Hello trader,

Friday’s market action left a tingle running down my spine.

There are several warning signs flashing—that simply can’t be ignored any longer.

It’s a critical earnings week, as companies like Tesla, Amazon.com, Apple, Exxon, Pfizer, McDonalds, Microsoft, and Facebook are all set to report.

But I’m not waiting to hear from them before I start laying down some bearish bets…

I’ve already started.

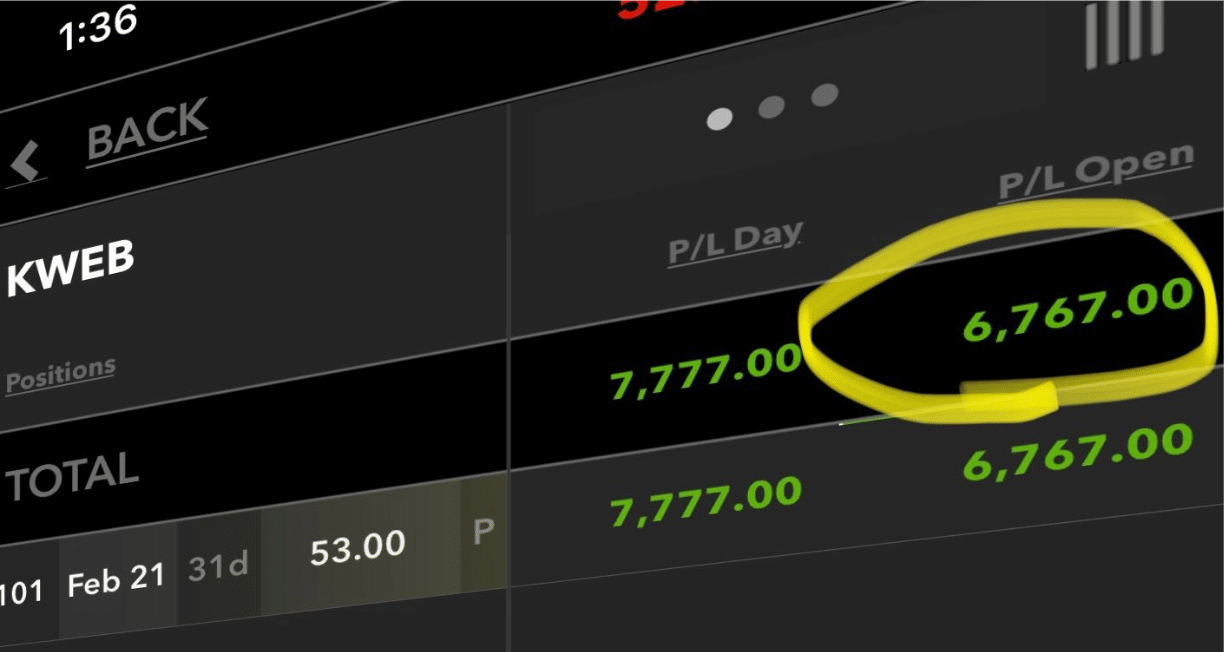

This bet against Chinese markets already paid close to $7,000…and I still have half!

There are several catalysts that we need to cover before Monday’s session… as well as… plenty of potential traps I want you to be aware of.

And If I’m right… This could be one heckuva week for trading.

Don’t Discount Fear

Plenty of people home and abroad were troubled by reports of the Coronavirus. You might remember a few years back with the Ebola scare, SARS, or the Swine Flu. Neither really hurt the market directly. But investors love to panic.

When stocks want to top out, they’ll grab on to the closest excuse they can. Yes, interest rate announcements and other big market movers create real impacts. But this isn’t one of those yet.

I already had my doubts this rally had much juice left. That’s the real reason markets turn. However, media outlets exacerbate pullbacks by whipping folks into a frenzy.

For now, just take this news with a grain of salt as it relates to the markets.

Politics Around the World

Impeachment proceedings should deliver a sideshow for the next few weeks. It’s unlikely that Trump will be removed from office. More likely, any revelations will simply damage his re-election prospects.

However, the real newsmaker comes from Europe. Most of you probably forgot, but January 31st is the official Brexit date.

Investors poured serious capital into UK equities this past month. While we know when Brexit happens, we don’t know how it plays out afterward. There is still plenty of uncertainty about what the post-world looks like. Will things run smoothly or will it take years to work through unforeseen obstacles? What will the UK trade deals look like with the US? This is likely a buy the rumor sell the news event.

Tit for Tat

Speaking of trade, with the feckless China phase one deal signed that addresses none of the primary concerns that started the tariff war, it also looks unlikely China can meet its purchasing obligations. Several economists pointed out that despite the agreement, it’s mathematically impossible to reach many of the objectives. And, in a last twist, many tariffs remain on until China meets its obligations. So what actually changed?

On the other side of the world, words cross the Atlantic in a growing argument between the US and Europe. Trump threatened France and other countries with retaliatory tariffs if they levy digital taxes against Google or other tech companies. Europe responded that they would fire back with their own tariffs. Although it’s unlikely Trump will seek a new tif before elections, don’t count it out of the possible outcomes.

Earnings Roundup

With 9% of S&P 500 companies reporting earnings, 72% of those beat earnings expectations with 63% beating on revenue. If things landed where they are now, we would see a -2.1% growth year-over-year for Q4 and revenue growth of 2.7%.

Interestingly, companies with more international exposure are delivering worse earnings than those primarily focused on the U.S. The big winners so far have been the utilities. Metals & mining delivered the biggest declines.

