There are two rules I have on New Year’s Eve.

- Never drink and drive

- NEVER hold an ETN overnight, let alone for a trade.

While rule number one needs no explaining… I’m afraid that number two, might come to a surprise for some folks.

You see, there are better ways to capture profits without taking on all that risk.

Let me explain by going back two years…

Market volatility became an endangered species in the wild…something seen sporadically.

That all changed in early February.

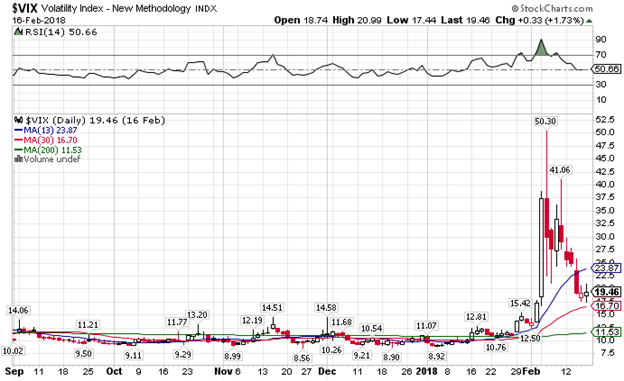

While the VIX never exceeded $17.28 through all 2017, the price suddenly spiked up to $50.30 in a matter of days.

VIX daily chart

Many traders rode the low volatility wave with the VelocityShares Daily Inverse VIX Short-Term exchange-traded note – symbol XIV. The stock aimed to return the opposite of the CBOE VIX.

After the VIX doubled during regular trading hours, the ETN sank 80% in after-hours. Eventually, it disappeared altogether, evaporating $1.5 billion in wealth.

During that same volatility spike, some obscure firm in Colorado hedge fund made $17.5 million by betting $200,000 on the SVXY options.

Let me explain the structures of ETPs, ETFs, and ETNs. Then I’ll show you how to trade them so you don’t blow up your account.

ETPs, ETFs, and ETNs

People throw around these three terms, interchangeably. They have some distinct differences that you need to understand.

ETFs – Exchange Traded Funds

Definition – ETFs act a lot like Mutual Funds that trade during the day like stocks. They hold assets such as gold, stocks, bonds, etc. The shares allow investors to take a stake in the assets.

Pros – ETFs provide easy diversification of your portfolio. Because they trade intraday like stocks, ETFs allow greater control of your entries and exits, unlike mutual funds that use end-of-day pricing. You can also find ETFs with exotic investments such as 2x leverage or inverse an index. High volume ETFs will generally have options available for trading as well.

Cons – ETFs have a higher tracking error than ETNs. Tracking errors are the difference between the underlying index and the ETF. For basic long indexes, this is typically associated with management fees. With leveraged, inverse, or derivative ETFs, you also have additional structural characteristics that increase tracking error.

Risks holding overnight – ETFs that hold straight stocks or bonds run similar risk as a mutual fund. Ones that hold derivatives such as futures or commodities are subject to the liquidity of that market. International ETFs also face the risk associated with investing in non-U.S. markets.

When these funds liquidate, they simply sell their assets and return the money to investors.

ETFs – Exchange Traded Notes

Definition – ETNs are debt notes issued by banks. Their performance is based on various assets and strategies. Instead of investing in a basket of assets, you’re buying a debt note promise from the issuer. They also have maturity dates when they expire.

Pros – ETNs tend to have lower tracking errors than ETFs since they don’t need to trade in and out of the underlying asset or strategy. They also allow for more investment choices, such as 3x leverage or 3x inverse.

Cons – ETNs carry the risk of not just the strategy, but the default risk of the issuer. You’re not buying assets. Instead, you’re buying their debt. If the provider of an ETF goes under, they sell the assets, and you’re fine. When an ETN issuer goes under, you get squat. These products also rarely have options available.

Risks holding overnight – ETNs have shown a higher risk of failure than their ETF counterparts. All the Lehman Brothers ETNs went belly up with the company in 2008. XIV was an ETN that went under issued by Credit Suisse. In fact, that instrument wasn’t designed to produce long-term gains according to the issuer.

When these notes close down, investors get hosed.

ETPs – Exchange Traded Products

Definition – Encompassing term for ETFs and ETNs

How to limit risk and turn a profit

I trade options on the UVXY all the time.

I would NEVER own an ETN overnight. Quite honestly, I’d never use it for a day trade.

Instead, I trade options against them. This lets me profit off their moves without the risk of holding the underlying instrument. In fact, this would be the poster child for why people should trade options!

Once you learn how to master these trades, you’ll find high probability setups that work over and over. One of my favorites is a trade on UVXY options using the VIX and VVIX to time the entry.

You can read all about it in my free article – 3 Winning Volatility Trades.

ETP option trades should be a core part of your portfolio. I use them every day in Total Alpha as straight trades and hedges against other positions.

You can learn how to execute these trades by becoming a member of the exclusive Total Alpha team.