The global stock market got its first taste of volatility yesterday after a U.S. airstrike took down Iranian general, Qasem Soleimani.

The VIX, the market’s fear index, shot up by more than 12% and closing about 14 on Friday.

Is 2020 the year volatility makes a comeback?

It could very well be.

However, I won’t need it to improve on last year’s performance.

You see, after a thorough review of my trades, I found some holes that I can easily button up—which should lead me to bigger and better profits.

For example, not closing out trades when they’ve reached 90% maximum profitability.

When the risk heavily outweighs the reward then it’s time to get out.

I know that, and I’m going to try to do a better job of not letting winners turn into losers.

I want to be smarter with risk management for sure. But that’s not all.

I also want to sell more options premium and lower down my cut down my costs.

Why are these three themes so essential for me to create consistent income?

A Volatile Year Passed, and Another Is Around The Corner

Buy and hold seems like a reasonable strategy for 2019 when you look back, especially considering that the average hedge fund returned a pathetic 8.5%. But hindsight is always 20/20.

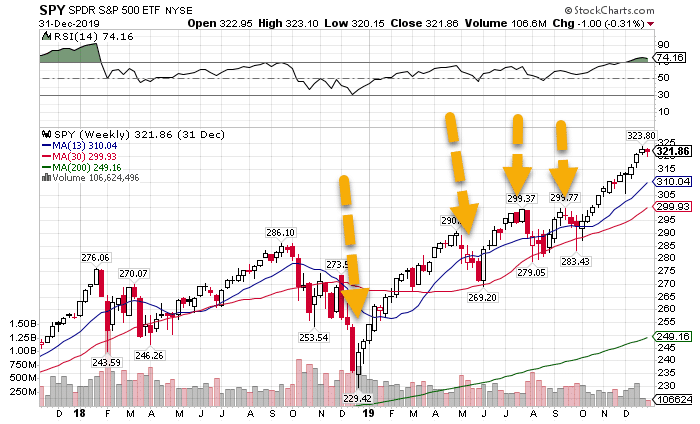

Let me take you back to the beginning of 2019. Stocks came off a massive slide as the Fed raised rates.

SPY weekly chart

In fact, the actual easy money came in the last quarter. The first three contained sizable pullbacks and data uncertainty.

Now everyone thinks the world is set on cruise control. With a decade of straight gains behind us, I think 2020 will be even MORE volatile that 2019.

Selling Premium

As I reviewed my trade journal for 2019, it became painfully obvious that directional option plays require a lot of work.

Buying and selling options puts anyone at an immediate statistical disadvantage. Most directional option bets only work out 30%-40% of the time. We make money by getting bigger payouts than our losses.

However, selling premiums is such a consistent payout with less management, I can’t afford to pass it up any longer. When you set up option selling correctly, not only do you get the inverse of the odds mentioned above (60%-70% win rates), you work time and implied volatility decay for you.

You can read up on time decay in my free article here.

I also learned that I’m a busy person that can’t be in front of the computer as much as I used to. My trading strategies needed to reflect that. That’s why I plan to take trades that require less management and screen time like iron condors and spreads…premium-selling strategies.

Managing risk smarter

In that same vein, I want to stop letting trades ride until expiration. You can find plenty of studies that show how managing your profits to 30%-50% of maximum potential not only jacks up your win rate well past 80% but provides a better P&L per day.

2019 saw plenty of winners turn to losers in the last few days of expiration…quite unnecessarily. With a credit spread at 90% of maximum profit with 50% of the time already expired, the value of that last 10% for the amount of time just isn’t there.

I typically sold options only going out a week or two through most of 2019 for at-the-money credit spreads. That created what’s known as ‘gamma risk’ – the risk that trades become more directional and don’t profit from time and implied volatility decay.

In 2020, I want to push that out to 30-45 days. That reduces the volatility in the trade if it moves against me, and lets me manage to partial profit if it works in my favor.

Reducing costs

Between June and the end of December, I spent $26,000 on commissions with E-Trade. At the same time, stock trading became free for most platforms. No platform came out and offered free options trading. But it got me looking around.

This isn’t a knock against E-Trade by any stretch. I loved their platform and service for a long time. The decision came down to costs. E-Trade wouldn’t budge, and TD Ameritrade came close. Yet, TastyWorksdelivered the best costs by a mile.

My Consistent Income Goals

2020 will mark the first year that I focus more on consistent income than big gains. Instead of trying to turn over 200%-300% in a year, I’m looking for 50%. That’s about 1% a week.

But the best part – I want to achieve a win-rate over 90% on these new strategies! It’s a lofty goal, I know. That’s why I chose these strategy shifts. It puts the statistics in my favor.

Of course, I will still have plenty of juicy trades that provide nice bonuses. The goal is simple – a balanced portfolio.

So are you ready to join me in the 90% win-rate quest?

Click here to join Total Alpha.