You haven’t truly danced with the devil until you traded volatility. It’s a tricky business best left to the professionals.

But who’s going long volatility in Bullseye and Total Alpha this week and has two thumbs?

This guy!

With the market at all-time highs and some economic data actually showing improvement— now is not the time to be concerned with actual problems.

Heaven forbid investors look at declining earnings and easy Fed policy as warning signs.

No, it’s so much easier to buy into the story and follow like lemmings over the cliff.

Friday marked the 5th consecutive bullish weekly close on the SPY.

3rd quarter earnings show a decline of 2.4%, making it the third straight quarter for year-over-year declines since 2015.

Revenue grew 6.2%, with 60% of the S&P 500 companies beating estimates.

Let me break it down for you – our entire market is juiced by the Fed. How do I know? Look at December of last year. Heck, look at the reaction of the recent rate decision.

And guess what happens when they pull back?

Yeah, the market could go up even further. But the higher it goes, the harder it falls.

Equities say full speed ahead

You really can’t find any index that looks bullish here…unless you actually do your homework.

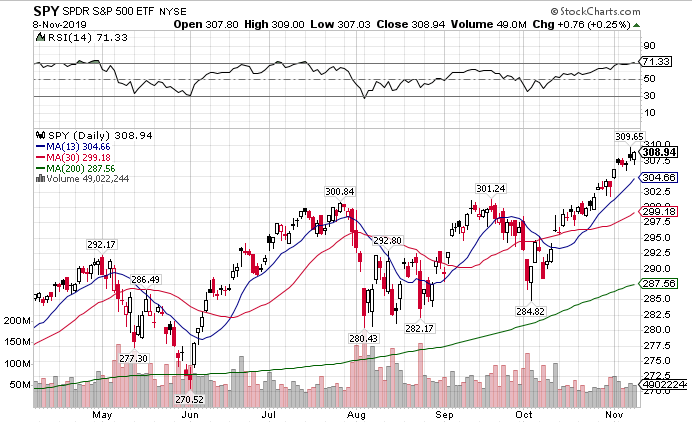

The SPY continues to make new highs in an overextended rally.

SPY daily chart

It’s marched non-stop since the beginning of October straight through the present. Remind me which month everyone says is the worst for stocks?

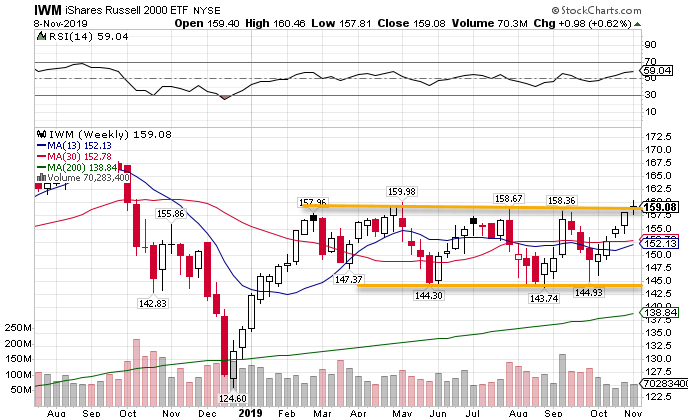

So why aren’t small caps playing along? The IWM rallied but hasn’t broken its weekly range. Is the 4th time the charm?

IWM weekly chart

Every nook and cranny of the equity market is overextended. A healthy market needs to take a little off the top here before continuing the next leg.

Bonds won’t fall far

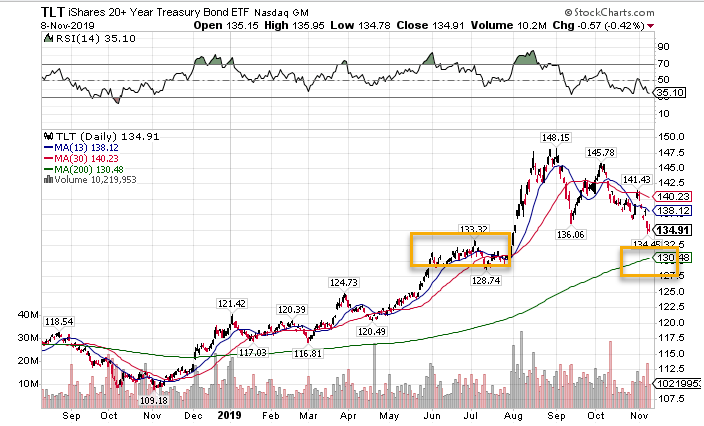

Pundits love to point to falling bonds as signs of confidence.

