At one point the world collapsing on Coronavirus hysteria. With no fresh news, and the attention span of a puppy, markets rallied back to all-time highs.

Stocks shredded shorts across the board, recovering all their losses and then some. Technology managed to stretch to new levels by week’s close while other indexes popped their heads up there intraday. The QQQs shattered their previous record, finishing up 4.19% on the week.

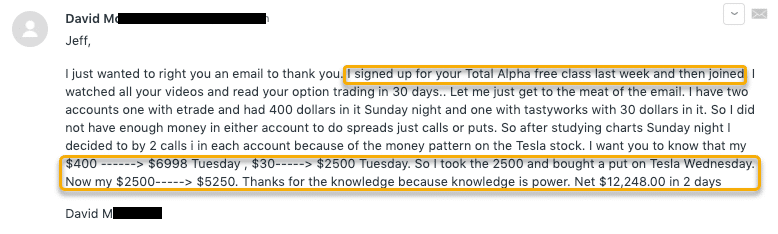

Yet, TSLA captured the spotlight with an epic short squeeze reminiscent of the dotcom bubble. While a few funds lost enormous bets, one Total Alpha member crushed it.

That’s a 2800% return in 2 days!

This week’s jump begins with a market that’s virtually unchanged in three weeks but a whole lot more worried. But is it justified?

Robust Data Drives The Economy

Bullish analysts point to data that shows the U.S. economy remains strong, justifying lofty equity valuations.

Jobs numbers from last week demonstrate continued gains in both employment and wages. The U.S. economy added 225,000 jobs in January, double expectations. While unemployment edged up to 3.6% from 3.5%, it’s nonetheless historically low. Labor force participation rate climbed to 63.4% from 63.2%, the best since 2013.

With 64% of S&P 500 companies reporting, 71% of those beat EPS estimates, with 67% exceeding revenue estimates. That sounds good until you realize that Q4 earnings growth is only 0.7%. However, that would market the first YOY earnings increase since Q4 of 2018. Revenue growth is coming in at 3.5% growth YOY, which isn’t too shabby.

Manufacturing continues to show expansion, with the IHS Markit U.S. Manufacturing PMI posting 51.9 in January. While it’s not great, it’s still better than a contraction. On a global scale, the J.P. Morgan Global PMI came in at 50.4. Again, nothing magical, but at least it’s positive.

Coronavirus Impacts Supply Chains

The Coronavirus outbreak continues to work its way through Wuhan. There’s been a few cases of infections outside of China, though nothing of any size.

Chinese factories return from the Lunar New Year on February 10th. It’s the second major point where we find out the true disruption of the virus. The U.S. and several other countries already laid tight travel restrictions to and from China’s mainland. Experts believe that supply chains will start to show more stress as the problems wear on. Most of these revolve around electronics.

Supply chains have already been delayed by a week. Importers worry that once people return to work, they’ll find things taking significantly longer to reach their destination. This is likely to hit one of America’s beloved devices – the iPhone.

That development caught my eye given AAPL is still at record highs. The P/E of 25x doesn’t make the stock that expensive. But it probably doesn’t consider serious production disruptions. Given the significant weighting of the stock as a component of the S&P 500 and the Nasdaq 100, it creates a risk markets haven’t baked in.

Still, the Chinese markets recovered a good amount of their losses. While they’re still 8.53% off their highs of the year, they’re 4.4% off their lows as measured by the FXI ETF.

Democratic Field Shakeup

The biggest surprise of the week came with the contested Iowa results. While it’s not shocking that anyone other than Joe Biden won, the fact that he placed 4th did catch folks off-guard. It reminds many of the sea change from established candidates to Donald Trump that took hold in 2016.

As more progressive candidates like Bernie Sanders and Elizabeth Warren show strong performance, market pundits worry their policies will quickly derail the bull market. Neither shows a fondness for Wall-Street, if not exhibiting outright disdain. Even if Pete Buttegeig emerges as the candidate, it presents another unknown for the markets…who hate uncertainty.

What I’m Watching

Not a lot of data hits the wire this week to make mention of other than CPI numbers on Thursday. Otherwise, I’m more interested in how the markets trade from here. While the SPY is virtually unchanged over three weeks, the VIX is up almost 30%, climbing from $12 to $15.50.

Bonds still look robust, with their bull run not complete. That’s why I already posted a put spread in TLT for Total Alpha Members. I’m trading both sides of the market until I get a clearer picture of where things are headed.

Expected earnings dates listed in (…)

Stocks I want to bet against…

NFLX (April 21), AMZN (Apr 23), CRM (Mar 2), AMD (May 5), UBER (Feb 6), FB (Apr 22), WORK (Mar 4),

Stocks I want to buy…

CMG (Apr 22), DIS (May 13), MJ (none), CVNA (Feb 26), UNG (none), XLE (none), WDAY (Feb 27), LK (??), PTON (May 6), BUD (Feb 27), TTD (Feb 20), TWLO (May 3), SPCE (Feb 25), NIO (Mar 3), TLT (none), UVXY(none), W (Apr 21), BYND (Feb 10), PBR (Feb 26), PAYC (May 2), OLED (Feb 20), JCOM (Feb 10)

Want to profit from the market in any direction?

We’ve got a great package lined up for you at Total Alpha.

