We are almost to the main event you’ve been waiting for…earnings season.

This week we get a deluge of corporate reports starting with our financial institutions. Will the banks confirm the Fed’s rosy outlook or will they be a bunch of Debby Downers?

This week’s jump begins with our favorite banks from Citigroup to Goldman Sachs giving their annual reports.

Unlike the quarterly earnings reports— annual reports give us more insight into a company’s performance and outlook.

The question we all have to ask – will earnings results reflect a market that is near all-time highs?

With the surge in equities we’ve seen over the last two months, things had better be smelling like roses.

Otherwise, we’re in for a blistery winter.

The Impact of Low Rates

Banks need to face the reality of lower interest margin spreads for probably the next few years. Given this is a major source of income, plus any of them that dropped trading commission revenues, we have to ask how they plan on making any money?

When you yank back on the normal sources of profits, good old greed tends to take over and push players to bad actions. We need to look no further than the financial crisis from ten years prior. In fact, we’ve already seen an uptick in interest for those esoteric financial products.

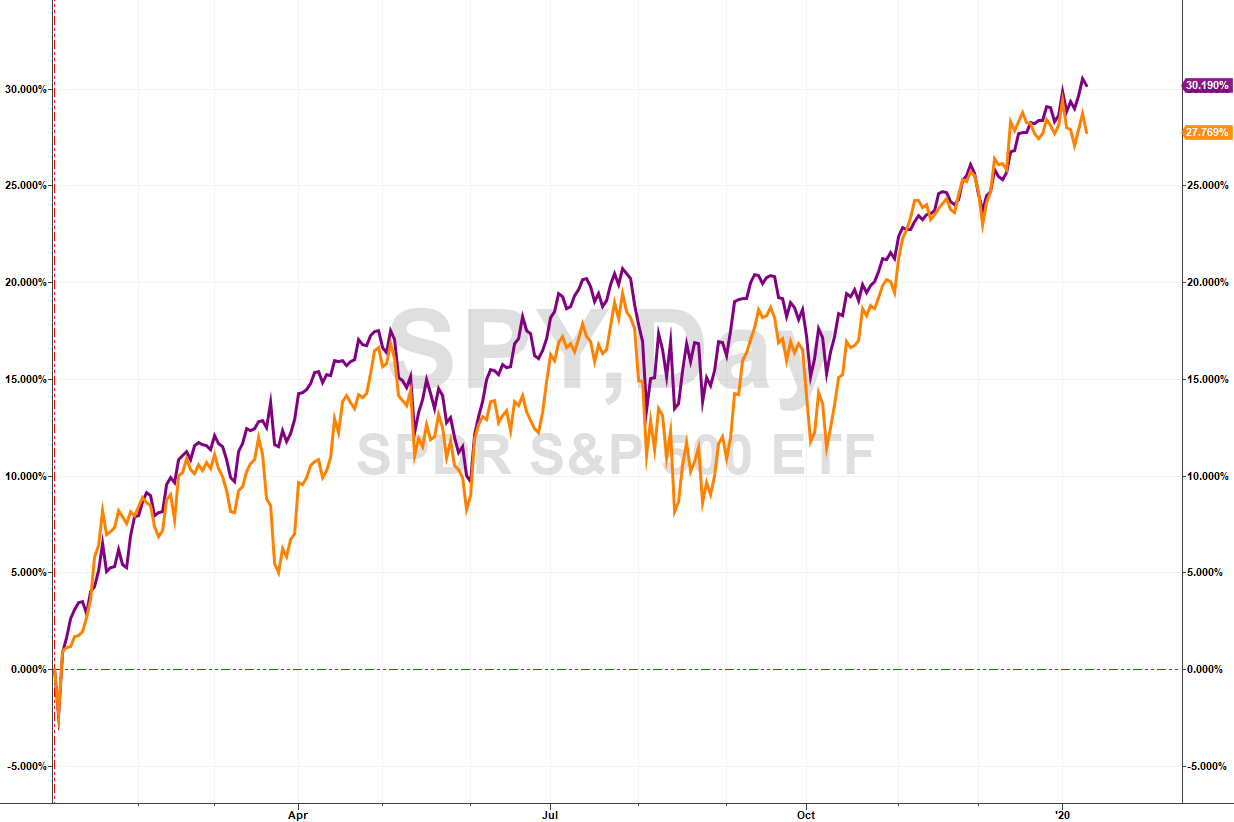

Analysts currently forecast 7.3% earnings growth for Q4 with revenues growing at 1.2%. Through 2019, the S&P 500 Financial Sector (XLF) largely kept pace with the S&P 500 itself (SPY).

SPY (Purple) vs XLF (Orange) Daily Chart

I’ll be especially interested to hear commentary on lending towards oil and gas drillers in the U.S. With reports that projects aren’t turning the production originally forecasted, I want to know if this is both true, the expected contraction in lending, as well as any banks with excessive exposure.

The other area of interest will be trading revenues. This helps me understand the shape of the trader’s market and the scale of passive investments.

The more money tossed into these follow-the-market ETFs, the more exposure I see to the downside.

