The Fed came and went like a whisper no one heard. They confirmed low-rates and a commitment to higher inflation leading to a muted market response. It’s almost like we knew what they were going to say…

Back on planet Earth, the rest of us were trading the markets in front of us. Stocks took a face plant into the close as investors shrugged off the Fed’s support.

The markets sit at a key inflection point. Let’s take a look at areas you need to pay attention to, and where you can make some healthy green.

Key Stocks I’m Trading Right Now

Every day, I update my list of stocks that I’m watching for setups. While I normally reserve this for paid members, I’ll give you a look at what I’ve got my eye on.

Expected earnings dates listed in (…)

Stocks I want to bet against…

NFLX (April 21), AMZN (Jan 30), AAPL (Jan 28), FB (Jan 29), CRM (Mar 2), AMD (Jan 28), HUBS (Feb 12), TWLO (Feb 5), NOW (Jan 29), SPCE (Feb 25), TLT (none)

Stocks I want to buy…

CMG (Feb 4), DIS (Feb 4), MJ (none), CVNA (Feb 26), PLNT (Jan 29), UVXY (none), STZ (April 2), UNG (none), TSN (Feb 6), BYND (Jan 27), XLE (none), WMT (Feb 18), BA (Jan 29), WDAY (Feb 27), LK (??), PTON (Feb 5), KL (Feb 20), BUD (Feb 27), BKNG (Feb 26), HON (Jan 31), WORK (Mar 4), TTD (Feb 20)

Amazon already paid me well over $40,000 in the past month. I’m already in trades with AAPL, FB, WDAY…well let’s just say I’ve got a few on the books…most of which are at a profit.

One of The Best Days To Trade

The day after the Fed is one of my favorite days to put on new trades. That’s why I’m hosting a live event at noon today. Best of all, I’ll be trading for the whole world to see. Find out how to apply all the techniques and skills to real trades.

You can hop on and watch at noon by clicking this link.

This is going to be awesome. Not only does the timing line up here, but with yesterday’s close, the markets display a lot of volatility. That creates plenty of opportunities for some juicy trades if you know where to look.

Earnings Deluge

You might have noticed that I’ve got a lot of plays that go through earnings. We’re seeing a lot of stocks trade inside the expected move priced by the options.

The question remains whether the Coronavirus takes a huge chunk out of the Chinese economy. Estimates already suggest shaving off 2% from the already paltry 6% GDP.

That’s what made Apple’s earnings remarkable given their supply chain in China. It’s also why I sold a call spread on the company this week that’s already looking to be a nice trade.

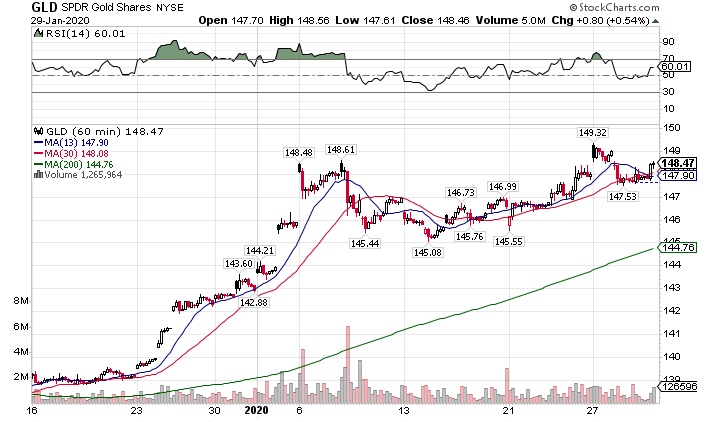

The Strength of Gold

Gold continues to show a ton of strength and is one of the markets I’m pretty bullish on. With equities primed to stall out and uncertainty creeping back in, gold benefits as the defacto ‘safety trade.’

This is what I’m holding after I already took some sick profits

Even if the precious metal pulled back to the 200-period moving average on the hourly chart, it would still be bullish. That’s why I’m taking dips as opportunities to load up.

GLD Hourly Chart

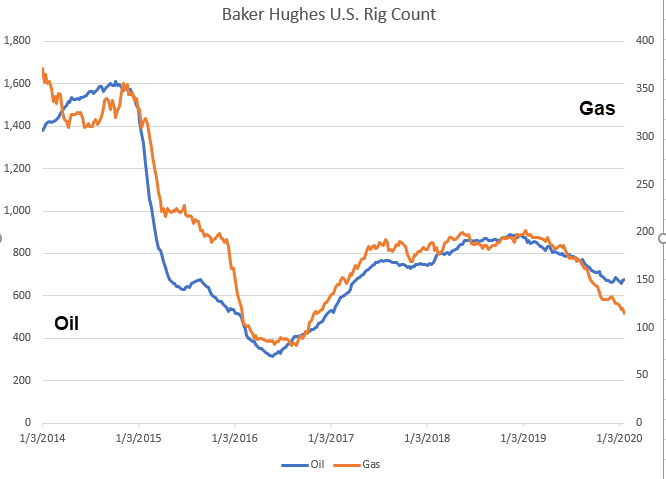

Possible Bottom In Energy

Crude oil, and especially natural gas, have been searching for a bottom for quite some time now. If natural gas gets much cheaper, they’ll be giving it out with packs of baseball cards.

The record production within the U.S. could be slowing as rig counts continue to decline.

The bottom in rigs in 2016 led to a decent rally in energy stocks through the remainder of the year, as well as the commodities themselves. While we probably have a but more to go given the stockpiles, we also have much higher global demand than we did then.

High Profits

I have to admit that I really like the cannabis industry at the moment. Times continue to change, with many states now legalizing medical marijuana if not recreational use. We’re already seeing presidential candidates talk about the issue, which could bring about change as soon as next year.

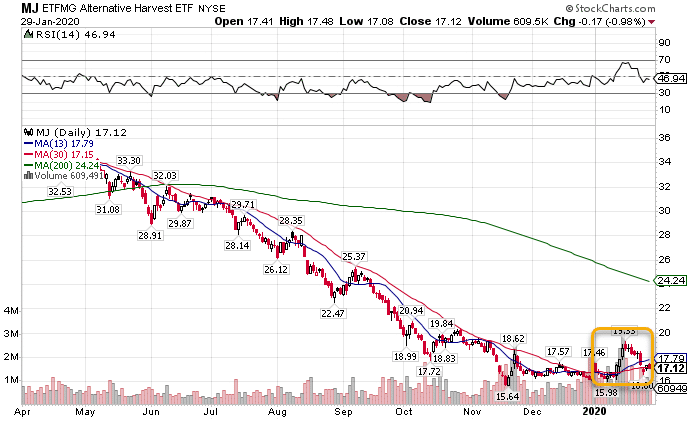

In particular, I like the ETF MJ that invests in the sector. It’s got a great risk/reward here as it’s very close to its all-time lows. Plus, it yields over 7% (though that’s likely unsustainable).

MJ Daily Chart

Check out the recent pop that broke the sustained downtrend. With a nice retracement, this ETF looks prime for the picking. This is one of those trades that could payout for months to come.

You And The Captain Can Make It Happen

The party boat sets sail at noon today. Join me for this special event. All the techniques and tricks will be on display. Watch me trade live!

Click here to join this live event