After weeks of virtually nonstop gains, Friday marked the first significant down day seen in the market in months. Overnight futures tanked on the news of a U.S. military strike against an Iranian state official.

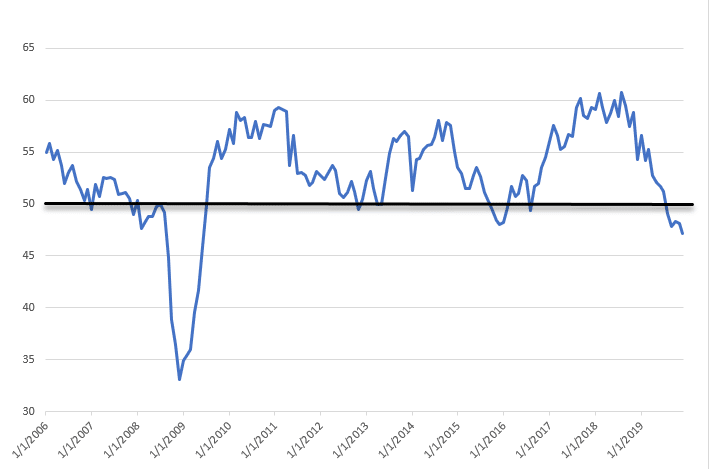

And while stocks did bounce after the initial reaction, they took a turn for the worse again, when the ISM manufacturing number came out showing the worst contraction since the recession.

ISM Manufacturing Reading

This could be a major problem for markets— if it’s banking on a recovery sustaining the economy— and a Fed that’s fine leaving rates at current levels.

Today’s Jump on The Week focuses on the inflection points in front of us that could bring this market rally to a grinding halt.

With a high correlation between major stocks and indexes, few areas will be spared the onslaught.

One place that returns consistent, uncorrelated results from the broader market – Penny Stocks. It’s not a bad place to play when your swing trade choices get thinner than a deli-slice of roast beef.

Find out how Penny Stock trading can help your portfolio. Check out Jeff Williams’ Free traing this Tuesday. Click here to learn more.

Geopolitical tensions crank up a notch

While this isn’t a Wag The Dog scenario, the death of the Iranian official stirred up a lot of questions. The major arguments boiled down to two areas.

First, the administration didn’t consult or at least inform Congress. Second, and more problematic, the person killed was an Iranian government official. In international politics, it’s one thing to kill a non-state actor. It’s entirely different to take out another country’s government official.

The concern of many lawmakers is this could be taken as an act of war. It’s not unusual to take steps to protect against imminent threats. However, this enters a gray area both in terms of precedent and transparency.

Markets are worried about war. Though they aren’t pricing a high likelihood, it’s still a consideration. I’ll be watching to see whether tensions or retaliatory efforts escalate.

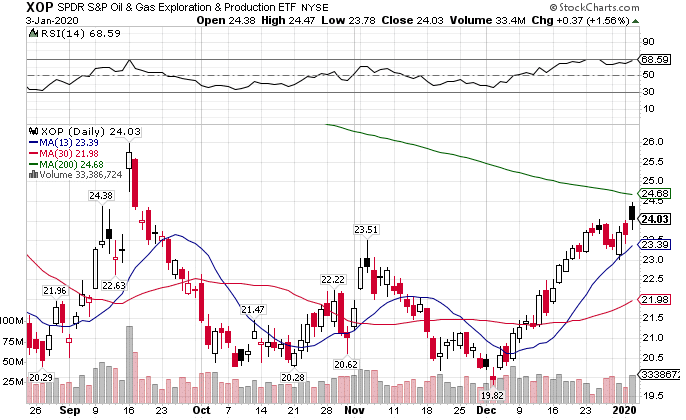

That also leaves crude oil and the XOP as a potential beneficiary, both of which have done quite well recently.

XOP daily chart

Keep in mind, markets haven’t really priced in an all-out war. If things heat up, stocks could dive quickly.

Data drop

IHS Markit data release on Monday will tell us whether the service sector is immune from the drag we’re seeing on manufacturing. While manufacturing only contributes 12% to GDP, services account for 88%. So if things start to slip, that’s when the bears will come out of hibernation.

I’m also watching mortgage application data for any signs of a slowdown in the housing market (not that I expect any). Friday’s jobs report will bring in the wage piece front and center. We’ll learn whether average hourly earnings are continuing their ascent or topping out.

Markets to watch

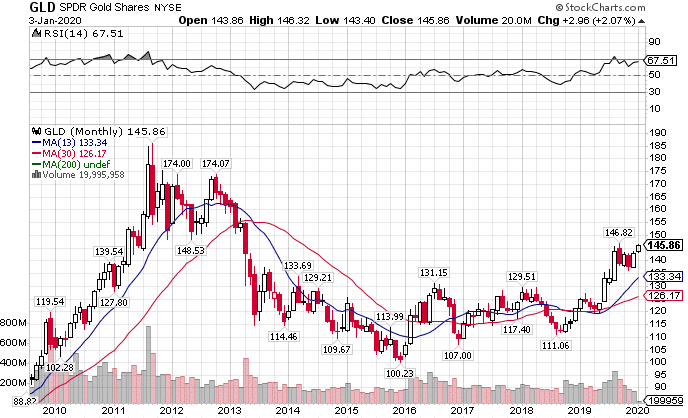

Keep an eye on gold and oil. Gold is set to break out of its multi-month range, which could put the all-time highs in its sights.

GLD monthly chart

Oil made a slow grind higher the back half of 2019. That’s built a solid base of support. With the conflict between the U.S. and Iran, any retaliatory actions or supply disruptions could push crude prices higher.

Stocks on watch

Call spreads

NFLX, AMZN, AAPL, TEAM, FB, AMD, CRM, SWKS

Put spreads

TWTR, FANG, EXAS, TPX, BIIB, COST, ULTA, ZS, CMG, IWM, AMZN, HUBS, DIS, MJ, AYX, TLT, CVNA, PLNT, UVX

Want even more trade ideas?

Check out how I generate weekly income with Total Alpha.

Next Week’s Calendar

Monday, January 6th

- 9:45 AM EST – Markit US Services & Composite Purchasing Manager Index December Final

- Major earnings: Cal-Maine Foods (CALM), Commercial Metals(CMC)

Tuesday, January 7th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Trade Balance for November

- 10:00 AM EST – ISM Non-Manufacturing Index For December

- 10:00 AM EST – Factory & Durable Goods Orders For November

- 4:30 PM EST – API Weekly Inventory Data

Wednesday, January 8th

- 7:00 AM EST – Mortgage Applications Data

- 8:15 AM EST – ADP Employment Change for December

- 10:30 AM EST – Weekly Dept. of Energy Inventory Data

- Major earnings: Greenbrier (GBX), Lenar Corp (LEN), Constellation Brands (STZ), Unified Natural Foods (UNFI), Walgreens (WBA), Bed Bath & Beyond (BBBY)

Thursday, January 9th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 9:45 AM EST – Markit Manufacturing Purchasing Manager’s Index December

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Acuity Brands (AYI), Simply Good Food (SMPL), KB Homes (KBH)

Friday, January 10th

- 8:30 AM EST – Non-Farm Payrolls, Unemployment, and Average Hourly Earnings for December

- 10:00 AM EST – Whosale Inventories November

- 1:00 PM EST – Baker Hughes Weekly Rig Count