Do you know what happens to the price of an option when the underlying stock pays a dividend?

Most traders don’t…

And because of it—they’re potentially leaving A LOT of money on the table.

Why?

Any option trade that extends over a dividend payment will be affected!

In other words, the best trade idea becomes a loser if you don’t consider dividends.

And do you know what else?

Popular ETFs like the SPY, DIA, and QQQ all pay dividends.

Of course, not every company pays a dividend, so this isn’t something that you’ll always need to address.

But here’s an example of when it was in play:

Recently, I took a trade where I sold a put spread on a Thursday that expired the following day.

That Thursday night I left, and the trade was at a profit.

But on Friday, I woke up to a harsh reality…

The dividend payment pushed the stock down, ruining my trade.

It’s a healthy reminder that we all need to touch-up on the basics.

So let’s make sure you learn from my missteps.

Option Prices Include Dividends

Most of the time you will never need to worry about dividends when you trade options. However, every once in a while, your trade will extend over the dividend payment date (known as the ex-dividend date). Option traders know this and price accordingly.

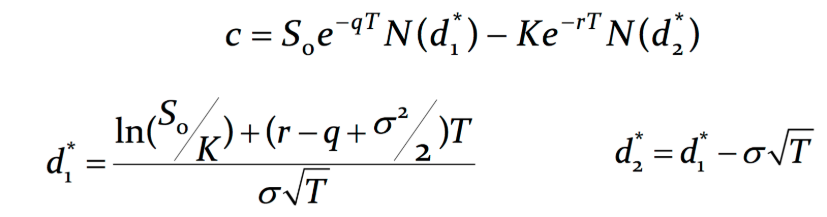

The option calculation formula includes dividends for individual equities and ETFs. Most platforms use the Black Scholes formula that looks something like this:

I know that it seems really complicated. Here’s what you need to know. See the ‘q’ in the equations above? That represents the dividend.

It’s no surprise that option models incorporate dividends. Otherwise, traders would quickly exploit the loophole for profits. Ironically, if the option price didn’t include dividends, traders would price it into the option premium over time through free-market mechanics anyhow.

Impact on call vs put options

Let’s think about how dividends would play out on options. When stocks pay out dividends, they usually drop at the open by the dividend amount (all other things being equal). That means that put options benefit and call options lose.

Now consider how put and call options work. The seller of a put option is obligated to buy the shares of a stock at a specified strike up until expiration. So, if a dividend drops the price of a stock, they need to collect additional premium upfront. That means that put option contracts that extend over a dividend payment cost more.

Conversely, call option sellers are obligated to sell the shares of the stock at a specified strike up until expiration. They can theoretically collect the dividend. So, they don’t need to collect as much of a premium. Therefore, call options that extend over a dividend payment cost less.

A note on major market ETFs

Maybe you noticed that the majority of the time, the SPY trades pretty close to the S&P 500 index. How can that be if the SPY keeps paying a dividend? Wouldn’t the gap keep getting wider and wider over time? There are also fees to consider.

I’ve heard a lot of explanations as to what causes this phenomenon. None of them seem reasonable to me. Some make more sense than others. But the bottom line is I’m not sure why it happens.

However, I am sure that it does happen. The gap created by the dividend tends to fade over a few weeks.

How it affects vertical spreads

So far, we discussed straight buying and selling of options. But what happens with vertical spreads?

In that case, it becomes a wash. The fact that you buy and sell a call or put option pair cancels one another out. However, when you don’t pay attention, you might pick the wrong strikes.

Here’s a practical example. The other day I sold an at-the-money put spread on a stock that expired the next day. That meant that I sold puts at one strike price right at-the-money and bought puts at another lower strike price out-of-the-money.

However, I forgot the stock paid a dividend on the expiration date…silly me. That meant the stock automatically opened up lower the very next day, putting me immediately behind.

Use it to your advantage

Now we know how to avoid the mistakes, why not use it to our advantage? The very same problems with selling a put spread into dividends help us when you sell call spreads.

This isn’t something that you can rely on to just make you oodles of money. Remember, traders already know about this and will price it into the options. That means the spreads aren’t as juicy as they normally would be. But, the stock still gets hit all the same on dividend day.

Ready to get started?

Total Alpha has trades for everyone. New traders, experienced traders, conservative traders…it doesn’t matter. You’ll find something that fits your style at Total Alpha.