If you’re reading this, then you managed to survive a tumultuous news week. Markets shrugged off everything from the Fed announcement to Brexit, even a lackluster trade agreement with China.

Your jump on this week shines the spotlight on catalysts—sure to have an impact on the market.

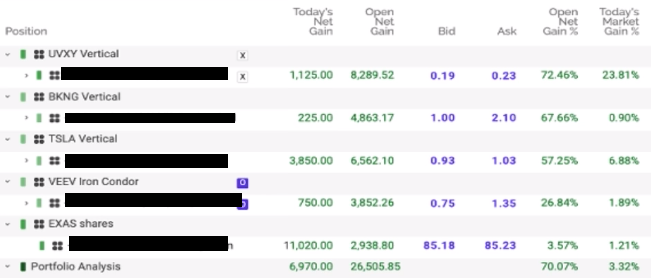

Plenty of traders went light this week, and I don’t blame them. I let my money pattern guide me, and boy did it, my Total Alpha account grew by more than $26K, check it out below.

Knowing the real market movers helped me cash in this week!

Don’t get fooled into the false sense of calm. Remember last year when markets crashed right into Christmas? Who says the grinch won’t show up again this year?

That said, I’ve rounded up all the important catalysts that you should be focused on for the upcoming week, it includes earnings dates, the economic calendar, and so much more.

I’m certain the trade deal drives more uncertainty

Businesses hate operating with uncertainty. No one wants to commit capital to long-term projects without a sense of where things are headed. Just look at all the manufacturers upended by the tariff war with China.

So why isn’t the trade deal helping the markets? It comes down to two points. First, everyone already expected this watered-down agreement. Frankly, no one knows whether it changes anything. China could fail to live up to its end but pretend while Trump goes off to campaign.

Second, we have no certainty for anything beyond this toothless accord. There’s a host of tariffs still at play, both with China and globally. There is zero clarity on those, which dwarf any assurances provided by this phase one deal.

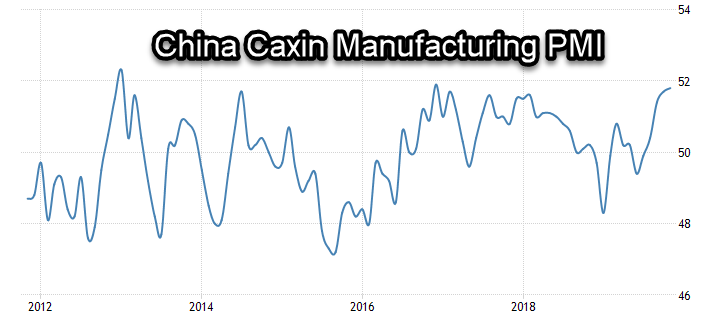

We’re also seeing signs China’s economy may be reinflating. If that’s true, it gives them a stronger hand to play with.

Brexit has done and gone

After years of bickering, Britons finally handed Boris Johnson enough seats in parliament to exit the European Union. Unless he faces significant blowback from negotiators, Johnson expects to take the U.K. out of the E.U. by the end of January.