How Bad Are The Transports

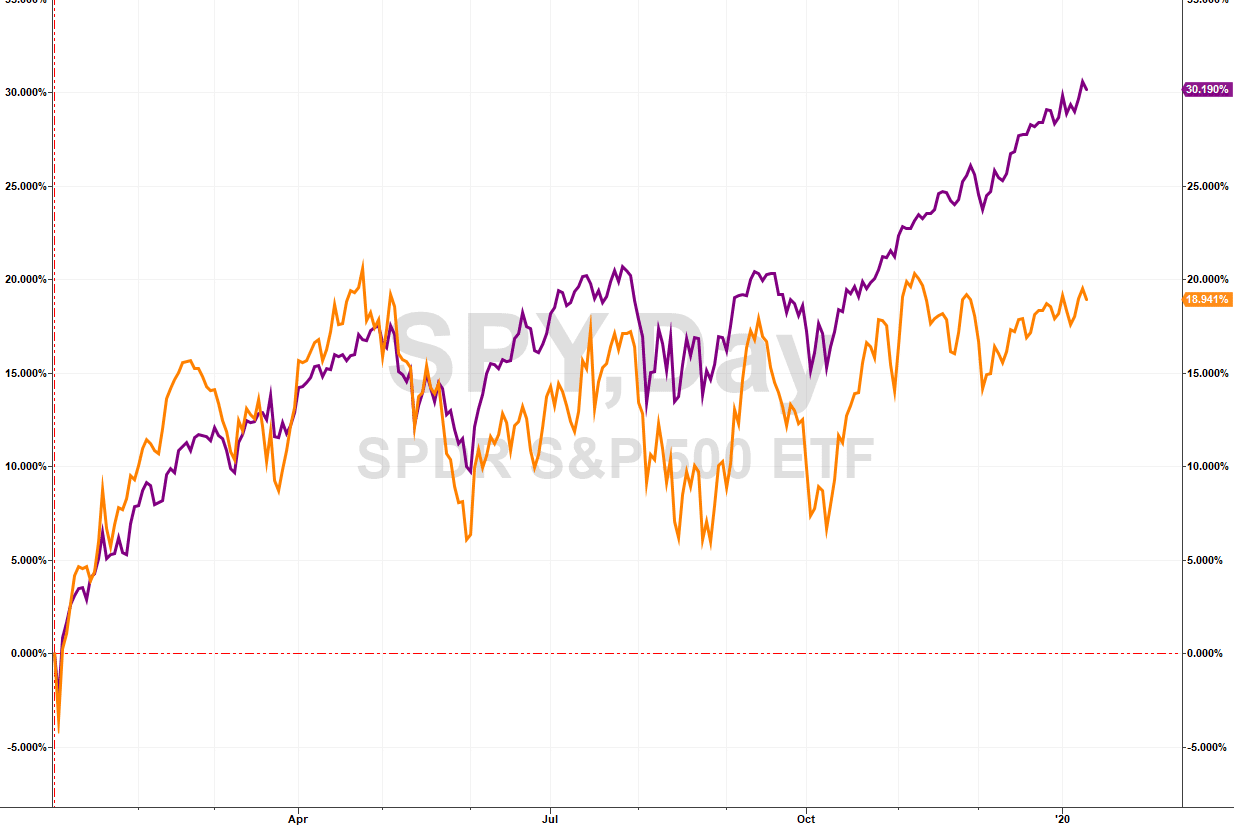

Normally, transportation stocks accelerate in a booming economy (or at least Dow Theory says so). Yet, this sector barely topped half the gains achieved by the S&P 500 in 2019.

SPY (purple) vs IYT (orange)

Maybe it’s the hangover from the Amazon effect. But everything from rail to airlines fails to make headway, even when their oil input costs are at historic lows.

Something seems amiss here for me. We certainly haven’t become less of a consumer nation. Yet, the policy failed to help the manufacturing decline in the country, and I haven’t seen anything other than bustling airports.

I know of the driver shortage that’s plagued trucking for the last decade. But, either the transports are plagued by similarly inept management, there is some structural change affecting completely different areas all at the same time…or as I suspect, it’s the only sector telling us the truth.

Inflationary Data

Markets will retain their bullish tone until the Fed decides that their two-year experiment that’s grown into a decade long project needs to come to an end. Every piece of possible inflation brings us a look at how close we are getting.

With Consumer and Producer Price Indexes delivering data this week, I want to see how high they go, as well as how high the Fed is willing to take it. The 2% target now seems to be a suggestion, as Powell noted his willingness to let inflation push beyond the red-line.

And Lest We Forget…

There is always an opportunity for politicians home and abroad to screw up the markets with a tweet or a grand feat. While impeachment shouldn’t bring any surprises, everyone was caught off guard by the U.S.-Iranian conflict to start the year.

I don’t expect that we see any major kerfuffles from Brexit to Congress. But, that’s the thing about unknown events…you don’t see them coming!