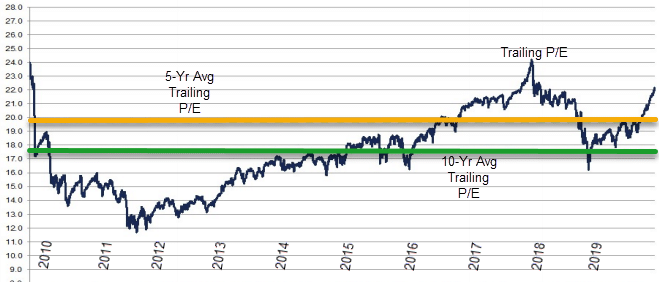

Not too many companies have reported so far, so we are working with limited data. Analysts forecast 2020 growth of 9.5% in earnings and 5.4% in revenues. This puts the forward 12 month price to earnings ratio at 18.6.

There’s been a lot of talk about how far markets have run. When I look at valuations, they are high, but not out of the normal range. Plus, given the highly accommodative Fed, these seem reasonable.

Data I’ll Be Watching

Nothing takes more precedent this week than the January Fed meeting. Their interest rate decisions on Wednesday shouldn’t be a surprise. No one expects them to raise or lower rates. I even expect their wording won’t change much. But, this will be the headliner for the week.

There’s also some fantastic earnings from Tesla to Mastercard this week that should give us a lot of market-moving opportunities.

Stocks on watch…

Call spreads

NFLX, AMZN, AAPL, FB, CRM, AMD, HUBS, AYX, TWLO, NOW, SPCE

Put spreads

BIIB, CMG, DIS, MJ, TLT, CVNA, PLNT, UVXY, STZ, UNG, TSN, BYND, XLE, WMT, BA, WDAY, PTON, LK

Want even more trade ideas?

Check out how I generate weekly income with Total Alpha.

This Week’s Calendar

Monday, January 27th

- 10:00 AM EST – New Home Sales December

- 10:30 AM EST – Dallas Fed Manufacturing January

- Major earnings: DR Horton (DHI), Sprint (S), Brown & Brown (BRO), F5 Networks (FFIV), Juniper Networks (JNPR), Whirlpool (WHR).

Tuesday, January 28th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Durable Goods December

- 10:00 AM EST – Consumer Confidence

- 10:00 AM EST – Richmond Fed Survey

- 4:30 PM EST – API Weekly Inventory Data

- Start of January Fed Meeting

- Major earnings: Alaska Airlines (ALK), Graphic Packaging (GPK), HCA Healthcare (HCA), Harley Davidson (HOG), Lockheed Martin (LMT), Mccormick (MKC), 3M (MMM), Nucor (NUE), Pfizer (PFE), Pulte Homes (PHM), United Technologies (UTX), Xerox (XRX), Apple (AAPL), Advanced Microdevices (AMD), CH Robinson (CHRW), Eba (EBAY), Monster Energy (MSTR), Stryker (SYK), Xilinx (XLNX)

Wednesday, January 29th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:00 AM EST – Pending Home Sales December

- 10:30 AM EST – Weekly DOE Inventory Data

- 2:00 PM EST – Fed Rate Decision

- 2:30 PM EST – Fed New Conference

- Major earnings: Automated Data Processing (ADP), Anthem (ANTM), Boeing (BA), Dow (DOW), Dynatrace Holdings (DT), Brinker (EAT), Extreme Networks (EXTR), General Dynamics (GD), General Electric (GE), Corning Glass (GLW), Hess (HES), Mastercard (MA), McDonalds (MCD), Marathon Petroleum (MPC), Nasdaq (NDAQ), Norfolk Southern (NSC), Oshkosh (OSK), Progressive Group (PGR), Stanley Black & Decker (SWK), AT&T (T), T Rowe Price (TROW), Textron (TXT), Archer Daniels Midland (ADM), Ameriprise Financial (AMP), Cree Inc (CREE), Cirus Logic (CRUS), Facebook (FB), Hologic (HOLX), Legg Mason (LM), Las Vegas Sands (LVS), Mondelez (MDLZ), Microsoft (MSFT), ServiceNow (NOW), Qorvo (QRVO), Tesla (TSLA), United Rentals (URI).

Thursday, January 30th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Q4 GDP, Personal Consumption, and Core PCE.

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: AmerisourceBergen (ABC), Alexion Pharmaceuticals (ALXN), Biogen (BIIB), Blackstone (BX), Consol Energy (CNX), Dupont (DD), Hershey (HSY), International Paper (IP), Coca-Cola (KO), Levi Strauss (LEV)I, Eli Lilly (LLY), Phillip Morris (MO), Raytheon (RTN), Sherwin Williams (SHW), Thermo Fisher Scientific (TMO), Tractor Supply Co. (TSCO), United Postal Service (UPS), Valero (VLO), Verizon (VZ), Westrock (WRK), Xcel Energy (XEL), Amgen (AMGN), Amazon (AMZN), Cypress Semiconductor (CY), Electronic Arts (EA), Edwards Lifesciences (EW), Visa (V), Western Digital (WDC), US Steel (X).

Friday, January 31st

- 8:30 AM EST – Personal Spending, Income, and PCE Deflator For December

- 9:45 AM EST – Chicago PMI

- 10:00 AM EST – University of Michigan Sentiment January

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Booz Allen Hamilton (BAH), Berry Plastics (BERY), Caterpillar (CAT), Church & Dwight (CHD), Charter Communications (CHTR), Colgate Palmolive (CL), Chevron (CVX), Honeywell (HON), Illinois Tool Works (ITW), Johnson Controls (JCI), KKR & Co (KKR), Phillips 66 (PSX), Weyerhaeuser (WY), Exxon Mobil (XOM).