The Fed meets this week for the final time this year, where economists expect them to hold rates steady. They’ll tell you everything is great and that they have everything under control.

But we all know that isn’t true.

That’s why I’m here to give you the inside scoop on what’s at stake and how to take advantage of the opportunity.

Let’s dive deeper into equities and across other markets to find you the best opportunities.

Small caps but big rewards

For over a year the Russell 2000 small-cap index lagged the major markets. But things are about to change. Money already started flowing out of the tech sector and into small caps according to the top ETF flows from last week.

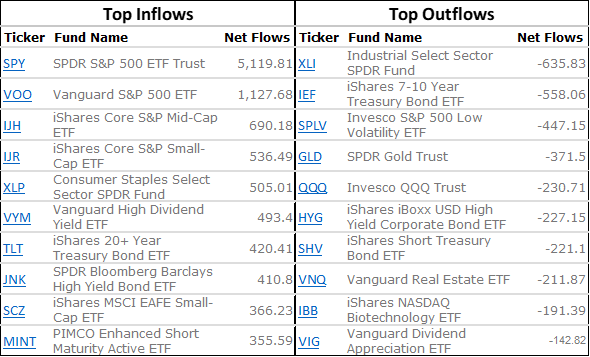

Net flows in U.S. Millions

The other top performer still remains the consumer staples sector. Earnings in companies like Costco (COST) coming up create great trading opportunities.

Diverging safety flows

You may have noticed a divergence in the safety trade. Investors continue to drop short-dated treasures in favor of long-dated ones. That doesn’t bode well for the yield curve,

But has it really caused any problems? Let’s check out the current U.S. treasury rates.

Source: U.S. Treasury

While the yield curve is compressed, there isn’t an inversion anywhere in the curve yet. The traditional measure of the 2-year to 10-year difference comes in at 0.23%. Not great, but still in the positive.

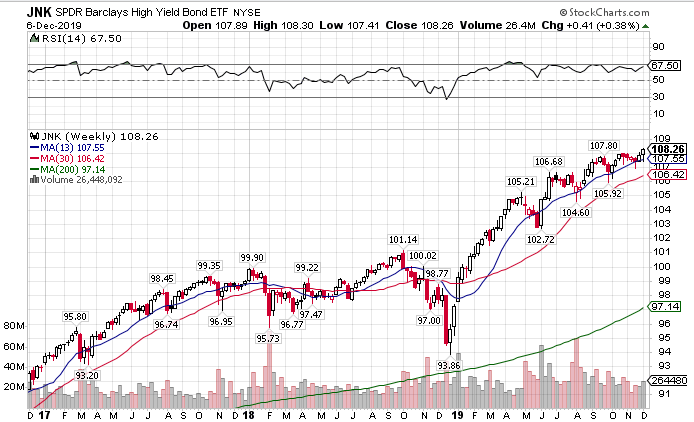

We’re also seeing investors search for yield in the fan-favorite Junk Bond sector. That’s a safe place to rest. Not like it caused any problems like the Savings & Loan crisis in the ‘80s (FYI…it did).

JNK weekly chart

If you want to see a problem look no further. We’ve made it incredibly cheap for garbage companies to issue debt. They’re getting better rates than most of us on our home loans.

You might as well create a corporation around a bag of horse manure and issue debt because it’ll be cheaper than going to the bank to refinance your house.

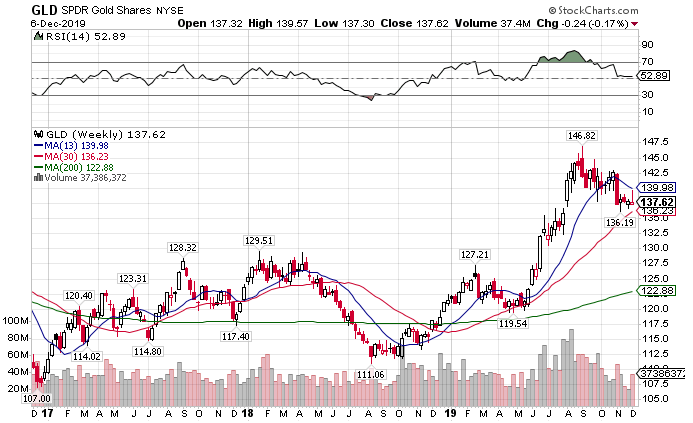

Gold continues to get weaker by the day as China slows its purchases of the yellow metal. Apparently, you don’t need a lot of good currency when your economy is in the dumps.

GLD weekly chart

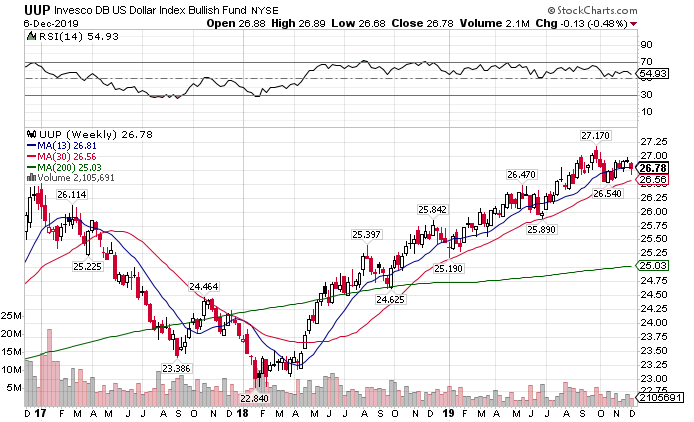

And the U.S. dollar remains exceptionally strong despite every effort from the Fed to weaken the currency. Maybe if they raise rates it will weaken the dollar? Might as well try…every other economic principle we learned no longer seems to matter.