Stocks on watch

Call spreads

NFLX, AMZN, AAPL, TEAM, FB, AMD, CRM, SWKS

Put spreads

TWTR, FANG, EXAS, TPX, BIIB, COST, ULTA, ZS, CMG, IWM, AMZN, HUBS, DIS, MJ, AYX, TLT, CVNA, PLNT, UVX

Want even more trade ideas?

Check out how I generate weekly income with Total Alpha.

Next Week’s Calendar

Monday, January 13th

- Nothing to see here…

Tuesday, January 14th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Consumer Price Index December

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Citigroup (C), Delta Airlines (DAL), JP Morgan (JPM), Wells Fargo (WFC), First Republic Bank (FRC)

Wednesday, January 15th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – Empire Manufacturing Index for January

- 8:30 AM EST – Producer Price Index for December

- 10:30 AM EST – Weekly DOE Inventory

- Major earnings: Bank of America (BAC), Goldman Sachs (GS), PNC Bank (PNC), United Healthcare (UNH), US Bankcorp (USB), Alcoa (AA), Blackrock (BLK),

Thursday, January 16th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Import Prices, Retail Sales for December

- 10:00 AM EST – Business Inventories November

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Bank of New York Mellon Corp (BK), Home Bancshares (HOMB), Morgan Stanley (MS), PPG Industries (PPG), CSX (CSX), Ozark Bank (OZK), People’s United Financial (PBCT)

Friday, January 17th

- 8:30 AM EST – Housing Starts & Building Permits for December

- 9:15 AM EST – Industrial Production and Capacity Utilization for December

- 10:00 AM EST – U. of Michigan Confidence

- 1:00 PM EST – Baker Hughes Weekly Rig Count

- Major earnings: Citizens Financial Group (CFG), Fastenal (FAST), J.B. Hunt Transport (JBHT), Kansas Southern Rail (KSU), Regions Financial (RF), Schlumberger (SLB), State Street (STT)