Netflix, IBM, Procter & Gamble, Southwest Airlines are just a few of the companies reporting earnings this week.

A jam-packed, despite it being a shortened week of trading.

That means there are plenty of opportunities to profit, and I don’t want you to miss anything.

So let’s get started with The Jump on the Week…

My oh My That Lovey SPY

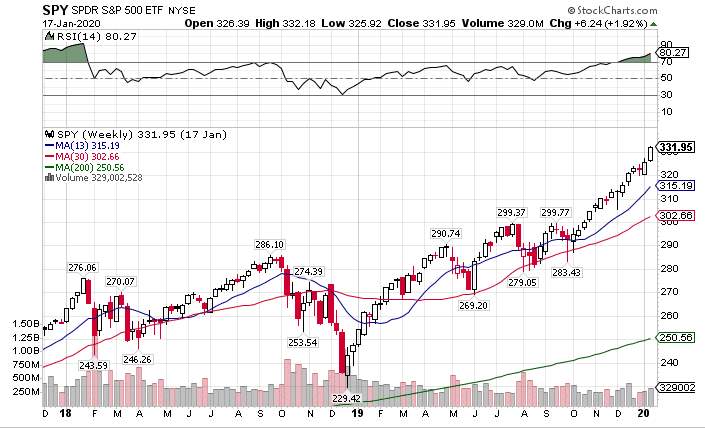

Last week I made a case for why I see a top in the markets within the next couple of weeks. Probabilities sit in my corner, so if I lose, it wasn’t because I made the wrong decision.

Markets closed again at their highs without showing signs of a reversal in the indexes themselves. Even though we’ve seen some major market leaders rollover, the laggards picked right up where the others left off.

SPY Weekly Chart

I fully expect that the deluge of earnings gives investors a lot to consider. Well probably see laggards like Netflix make a recovery, while runners like Intel and Skyworks receive a cooler response.

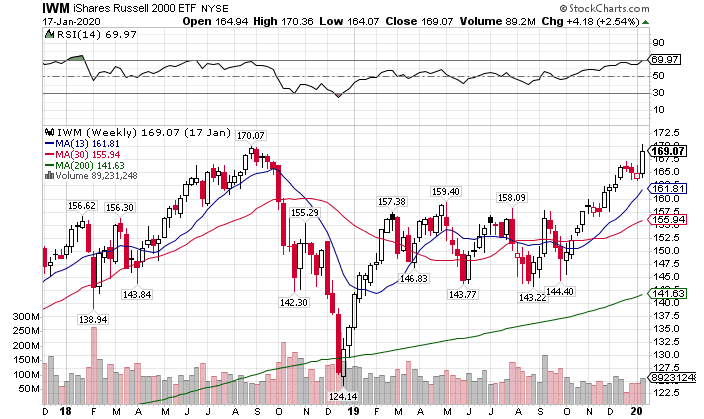

The index to watch this week is the Russell 2000 (IWM). It’s within a breath of breaking its all-time highs. How it reacts afterward will tell me the expectations for the overall market.

IWM Weekly Chart

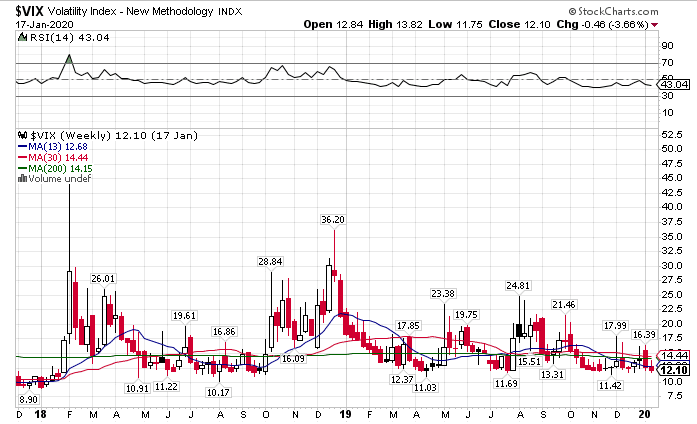

Pay Attention to Volatility

I cannot stress enough the importance of watching volatility. The VIX, which measures trader expectations for volatility, is at extreme lows. Because this index is mean reverting, the further it gets away from the average, between $15-$18, the more likely it is to snap back. Typically, this coincides with the drop and stock prices.

VIX Weekly Chart

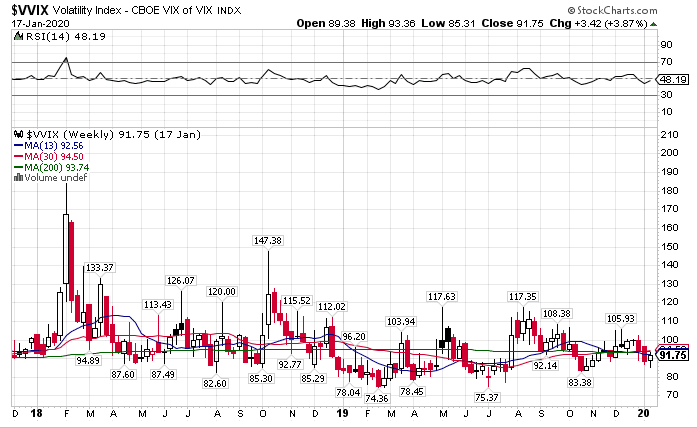

Also, I watch the VVIX, which measures demand on VIX options. The higher the demand, the more traders are betting on a pop in the VIX – or at least hedging their positions.

