Did you know you can make money on a stock’s earnings without having to pick which direction it goes.

In fact, this strategy allows you to profit without having to be exact.

When structured correctly, your probability of success goes through the roof. And scoring consistent profits becomes the norm…

Let me introduce you to the Iron Condor.

You know what I love about this strategy? If I wanted, I could place my exit trade right after my entry and never look at it again!

That’s right…this is about as hands-off as you can get. In fact, some people play iron condors without ever looking at a chart!

Deciding on my first victim was easy. After Nathan Bear’s Weekly Money Multiplier probably paid for another Porsche with his trades on ROKU last year, there was no way I’d let this one go.

So today, I wanted to walk you through my recent iron condor in ROKU that let me walk away with a cool $10,000 in profits.

Setting up the trade

Iron condors may sound scary. Actually, they’re pretty easy to understand and execute.

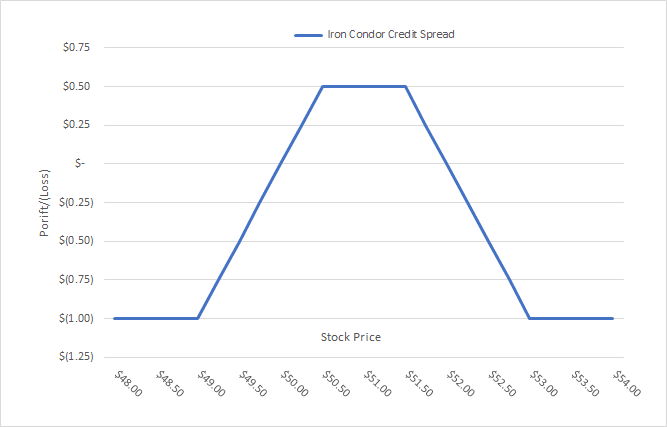

If you’re familiar with credit spreads, you’re simply putting on a call credit spread and a put credit spread for the same expiration. The payoff diagram looks something like this:

When you initiate the trade, you receive a premium (credit). The maximum amount you can make on the trade is the premium paid up front. However, you can exit the trade for partial profit at any time up to expiration.

Here’s how the trade sets up:

- I sold the $105 puts

- I bought the $100 puts

- I sold the $170 calls

- I bought the $175 calls

This paid me $1.11 premium per spread I put on or $1.11 x 100 shares per option contract = $111 per spread.

Remember, option contracts control 100 shares of stock.

The maximum amount I could lose in the trade is the distance between the strikes on either side less the premium I received up front. That means I stood to lose a maximum of $175-$170 – $1.11 = $5 – $1.11 = $3.89 x 100 shares = $389 per spread.

Here’s the thing about iron condors – if I lose because the stock broke through the put spread side the call spread side will expire worthless and visa versa. That means you can’t lose on both sides, just one.

Recommended Link

The secret about earnings

Here’s the trick to making this all work. Option prices are made up of 3 major components – time to expiration, distance from the current price, and implied volatility.

Ready for the secret?

As a stock approach earnings implied volatility rises. That means I get paid more for the trade!

But guess what? Once the company announces earnings, implied volatility drops, which drops the price of the options.

So why does this happen? Well, think of implied volatility as demand for options on a stock. As you approach earnings, no one knows what will happen.

So, investors buy up options because they want to take advantage of the price action after earnings.

Once earnings are announced, investors know the ‘news’ and can price the stock accordingly.

Making the trade work

So how does this help with this trade?

Right before earnings, you can read the options market’s opinion of how much they expect the stock to move after earnings. You can then compare that to the historical movements of the stock post-earnings.

If you want to figure out the expected move for a stock, take the first put option and call option that are out-of-the-money and add them together for the Friday expiration. That will give you a rough idea.

When you believe that the options market is pricing in too large of a move, as I did in this case, then you can deploy an iron condor to profit from the mispricing.

In this case, the options market said it expected a move of ~$20, or around 15%. Historically, ROKU doesn’t move that much, nor did I expect that it would this time.

All I needed the stock to do was not exceed $170 per share or fall below $105 per share. As long as that happened, I made money.

The cool part is once the earnings announcement was released, the option premium dropped like a stone. That let me close out the trade close to maximum profit.

Think that implied volatility doesn’t make that much of a difference? Let me put it this way – prior to the announcement, my trade was basically flat. After earnings hit the wire, even with a full week left until expiration, I closed out the trade at close to 100% of maximum profit potential!

Simple management

Trades like these don’t get any easier to manage. In many cases, I drop in my exit order once I enter the trade and let the probabilities work in my favor.