This Week’s Calendar

Monday, February 10th

- Major earnings: Allergan plc (AGN), Avaya Hldg Corp (AVYA), Diamond Offshore Drilling (DO), Callaway Golf (ELY), Edgewell Personal Care Company (EPC), Golub Cap BDC Inc (GBDC), Loews Corp (L), Aethlon Medical Inc (AEMD), Amkor Tech (AMKR), Digital Turbine Inc (APPS), Brighthouse Finl Inc (BHF), Chegg Inc (CHGG), DaVita Inc (DVA), Fluidigm Corporation (FLDM), Green Plains Inc (GPRE), II-VI Inc (IIVI), Mimecast Ltd (MIME), Molina Healthcare (MOH), OneMain Holdings Inc (OMF), Ringcentral Inc (RNG), STERIS plc (STE), Voya Finl Inc (VOYA), XPO Logistics, Inc. (XPO)

Tuesday, February 11th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: AutoNation Inc (AN), Cerence Inc (CRNC), Dominion Energy Inc (D), Diebold Nixdorf Inc (DBD), Exelon Corp (EXC), Hasbro Inc (HAS), Hilton Worldwide Hldg Inc (HLT), Louisiana-Pacific Corp (LPX), Masco Corp (MAS), Martin Marietta Materials (MLM), National Retail Properties Inc (NNN), Omnicom Grp Inc (OMC), Sealed Air (SEE), Sensata Technologies Hldg N.V. (ST), TEGNA Inc (TGNA), Under Armour Inc Cl A (UAA), US Foods Hldg Corp (USFD), Virtu Finl Inc Cl A (VIRT), Akamai Technologies (AKAM), CNO Finl Grp, Inc. (CNO), DCP Midstream LP (DCP), Douglas Emmett Inc (DEI), Exact Sciences (EXAS), Goodyear Tire & Rub (GT), Lattice Semiconductor (LSCC), Lyft Inc (LYFT), NCR Corp (NCR), Insperity Inc (NSP), UDR Inc (UDR), Western Union Co (WU)

Wednesday, February 12th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Bunge Ltd (BG), Blackstone Mortgage Trust Inc (BXMT), CME Grp Inc (CME), CVS Health Corp (CVS), Global Payments Inc (GPN), Interpub Grp Cos (IPG), IQVIA Hldgs Inc (IQV), Moody’s Corp (MCO), Noble Energy (NBL), Molson Coors Beverage Co (TAP), Tradeweb Mkts Inc (TW), Acadia Realty Trust (AKR), Antero Midstream Corp (AM), Applied Materials (AMAT), Antero Resources Corp (AR), Altice USA Inc Cl A (ATUS), Bruker Corporation (BRKR), Cadence Design Systems (CDNS), CF Industries Hldgs Inc (CF), Change Healthcare Inc (CHNG), Cisco Systems (CSCO), CenturyLink Inc (CTL), CoreCivic Inc (CXW), Equifax Inc (EFX), FTS Intl Inc (FTSI), Healthcare Realty Tr (HR), HubSpot Inc (HUBS), Intl Flavors/Fragr (IFF), Laredo Petro Inc (LPI), MGM Resorts Intl (MGM), Marathon Oil Corp (MRO), NetApp Inc (NTAP), Perspecta Inc W/I (PRSP), Pluralsight Inc (PS), Redfin Corp (RDFN), Regency Centers (REG), SunPower Corp (SPWR), SS&C Technologies Hldgs Inc (SSNC), Stag Industrial Inc (STAG), Taubman Centers Inc (TCO), TripAdvisor Inc When-Issued (TRIP), Trimble Navigation Ltd (TRMB)

Thursday, February 13th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Consumer Price Index January

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Acorda Therapeutics Inc (ACOR), Agios Pharmaceuticals Inc (AGIO), Amer Intl Grp (AIG), Ares Mgt Corp (ARES), Aircastle Ltd (AYR), Borg Warner (BWA), Cincinnati Bell (CBB), Dana Inc (DAN), Duke Energy Corporation (DUK), First American Finl Corp (FAF), Forum Energy Technologies Inc (FET), Fidelity National Information (FIS), Generac Hldg Inc (GNRC), Huntsman Corporation (HUN), Incyte Corp (INCY), Iron Mountain Inc REIT (IRM), Ironwood Pharmaceuticals Inc ‘A (IRWD), The Kraft Heinz Company (KHC), Laboratory Corp Amer Hldgs (LH), Annaly Cap Mgt Inc (NLY), PBF Energy Inc Cl A (PBF), Pepsico Inc (PEP), Ryder System (R), Tempur Sealy Intl Inc (TPX), Waste Mgt Inc (WM), YETI Holdings Inc (YETI), Zebra Technologies ‘A’ (ZBRA), Zoetis Inc (ZTS), Arista Networks (ANET), Alteryx Inc (AYX), Black Knight Inc (BKI), Cargurus Inc (CARG), The Chemours Company (CC), Cognex Corp (CGNX), Columbia Ppty Trust Inc (CXP), Datadog Inc (DDOG), Digital Realty Trust Inc (DLR), DexCom Inc (DXCM), Expedia Grp Inc (EXPE), Fidelity Natl Finl Inc (FNF), GoDaddy Inc (GDDY), Healthcare Trust of America (HTA), Mattel, Inc (MAT), Mohawk Indus (MHK), CloudFlare Inc (NET), Nvidia Corp (NVDA), Roku Inc Cl A (ROKU), Repub Svcs Inc (RSG), SVMK Inc (SVMK), Yelp Inc (YELP),

Friday, February 14th

- 8:30 AM EST – Import Prices, Retail sales, and Producer Price Index for January

- 9:15 AM EST – Industrial Production and Capacity Utilization for January

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Arbor Realty Trust (ABR), Air Lease Corp (AL), American Axle & Manufacturing (AXL), Immunogen Inc (IMGN), MGM Growth Pptys LLC Cl A (MGP), Newell Brands Inc (NWL), Portland General Electric Co (POR), PPL Corp (PPL), Terex Corp (TEX)