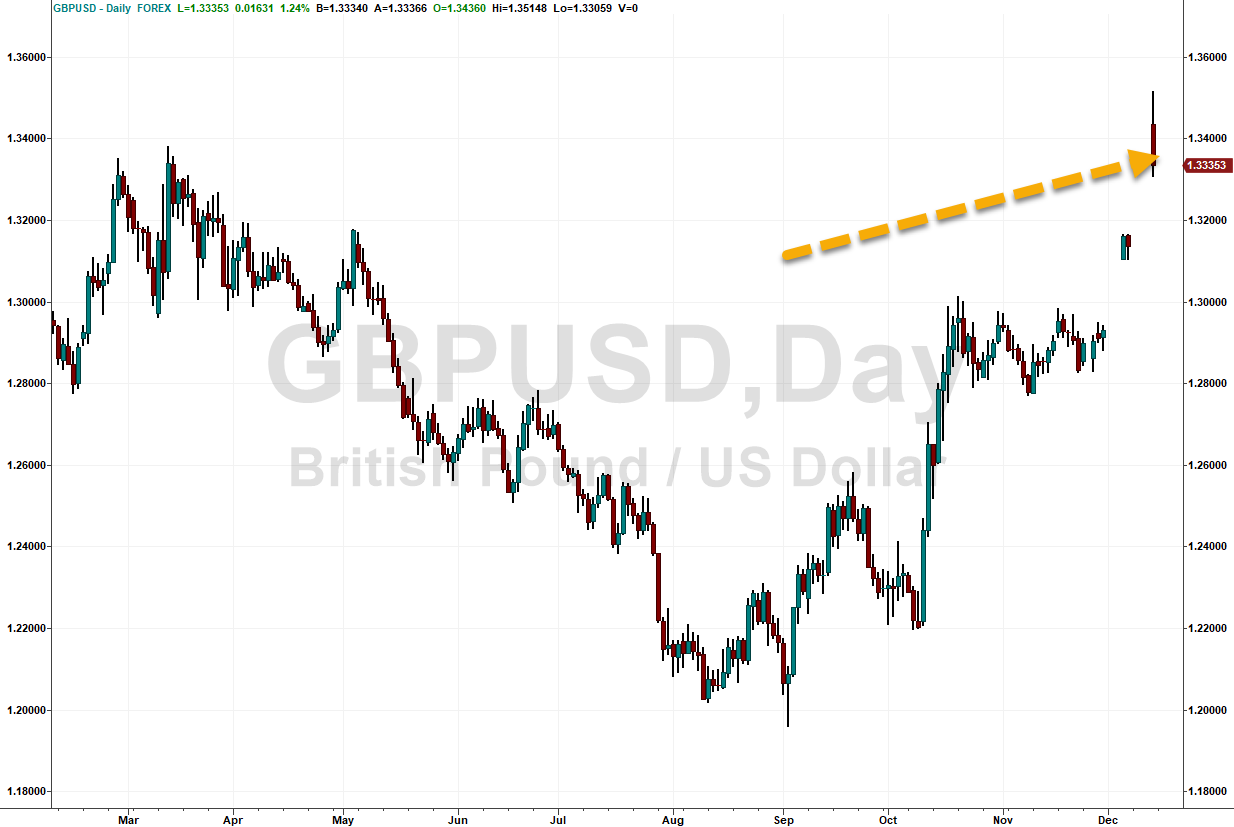

Immediately following the vote, the British Pound Sterling spiked 2% against the U.S. dollar before tapering its gains. That’s after it already gapped up to start the week.

GBP/USD daily chart

U.K. businesses can now commit to longer projects with this vote finally behind them. That makes the already attractive valuations on the FTSE stocks look even better.

Probably why the index shot up like a rocket to close out last week.

EWU weekly chart

I’m really interested in the impact on the E.U. members. Even though it’s not what many wanted, the finality of Brexit could release economic growth among members from Spain to Germany, whose stock markets have been pounded over the last few years.

EWP weekly chart

Important data being delivered

While most of us cram in last-minute shopping, we’ll receive some critical readings on the U.S. economy. The week starts strong with data the December Empire Manufacturing report along with Markit Composite PMI, Manufacturing, and Services PMI.

They’ll give us a good look into whether the economic reflation continues.

Tuesday drops housing-related data, the one bright spot for the U.S. economy. Tight lending standards have kept a lid on inventory both for buyers and renters. We also get industrial production for November.

We get our usual energy inventories and jobless claims on Wednesday and Thursday. Friday gives us revisions to Q3 GDP. Last quarter came in at a whopping 2.1% after a 2.0% in Q2.

There’s also some inflationary data with core personal consumption and expenditures. Not to be forgotten…Kansas City Fed Manufacturing for December.

And lest we forget…

The U.S. congress finishes out their budget deal, along with kicking impeachment to the senate (assuming the vote passes), as well as slipping through the USMCA if there’s still time. I’m sure there will be plenty of posturing and punditry to create plenty of family arguments around the dinner table.

On watch…

Call spreads

NFLX, AMZN, TEAM, FB, CVNA, AMD, PTON

Put spreads

TWTR, WYNN, FANG, EXAS, TPX, BIIB, COST, NKE, TSLA, ULTA, ZS, CMG, SMG, IWM, GOGO, AMZN, HUBS

Want even more trade ideas?

Click here to learn more about Total Alpha

Next Week’s Calendar

Monday, December 16th

- 8:30 AM EST – Empire Manufacturing for December

- 9:45 AM EST – Markit US Composite PMI and Manufacturing December Preliminary, US Services PMI December Final

Tuesday, December 17th

-

- 8:30 AM EST – Housing Starts & Building Permits for November

- 9:15 AM EST – Industrial Production & Capacity Utilization for November

- 4:30 PM EST – API Weekly Inventory Data

- Major Earnings: Jabil (JBL), Navistar (NAV), FedEx (FDX)

Wednesday, December 18th

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: General Mills (GIS), Paychex (PAYS), Micron (MU)

Thursday, December 19th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Current Account Balance for Q3 – If you want something random to look at

- 10:00 AM EST – Existing Home Sales November

- 10:30 AM EST – Weekly EIA Natural Gas Inventories

- Major earnings: Conagra (CAG), Darden Restaurants (DRI), Nike (NKE)

Friday, December 20th

- 8:30 AM EST – GDP Q3, Personal Consumption, Core Personal Consumption Expenditure (PCE)

- 10:00 AM EST – Personal Spending & Income November

- 11:00 AM EST – Kanas City Fed Manufacturing for December

- 1:00 PM EST – Baker Hughes Weekly Rig Count

- Major earnings: Carmax (KMX), Winnebago (WGO)