The moment you buy an option, the clock starts. Every second of every hour eats away at the value of that contract. If you’re not careful, the option could be worthless by expiration!

I learned to flip the script by selling options. That put time on my side. Every second that ticked away filled my bank account.

Unlike stocks, option traders need a keen sense of time. Yet, most traders blindly buy options without grasping the impact.

Nothing sucks more than watching the stock do exactly what you wanted and still losing!

Don’t blame a losing trade on a bad strategy right away. You might just not understand time decay.

That’s why I use it for the foundation of my Total Alpha service.

Time decay means options lose value every day. The closer they get to expiration, the more they lose. Traders measure the loss with the Greek symbol Theta.

Option sellers leverage time decay to churn out consistent profits like insurance companies. Not only does it create high win rates… it gives you a statistical edge.

Let me show you how they do it.

Time Decay

Think of a coin. Each time you flip it, there is a 50% chance for heads. Now I bet you that it lands on heads 10 times in a row.

I would only win that bet 0.098% of the time.

Now suppose I made the same bet, but made you flip it 1 million times. You think it would show up head 10x in a row?

Absolutely, the statistics say it will happen.

Option contracts work the same way. Except, each day is like another coin flip. The more time you allow for an event to occur, the more likely it will occur.

That’s why far out-of-the-money options going out a month cost practically nothing. But go out a year, and they may have some value.

It’s all about probabilities. And time drives those probabilities. The longer until expiration, the greater the odds the option contract pays out.

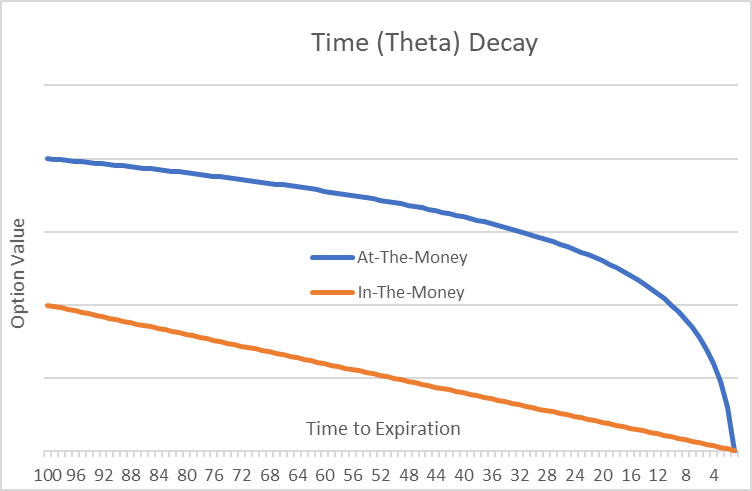

That creates the following graph on how the value of an option contract declines over time.

In-the-money options lose value in a straight line. Each day that passes cuts out the same amount as the last day.

At-the-money and out-of-the-money options work differently. They lose money at an ever-increasing rate. By the time you get within a week of expiration, it’s like a rock falling over a cliff.

Buying options

Let’s look at what happens when you buy an option.

Option buyers make money when a stock moves in the direction of their trade (up for calls, down for puts). At-the-money options have the highest amount of extrinsic value.

Note: Extrinsic value is the cost of the option that would goes to $0 by expiration. It gets smaller the further from the current stock price you get, both for in-the-money and out-of-the-money options.

Options closer to expiration cost less. But, they decay much faster. Conversely, options with a lot of time left decay slower. But they cost a lot more.

Also, the closer a stock gets to expiration, the more it moves directly with price (known as Delta). That’s why options with a long time to expiration don’t move a whole lot with the stock.

Let me lay out the big insight here. Ready?

Choose an expiration that is about 2x-3x the expected time for the trade to play out.

If you expect the trade will take two weeks to play out, give yourself a month or two. Any shorter and you run the risk of the trade not happening quick enough. Longer and you don’t get enough bang for your buck.

Now, you can reduce the impact of time decay by buying options further in-the-money. However, they go up in price as the intrinsic value increases. Additionally, the liquidity (ability to buy and sell) dries up.

That’s how I recently traded COST. I expected the setup to take a week to play out. So, I bought call options going out two weeks.

With the rise in the markets, I flipped 150% on the trade.

Selling options

So what happens when you sell an option?

You want options you sell to expire worthless. That lets you keep all the credit you receive from the sale.

Just like an insurance company, you want to collect the customer’s payment and not have to pay out a claim.

When you sell options with a lot of time left, you don’t make as much per day. Selling options close to expiration maximizes your pay per day.

However, there’s a catch…

As you get close to expiration the options start to get very cheap unless you’re at-the-money. In order to make the probabilities work, you either need to use good support and resistance or sell out-of-the-money options.

But, when you sell out-of-the-money options with little time left, you don’t get much. In fact, it can be so little that the commissions you pay don’t make the trade work.

There is a sweet spot depending on the type of trades you want to make.

First, you rarely want to sell anything over 60 days. Otherwise you don’t get enough value in the time decay. The ideal time frame for time decay is between 21-45 days.

That balances making enough on the trade and getting value from the time decay.

If you trade support and resistance levels, weekly options work well. This is the area I like to play.

I trade the charts using technical analysis. This lets me pick off areas where the stock should bounce in the other direction.

And I don’t need it to bounce for long. It can only be a few days. But, those few days are worth a lot of money in time decay, especially at the end.

So how much is your time worth? You can shorten your journey to profitability with Total Alpha. I show you exactly how I trade, along with the strategies that made me millions.