Did you know you can make money in this market without having to pick its direction?

I know it seems crazy—especially with the Dow dropping over 3,000 points…

But believe me, it is possible.

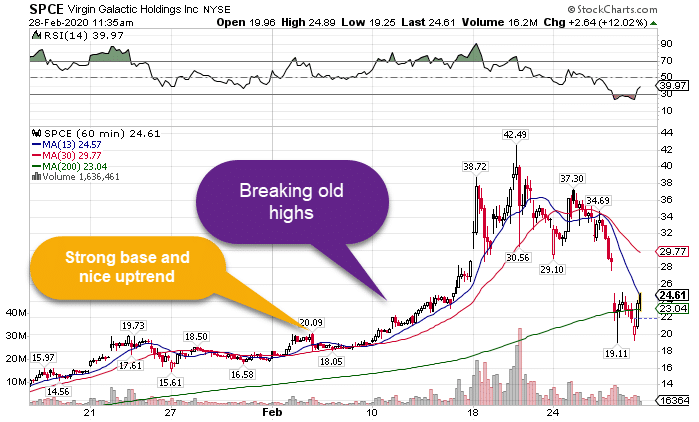

I want to dig into the trade I showed Total Alpha members: A covered call play in SPCE that took advantage of the crazy option volatility in the symbol.

SPCE Hourly Chart

Now, to some, the covered call is considered a conservative options strategy…

So you’re probably wondering why I would play it in such a volatile market…

The fact is, this strategy can be extremely lucrative when you play it correctly.

Selling calls into high implied volatility with a bullish chart (while being long the stock gives you a consistent trade that produces outsized returns).

Let me walk you through my thought process and how I structured this trade. I think you’ll be shocked at how much profits I captured.

As well as, how easy it is to replicate this strategy. One that I plan on trading more of, during this volatile stretch in the market.

Starting Idea

As I scanned through stocks the past few weeks, I noticed SPCE breaking out to the upside. The stock displayed a lot of strength in what appeared to be a topping market. WIth everything else starting to flatline, a stock moving off a solid base caught my eye.

SPCE Hourly Chart

I liked the fact that price remained above the 200-period moving averaged, while never dipping below the 30-period moving average by much. Once I saw it breaking through the old highs, I figured it was time to take some action.

Typically, I would look to start trading calls at this point. The problem was the implied volatility was pretty high because the stock jumped around so much. That made options excessively expensive.

So, what do you do?

Using implied volatility to your advantage

Much as we’re seeing now, when implied volatility increases, so does the price of an option. In those environments, I want to be an option seller.

Remember – option prices come from three components: implied volatility, the distance between the strike and current price, and time to expiration.

Here’s something you may not know – puts and calls aren’t always priced the same. In fact, puts are usually more expensive for ETFs, while calls are pricier for stocks. This interesting phenomenon occurs because traders like to use ETFs to hedge their long portfolios, while stocks can go to infinity (in theory), which creates more upside risk.

Looking at this trade, I wanted to take advantage of selling the premium on the calls, but not take the risk of shorting naked options. When I looked at selling a put spread, it didn’t give me enough reward for the trade.

That’s where the covered call came in.

The setup

I entered this trade by taking the following actions:

- Bought 5,000 shares of SPCE around $30

- Sold 50 call contracts for almost $4.00 per contract expiring the following week at the $30 strike price.

Let’s think about the math there for a second. I got $4 for the calls, which means I collected $4.00 x 50 contracts x 100 shares per contract = $20,000!

My total investment for this trade was 5,000 shares x $30 = $150,000. That means I earned a return on my investment of $20,000 / $150,000 = 13.33% in one week!

Obviously, there are downsides to this method. First, I would leave any gains over $34 on the table. The stock made a high of over $42. That meant that I left 5,000 shares x ($42 – $34) = $30,000 of additional profits on the table.

Second, I’m only protected down to $26. If the stock decided to fall out from underneath me, then I would be stuck with the losses beyond that point. However, that’s a lot better than not having been paid that $4 per contract to reduce my risk.

When I looked at the trade, I wasn’t certain whether the stock would break out to new highs or crash back down to $16-$20. This setup offered me the highest reward while reducing my risk.

Now, when the stock moves ‘in-the-money’ (where share price exceeds the strike price for calls), I run the risk of options assignment. This normally occurs when stocks get deep-in-the-money and close to expiration.

When I get assigned an option, that means I would be forced to sell the counterparty the shares of stock. Since I own 5,000 shares of SPCE against my calls, I would just sell those shares to them at the strike price. This isn’t a bad thing, but it can come with a few extra fees.

Video recap

To give you a little more bonus material, here is a video recap where I go into more detail about the trade.

Enjoy!