This week’s Intermarket analysis is brought to you by the letter ‘V’… for volatility. Because, if you haven’t noticed lately—Investors have been piling into stocks this year with less protection than a teen on prom night.

We need protection from teen wolves, not whatever dirty thoughts you had!

Markets love to go up…until they come crashing down.

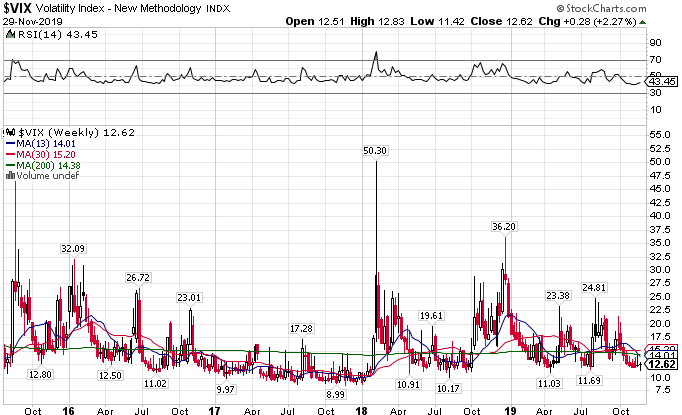

The VIX, the market’s fear and greed index, continues to trade under $13—which is low when compared to its historical average around $15.

VIX weekly chart

But guess what folks…that makes options super cheap to play. It allows you for extra cash to splurge on Cyber Monday sales (just like Jason’s Jackpot Trades)…

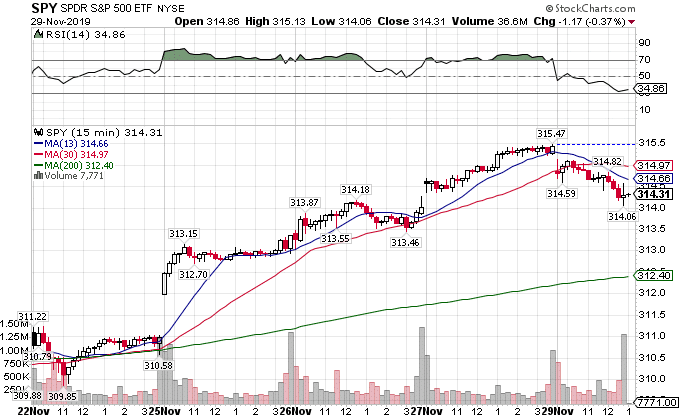

Gettin’ high with the SPY

You’d have to be, to buy the market up here. If you weren’t entirely hungover from turkey, you might have noticed a couple of kerfuffles in the market last week…starting with the fact that we didn’t end on the best of terms.

While everyone shopped on their phones, the market fell into the close 0.37%.

SPY 15-minute chart

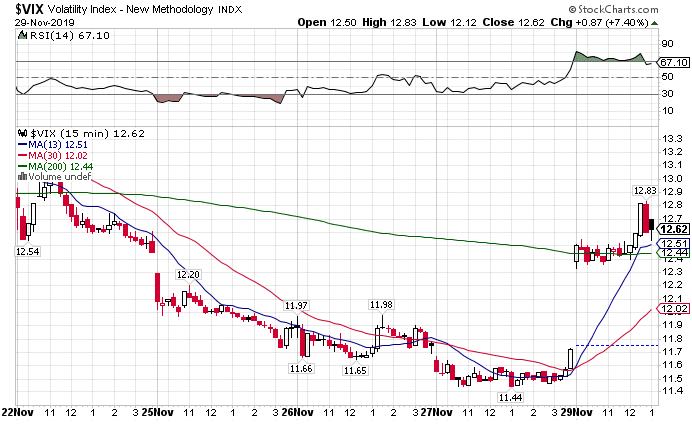

Usually, I wouldn’t fuss about something so small. But, here comes our old friend volatility. The ever sluggish VIX jumped 7.4% on the day.

VIX 15-minute chart

That pulled me out of my food coma for at least a good five minutes. I love trading the day after Thanksgiving. But, something smells fishy.

What other clues could our sleuthing uncover?

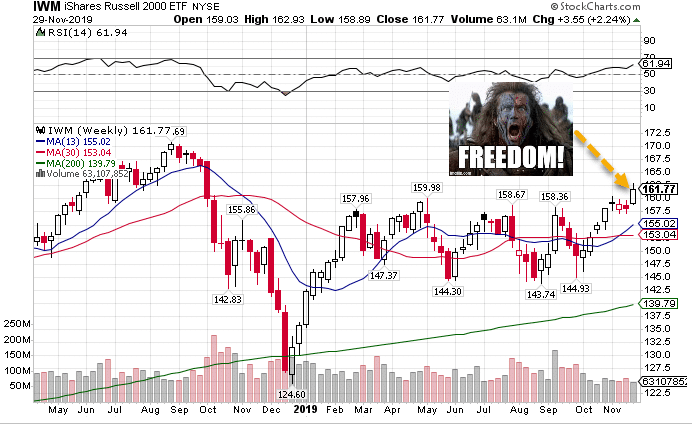

Small caps get their due

It’s been a tough year for the wittle guys in the market. They got picked on for not keeping up with their big brothers. Last week…they decided to hit puberty.

