom out and start to recover.

Earnings Puke

During the Great Recession, companies took the opportunity to throw up every bad thing on their balance sheets. Expect the same thing to happen in the coming months.

Corporate earnings will be effectively useless. Anything a company made will be historical and none of them can forecast what’s to come for the same reasons none of us know when we get to leave the house.

Heck, Delta’s burning $50M in cash a day!

My advice – only listen to what they have to say about how long they can survive. The ones with strong balance sheets will make it through.

Here’s How You Can Still Make Money

There’s a whole lot of money to be made out there if you know where to look.

Typically, I deliver my Bullseye Trade of the Week Monday morning with all the info needed to take the trade…

Except this market is anything but typical.

Instead, I’ve held back until we get our regular Monday selloff. ONLY THEN, do I dip my toes in and start delivering the my entries and price targets.

Not everyone is taking the ride. But some members absolutely killed it last week.

This was definitely one of the best Bullseye weeks so far!

The increased volatility makes it possible to hit these whoppers. Timing becomes critical.

Do yourself a favor. Look at the past few weeks of trading day by day. See if you notice any patterns as to how the market is moving both between days and intraday. You might be surprised what you find.

If you’re having trouble, try picking up some tips from my free masterclass. It’s a great way to learn some new techniques for looking at charts and trading the markets.

Stocks I want to bet against…

TLT (none), ZM (Mar 4), COST (Mar 5)

Stocks I want to buy…

MJ (none), UNG (none), XLE (none), WDAY (May 26), TWLO (May 3), OLED (May 7), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), CVNA (May 13), CMG (Apr 22), NFLX (April 21), AMZN (Apr 23), UBER (Jun 4), GDX (none), ROKU (May 13), MTCH (May 5), TDOC (May 5), ZS, AYX, RH, WORK, CRWD, IWM

This Week’s Calendar

Monday, March 23rd

- Major Earnings: None of note

Tuesday, March 24th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 9:45 AM EST – Markit US Manufacturing & Services PMI March

- 10:00 AM EST – New Home Sales February

- 10:00 AM EST – Richmond Fed Index for March

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Grocery Outlet Holding Corp (GO), At Home Grp Inc (HOME), Nike Inc Cl B (NKE), ProPetro Hldg Corp (PUMP), Steelcase Inc’A’ (SCS)

Wednesday, March 25th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Paychex Inc (PAYX), Winnebago Indus (WGO), Micron Tech (MU), Paysign Inc (PAYS)

Thursday, March 26th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – Kansas City Fed Manufacturing Activity March

- Major earnings: Signet Jewelers Ltd (SIG), Gamestop Corp (GME), KB Home (KBH), Sportsman’s Warehouse Hldg (SPWH)

Friday, March 27th

- 10:00 AM EST – University of Michigan Sentiment March

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: None of note