Normally, investors take money out of bonds to invest in stocks.

Except, the entire last year saw both of these markets trading in tandem. So which one is telling the real story here?

TLT daily chart

The bull market in bonds is far from over. Even the gravitational 200-day moving average sits extremely close by. Combined with a congestion area from the summer, the $130 price in the TLT will provide strong support.

What happens when we get there? That’s when the market really takes a downturn. If the traditional relationship of bonds and stocks returns, you’ll see a hard sell-off in equities pretty darn quick.

Yet, the market’s in trouble either way. If traders really start to unwind bond positions rates will spike up hard. That effectively negates any action the Fed takes.

Taken far enough, it could easily cause global bond selloff that spirals out of control.

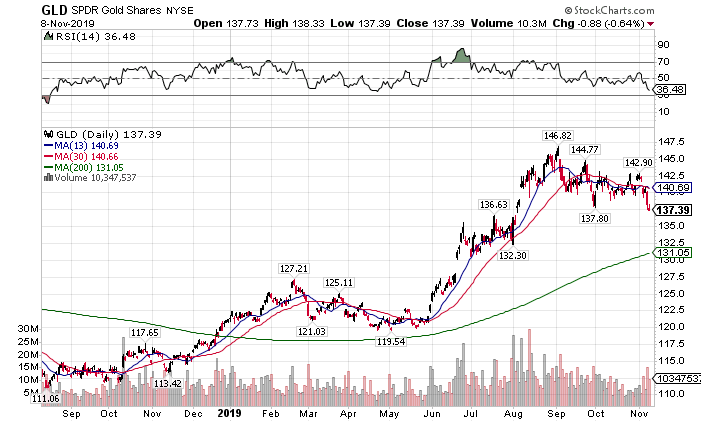

Gold still tells a cautionary tale

Just like bonds, gold won’t fall far before finding support. While the precious metal sold off last week, its move seemed tempered compared to bonds.

GLD daily chart

Its counterpart silver looks much more bearish than the yellow metal.

The VIX tells me what I need to know

No one exposes the truth better than the VIX. Traders hold record net shorts in VIX futures. The VIX continues to trade below $13.

VIX weekly chart

Count the number of weeks in 2019 the VIX remained below $13. We’re in the 3rd week. That’s why option traders aren’t buying it. The VIX may be at lows, but the VVIX continues to climb.

With record net shorts, a squeeze here could blast the VIX off quickly.

VVIX weekly chart

Show me the way sensei

Instead of buying stocks up here why don’t you give the neighborhood bully $5 to punch you in the face? You’d be much better off.

Look, trading long at highs is a fool’s game, especially for swing traders. Let’s say the market does rally some more. What are you going to pick up… 1%… 3%… if you’re lucky. I’m willing to bet you find a way to go broke faster.

That’s not to say you can’t find opportunities.

My boy Taylor Conway looks at dark pools with his Shadow Trader service.

You can be certain that when big money makes large options bets, they defend their trades even in down markets. Why do you think IPOs struggle to break below their opening print?

I want trades here that pay off big. Option calls in the UVXY or the VIX itself suit me just fine.

They don’t pay out often. But time it right and I’m looking at a multi-bagger. If I want to go a bit more conservative, I’ll do a buy-write.

But why am I telling you all this when you can just read these trades in my free article 3 winning volatility trades.

Why don’t you learn to think for yourself

It’s easy to work a 9-5 and not rock the boat… say yes every day, and go home to eat your spaghetti dinner.

Or, you could learn to trade the real way with Total Alpha. It will make you a better trader.