The IWM finally closed the week above the trading range that’s held them in place all year.

IWM weekly chart

That will bring in new money as investors and funds play catchup from missing the entire rally elsewhere.

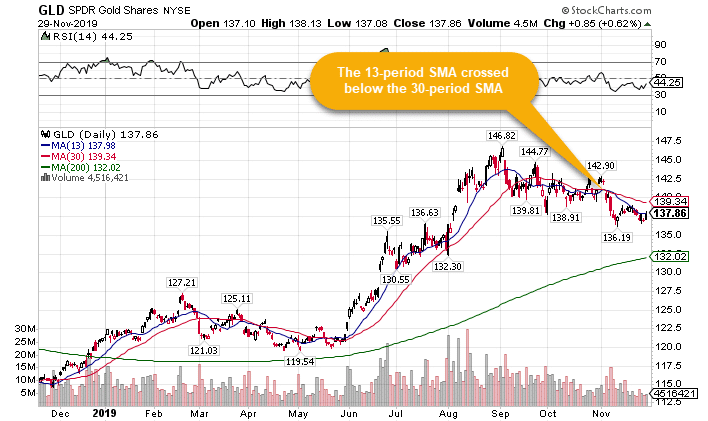

Gold lost its shine

Pundits claim that China’s mad buying spurred gold’s ridiculous run. Economists say its investors fleeing global equities for safety.

All I know is the trade looks over for now.

Gold’s refusing to get any traction to the upside. Every bounce is met by a wave of sellers. My trusted ‘money pattern’ tells me gold is about to roll over.

GLD daily chart

I’d look for the GLD to find support down at my favorite gravitational line – the 200-period moving average.

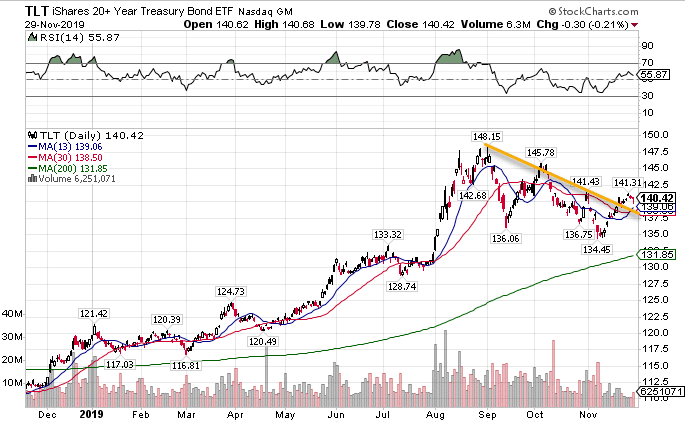

A little life in bonds

Maybe they’re the best of the worst… perhaps they’re being propped up by easy money. Whatever the case, bonds look bullish right here, right now.

The daily chart shows both my ‘money pattern’ and TLT breaking the upper trendline that connected the previous highs.

TLT daily chart

Could bonds be the bearer (pun intended) of bad news? Usually, stocks and bonds don’t trade in tandem. Is this the signal that says the rally in stocks is at an end?

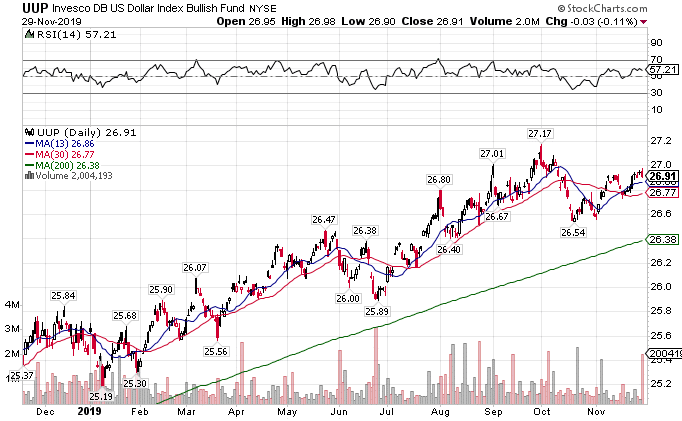

Never bet against the dollar

Long dollar investors continue to rake in the cash. This uptrend is relentless, even in the face of easy money.

UUP daily chart

The Fed says they want more inflation. How much control do they really have? They lower rates, and the dollar shrugs it off. Maybe this is why we haven’t seen any inflation in a decade despite easy money…because the Fed doesn’t control the dollar anymore.

Pray tell, what does this have to do with you?

I’m getting to it calm down.

Look, if you’re foolish enough to listen to the parade of poppycock that hits CNBC in the mornings calling for Dow gagillion, then I can’t help. You’ve already succumbed to the siren call that’s led many to sink their fortunes in the sea of sorrow.

Right now the best plays are short-term options trades…and I’m not saying that because that’s what I do every day. Listen to people with more money than me.

Warren Buffet currently sits on a stockpile of cash. Private equity funds slowed down their acquisitions. Why do this if the market will rip higher from here?

You want to limit your risk and still take down big game trades like a pro. That’s why my Total Alpha strategies work. I focus on a handful of stocks and setups that succeed year after year.

It’s easy to learn and you can implement it right here, right now.