VVIX Weekly Chart

Political Considerations

With the trade deal signed, all attention turns to the impeachment process in the U.S. While it’s unlikely to see the president removed, any revelations seen as impactful to the president or his opponents’ chances in the November elections could move markets.

I’m a bit more interested in how China proceeds with its corporate bankruptcy fallout. Politicians seem content to let a fair amount of underwater companies go out of business, hoping that normalized risk pricing mechanisms take over. Although their growth slowed to the lowest in over a decade, they’ll likely see some boost this year from the trade deal.

Normally, I’d drop oil into its own bucket. However, I think it’s worth noting its political implications. Countries from Saudi Arabia and Iran to Russia rely heavily on the price of fossil fuel. The increase in oil prices came on the backs of growing demand and lower production, led by Saudi Arabia.

These countries hope to boost their coffers through these actions. Given the other challenges they face, I expect them to keep production curtailed for the foreseeable future.

Natural gas is its own worst enemy. With record production in the U.S., the country still faces challenges finding willing buyers. This is causing a lot of banks to reconsider project funding.

The problems for both commodities here are twofold, neither of which portends well for either industry. First, fracking technology changed the production landscape over the last decade. The U.S. became much more self-reliant in its energy production. That means the OPEC members have to contend with these free-market cowboys.

Secondly, and much more serious for the industry – climate change…or should I say the business of climate change. Increased focus around the world led to massive investments. That’s dropped the costs of lithium-ion batteries by 70% in the last decade, as well as massive cost reductions in solar panels.

This trend isn’t slowing down. The international drive to move towards renewable energy consumption isn’t limited to the west anymore. China will likely spend more than any other country in 2020 to expand its renewable energy infrastructure. Corporations now include environmental sustainability as a core value.

All this leads to slow growth in fossil fuel consumption worldwide. Short-term, we’ll see oversold bounces. Long-term, the entire face of energy will change as we know it.

Data I’ll Be Watching

The biggest data pieces come from earnings. We get a lot of financials along with the start if tech with Netflix and Intel. I want to see how consumer demand fairs, along with whether semiconductors are at the beginning or end of the commodity cycle.

Markit data will provide some clues to the state of the consumer. We also get housing numbers, that should confirm a strong spot in our economy.

Stocks on watch…

Call spreads

NFLX, AMZN, AAPL, FB, CRM, AMD, HUBS, TEAM, AYX, WDAY, TWLO, NOW

Put spreads

TPX, BIIB, CMG, DIS, MJ, TLT, CVNA, PLNT, UVXY, BA, STZ, STLD, UNG, TSN, BYND, XLE, WMT

Want even more trade ideas?

Check out how I generate weekly income with Total Alpha.

This Week’s Calendar

Monday, January 20th

- Markets Closed for Dr. Martin Luther King Remembrance Day

Tuesday, January 21st

- 7:45 AM EST – ICSC Weekly Retail Sales

- Major earnings: Haliburton (HAL), FNB Corp (FNB), Comerica (CMA), Old National Bancorp (ONB), Capital One Financial (COF), Fulton Financial Corp (FULT), Interactive Broker (IBKR), International Business Machine (IBM), Navient (NAVI), Netflix (NFLX), United Airlines (UAL), Zions Bancorp (ZION)

Wednesday, January 22nd

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – Chicago Fed National Activity Index For December

- 10:00 AM EST – Existing Home Sales December

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Abbott Labs (ABT), Ally Financial (ALLY), Amphenol Corp (APH), Baker Hughes (BKR), Fifth Third Bank (FITB), Johnson & Johnson (JNJ), Nothern Trust (NTRS), Prologis (PLD), Citrix (CTXS), Kinder Morgan Energy (KMI), Raymond James Financial (RJF), SLM Corp (SLM), Steel Dynamics (STLD), Sterling Bank (STL), Teradyne (TER), Texas Instruments (TXN)

Thursday, January 23rd

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – Weekly DOE Inventory Data

- 11:00 AM EST – Kansas City Fed Manufacturing Activity December

- Major earnings: American Airlines (AAL), Bank United (BKU), Cadence Bank (CADE), Comcast (CMCSA), Freeport MacMoRan (FCX), Huntington Bank (HBAN), Jet Blue Airlines (JBLU), Key Bank (KEY), Kimberly Clark (KMB), Southwest Airlines (LUV), M&T Bank (MTB), Old-Republic (ORI), Proctor & Gamble (PG), Travelers Insurance (TRV), United Pacific Rail (UNP), VF Corpo (VFC), Associated Bank (ASB), Discover Financial (DFS), E-Trade (ETFC), Intel (INTC), Intuitive Surgical (ISRG), Skyworks (SWKS)

Friday, January 24th

- 9:30 AM EST – Markit U.S. Services & Composite January

- 1:00 PM EST – Baker Hughes Weekly Rig Count

- Major earnings: Air Products & Chemicals (APD), American Express (AXP), Nextra Energy (NEE), Synovus Financial (SNV), Synchrony Financial (SYF)