Every once in a while, the market throws us a curveball.

The perpetual uptrend from November appears to be ending after stocks took a face plant yesterday.

Of course, one down day in the market doesn’t cause a trend. However, the market has been sweeping negative catalysts under the rug for months now.

Could the deadly coronavirus be the tipping point?

I can tell you this… every trader will be glued in on Sunday to see how stock futures react to this weekend’s headlines.

As traders, we must be proactive in times of uncertainty.

We can either take steps to preserve capital or get aggressive and take advantage of the opportunity.

Now is not the time to freeze up.

Luckily, I was prepared for the sell-off.

Not only did I expect it, but I created a balanced portfolio to take advantage of it.

My favorite play happened to be put options against a Chinese market ETF – KWEB.

I expected Chinese stocks to be the first casualties of a market turn.

Make no mistake about it.

The market hates uncertainty. And whenever we have it—you can expect volatility to shoot up.

As an options trader, you have the tools to profit from market downturns.

Today, I’m going to teach you how it’s possible.

Take a Step Back

First things first – don’t get caught up in your trades when the market swings hard against you. Realize that these days can and will happen. They’re part of the game. That’s why it’s essential to focus on decision-making rather than results when you’re learning.

It’s not uncommon to get emotionally caught up in a trade or down day. If you find yourself paralyzed with fear – take a walk. Outside of day trades (and even then), no trade should freeze your thought process.

Keep some ‘out’ or release valve that lets you take a moment to collect yourself. Even a quick game of solitaire works just fine.

If you find yourself constantly checking trades, unable to get away from the screen – create a schedule to check your trades. Allow yourself four times during the day to check the markets. Most swing traders can put in their orders or alerts and walk away from the computer.

Hedge Your Risk

You’ve probably heard the term ‘hedge’ before. This means taking a position in another stock or product that has a negative correlation (generally moves opposite) your current position or portfolio.

Here’s a good example. Say I was long Apple’s stock. Normally, the S&P 500 (SPY) and Apple will go up and down together. However, I expect Apple to outperform the market. So, I can buy Apple’s stock and short the SPY. That gives me a ‘neutral’ position.

I like to create a balanced portfolio by looking at what’s known as ‘Delta.’ Delta refers to the amount of change you should see in an option given a $1 change in the underlying stock.

You can read more about the option Greek Delta right here.

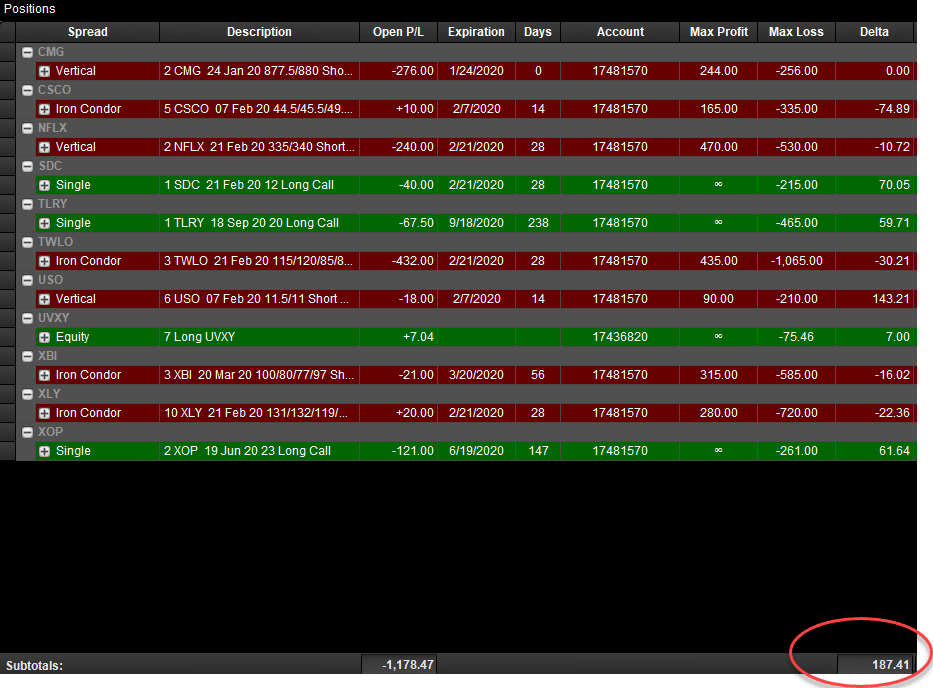

Here’s what a sample portfolio might look like:

Notice how all the positions wrap up into a clean number at the bottom. That 187.41 means that across all my holdings, a $1 average move in the underlying stocks would net me $187.41. That means I have an overall bullish bias.

Now, if I wanted to reduce that bias I could short stock or buy puts. That would bring down that number. Once I reach 0, I would have a neutral portfolio.

Take Advantage of Increased Volatility

One nice benefit of market drops is that volatility increases across the board. That means option sellers get paid more for their trades.

I love to use this opportunity to sell put spreads or other trades that pay more from higher due to elevated IV. That means that I not only get time decay working for me but any decreases in implied volatility will benefit the positions as well.

Additionally, I look for stocks to bounce off major support and resistance levels. That means looking for big round numbers like $100, $25, etc to enter trades. However, I cut my position size accordingly. That lets me take advantage of large price swings without blowing up my account.

Watch The VIX for Market Clues

I like to watch the volatility index (VIX) on big down days. It works as a great leading indicator to let me know whether stocks are nearing the bottom or still have further to drop.

The VIX typically trades the opposite of the market. When stocks drop, the VIX rises. But when stocks rise, the VIX drops. Intraday, the VIX tells where things stand. If I see the market making a lower low, but the VIX isn’t making a higher high, I take that as a signal the market may have found a bottom.

I also watch the VVIX which measures option demand on the VIX. If the VVIX is dropping along with the stock market, I take that as a signal stocks may be finding a bottom. Unlike the VIX, the VVIX can precede the actual bottom in stocks by a day or more.

Understand Stock Lifecycles

Stocks go through different phases as they churn higher. Identifying the current phase gives you invaluable insight into how to set up your trades.

I recently discussed this in a presentation—you can check it out right here.