You should be worried about markets making new highs on low volume. This is a fool’s rally set to fail. Every day sucks in more traders who buy stocks for fear of missing the next leg.

That’s when they pull the rug out from under your feet.

On Thursday at 12 PM ET, Jason Bond will teach you not to be this guy.

Ouch…

Violent moves in the market crush investors. But that’s when traders have their best moments. The key to trading a volatile market is your strategy selection and risk management.

Credit spreads work great and deliver consistent wins in volatile markets.

It’s one of the few ways that allow you to sell options with defined risk— and is ideal for market tops.

That’s why you need to make friends with them immediately.

The part I love about the strategy… You can close out the trade at any time for a significant portion of the profit.

Not only that, but it stacks the odds in your favor, allowing you multiple ways to come out on top.

Whether this is a new trade for you or you’re a seasoned pro, I’ve got something everyone can learn from.

I’ll teach you how I structure the trade, and most importantly, the ideal time to apply the strategy.

Advantages of selling options

Option sellers get a built-in benefit. Every day that ticks by eats away the value of an option contract until expiration. Not only do option buyers have to pick the right direction, but they also need to get the timing right. Otherwise, their options expire worthless.

That same time decay works for option sellers. They essentially become insurance salesmen who hope that no one ever makes a claim.

If you want to learn more about how time decay impacts options check out this free article.

In fact, there is a statistical advantage with selling options. Let’s go back to the insurance salesman example. No one would sell insurance if they couldn’t make a profit. The same thing works with option contracts. No one would take on the risk without being paid appropriately. That creates an inherent bias in favor of option contract sellers.

Setting up a credit spread

Credit spreads come in two varieties: put and call spreads.

Both work similar to one another.

Call spreads work by selling a call option at one strike price and then buying another at a higher strike price. Both option contracts need to have the same expiration and the same number of contracts.

Put spreads work like call spreads in reverse. You sell a put option at one strike price and then buy another put option at a lower price. All the same rules about expiration and the number of contracts apply here as well.

When you sell a credit spread, you receive money. This is known as the premium. Your goal is to keep as much of this as possible by expiration. However, you can take off the trade at a partial profit before expiration.

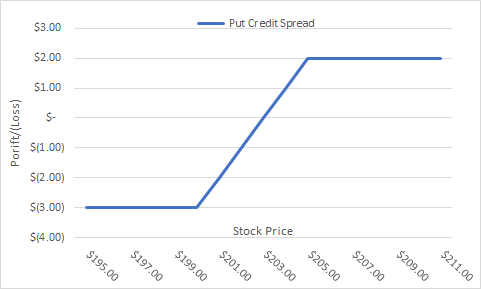

The payout graph for a put credit spread looks like this.

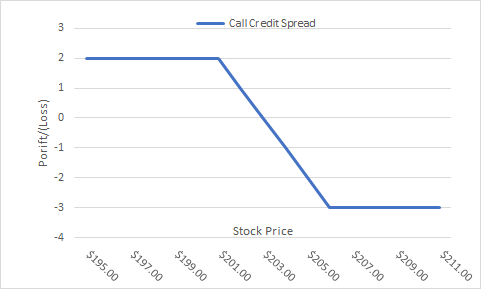

Call credit spread payouts look like a mirror image.

The most you can earn on the trade is the credit you receive for the sale. This happens when the stock hits expiration and is below the lowest strike price for a call spread or above the highest strike price for a put spread.

Your breakeven price occurs at the nearest strike price minus the premium for put spreads, or plus the premium for call spreads. Maximum loss is the difference between the strike prices less the premium for both calls and puts.

Here’s an example using the call spread chart above.

● I sell a call option contracts at the $200 strike price expiring in 21 days and receive $5.

● Then I buy a call option with the same expiration at $205 and pay $3.

● The premium I receive is $5 – $3 = $2, the maximum profit

● My maximum loss is $205 – $200 – $2 = $3

● My breakeven price is $200 + $2 = $202

Here’s the same example using the put spread chart above.

● I sell a put option contracts at the $203 strike price expiring in 21 days and receive $5.

● Then I buy a put option with the same expiration at $200 and pay $3.

● The premium I receive is $5 – $3 = $2, the maximum profit

● My maximum loss is $205 – $200 – $2 = $3

● My breakeven price is $205 – $2 = $203

Aligning it with tops and bottoms

Every so often, markets like to take a breather or retrace a move.

The problem is we don’t always know which will occur. However, the call credit spread works in both situations. Selling out-of-the-money call spreads lets time work in your favor, and sometimes price.

After a significant market run, I like to sell call spreads against the SPY that go out a week or so. Even a pullback for one or two days lets me pick up a chunk of the maximum profit. Ideally, I wait for a reversal signal from moving average crossovers or candlestick formations. I also like to time it with bottoms in the VIX.

When markets crash out, I love to sell put spreads that go out weeks if not months. That gives me plenty of time for the market to snap back and catch a big piece of maximum profit. Plus, implied volatility is generally at its peak, which also gives me another advantage.

The trick is not trying to go for it all every single time. When you can capture 30% to 50% of the maximum profit, it’s worth taking the trade-off.

Practice makes perfect

It can take time to learn to do credit spreads. For example, I spent years trying to figure out the best risk to reward. Turns out 30%-40% reward for your risk will do.

But, if you want to learn with others, then come join Total Alpha. You’ll get a chance to see me take these trades in real-time.

There’s a lot of profits to be made very soon.