UUP weekly chart

Smidgen of a spark in commodities

Word is OPEC and some other non-members plan to curtail production to raise oil prices. So far the rumor hasn’t done much for black gold.

USO weekly chart

All their efforts can’t offset the damage done by U.S. tariffs to Chinese production. Supply may be just below demand. But without a pickup in the global economy, oil has lost its slick.

Ohh and at this point, it’s probably cheaper to feed your kids natural gas than it is milk for breakfast.

UNG weekly chart

VIX Reversal

The VIX reversed after a big move early on the week, getting almost to $18. Its long tail candle on the weekly chart says it doesn’t plan to try that again anytime soon.

VIX weekly chart

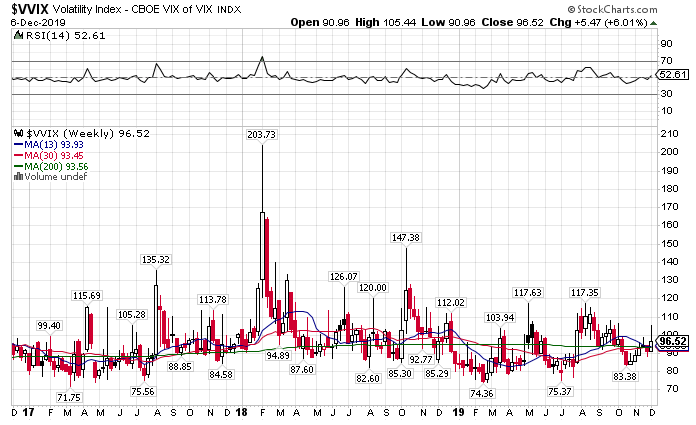

Still, the VVIX, which measures volatility of the VIX hasn’t broken down completely yet. It still looks like it wants to run a bit higher. Plus it closed back above its moving averages and into a zone that forecasts higher volatility.

VVIX weekly chart

The twofold path

I read two separate paths here. First, equities probably want to run a bit more to the upside through the end of the year. We could see a pullback for a few days. But it’s probably won’t be more than half of what we saw this past week.

Second, the Fed could screw everything up. Anyone gets a whiff of higher rates and it’ll make the 2018 end of year selloff look like a walk in the park. Plus we have the tariff deadline, budgets to pass, and a myriad of other obstacles to overcome.

The most likely path is the first of the two. But quite honestly, this is why I love trading. I don’t have to get everything right, just a few choice trades.

I wasn’t lying

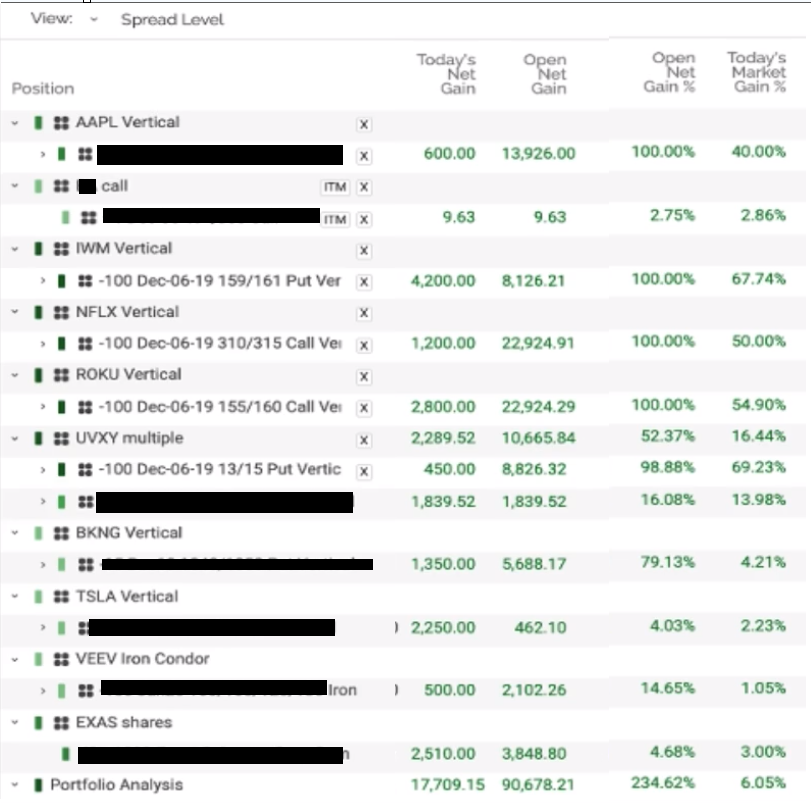

Last week I finished up big. See for yourself.

You can trade this market is right by my side, as a member of Total Alpha. These trades can be your trades.