I know a lot of traders are struggling in this market. Headlines like ‘Dow Plummets 3,000 Points’ grabs folks attention, sending a shiver down their spine. Instinctively, they hit the sell button at the exact wrong time.

My advice: Ignore the headlines and focus on what the charts instead!

You need to stop what you’re doing and listen up. I’m going to give you three keys to not just winning in this market, but winning big. Instead of running for the hills, I want to be selling premium, collecting gold, and managing risk.

We’ll see plenty of headlines drop over the coming weeks and months. Infection cases will grow both in the U.S. and globally. That’s a given.

What I want to do is assess the situation objectively. Stocks pulled back from stretched valuations to pretty attractive levels. With the Fed supporting the markets, this is the time to pick your spots.

I’ve got a few examples I want to share with you along with some tips that will keep more cash in your pockets.

Grab some gold

For the past few weeks, I’ve been telling Total Alpha members about gold. I saw plenty of signs that a pullback was imminent. Within this environment, I like gold to outperform by a wide margin.

Recently, I wrote a newsletter about my trade in gold as well as shared a video recapping my strategy. With equities looking rather dicey, I liked gold as a hedge against the market. Investors like to use gold as a ‘safety’ play that trades the opposite of the markets.

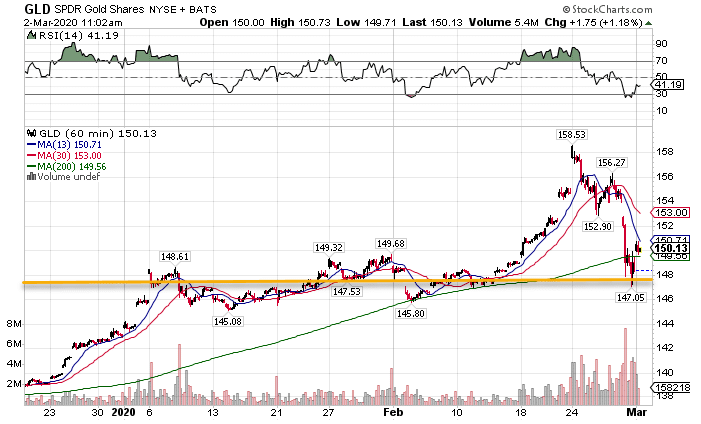

Let me show you what I saw in gold from two angels. First – the hourly chart.

GLD Hourly Chart

Prior to the recent breakout, gold had a nice bullish uptrend in place. It kept making a series of higher highs and higher lows, along with the 200-period moving average providing excellent support.

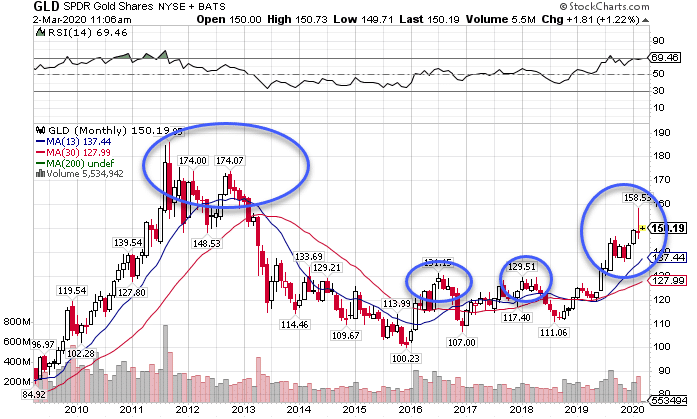

Now, I want to take you out to a monthly high-level perspective and show you something interesting.

GLD Monthly Chart

Long before this market tanked, and even before it really the rally to end the year, gold had closed above its recent highs in 2016-2018. That told me this wasn’t a short-term run but something more substantial.

That’s why I think gold could get all the way up to the all-time highs we saw back in 2011-2013.

Sell into drops

When markets drop, implied volatility rises. It’s not a 100% correlation, but it’s in the high 90’s. That makes options expensive to buy but great to sell.

Picking the right stocks becomes essential. For that, I look at the broader landscape to see what’s going to rebound and which will lag.

There are two macroeconomic themes dominating the news right now: Coronavirus and The Fed.

School closings, travel restrictions, and government policies that keep folks in their houses hurt companies that rely on discretionary spending. That means airlines hurt, amusement parks, or anything else that relies on attendance.

On the flip side, companies that improve the home entertainment experience stand to benefit. That includes streaming services, gaming companies, and even home delivery services.

Now, as the market swings from the upside to the downside, I want to be selling call credit spreads into rallies and put credit spreads into declines. Typically, I go out 30-45 days for expirations but may choose shorter-dated contracts based on the charts.

When I sell options I get time decay working in my favor. If I sell when implied volatility is high, that means declines in IV also work in my favor. That’s the edge to making consistent gains in this market.

That’s why I prefer not to buy puts or calls outright. With implied volatility elevated, I’m fighting both time and IV decay.

Adjust your risk

Volatility means opportunity. But if you’re not careful, the swings can knock you out of trades. That’s why I reduce the amount I put into each trade.

Think of it this way. Normally, a stock moves around $5 in an average week. In this environment, it could jump around $7.50. That’s a 50% increase in volatility. Why not use this to your advantage?

I scale back my trades sometimes as much as 50% of what’s typical. Instead, I let the increased price movement work in my favor. That means scaling in to trades and scaling out. I’d rather make a bunch of small trades than one giant trade.

Focus on your setups

Above all else – trade within your comfort zone. No one knows your strategy better than you. Just because the markets go wild doesn’t mean that you need to abandon your trading plan.

A great example is Nathan Bear. He’s primarily a long trader. He’s found fewer trades in this environment. But, he’s just fine with that. He waits patiently for the setups to come to him, rather than chasing the market.

That’s exactly what I want to do and you should be as well. Don’t compare yourself to the message boards or the broader market. As traders, we focus on setups and execution. Work on those two things and profits will follow.