Earnings this quarter have been downright abysmal… despite 80% reporting above consensus.

Come on, year-over-year is -3.7% growth and 80% of the companies beat?

Any competent analyst should be alarmed… and yet I sense a real lack of urgency there.

It’s apparently a lot easier to set the bar so low and feign surprise than to actually do one’s job these days.

Just another reason why Wall-Street isn’t in your corner.

If they won’t tell you the real story… I will!

The road this far

We’ve had almost half the companies in the S&P 500 report earnings so far.

Of those who reported, 80% beat earnings and 64% beat revenues.

Let’s remove the ‘fluff’ factor that analysts put into these numbers to gain some perspective.

Here are the real facts:

- A -3.7% growth YOY in earnings is well below the 5-year average of +6.9%

- If we land at -3.7% (which is improved from the -4.8% the week before), it makes 3 straight quarters of declines.

Fun fact: the last time that happened was 2015-2016 - Companies reported +3.8% above expectations on average

That’s well below the prior year of 5.2% and a 5-year average of 4.9%

- YOY revenue growth is 2.8%, below the 5-year average of 3.5%.

It also marks the lowest growth rate since Q3 2016 of 2.7%

They can smear as much lipstick on the pig as they want. But, these earnings don’t point to a robust economy.

Keep in mind, these are U.S. companies. That’s not to speak of international companies from Hong Kong to Germany that will fare much worse.

Earnings Outlook

On top of just a lousy quarter, companies aren’t spraying confetti for the future.

The ever-optimistic analysts come up with the following

- Q4 2019 earnings growth of 0.7% and revenue growth of 3.0%.

- All 2019 earnings growth of 0.6% and revenue growth of 4.0%.

- Q1 2020 earnings growth of 6.0% and revenue growth of 4.7%.

- Q2 2020 earnings growth of 7.3% and revenue growth of 5.2%.

- All 2020 earnings growth of 9.9% and revenue growth of 5.3%.

Maybe we did so lousily in 2019 that it’s impossible not to beat the comps.

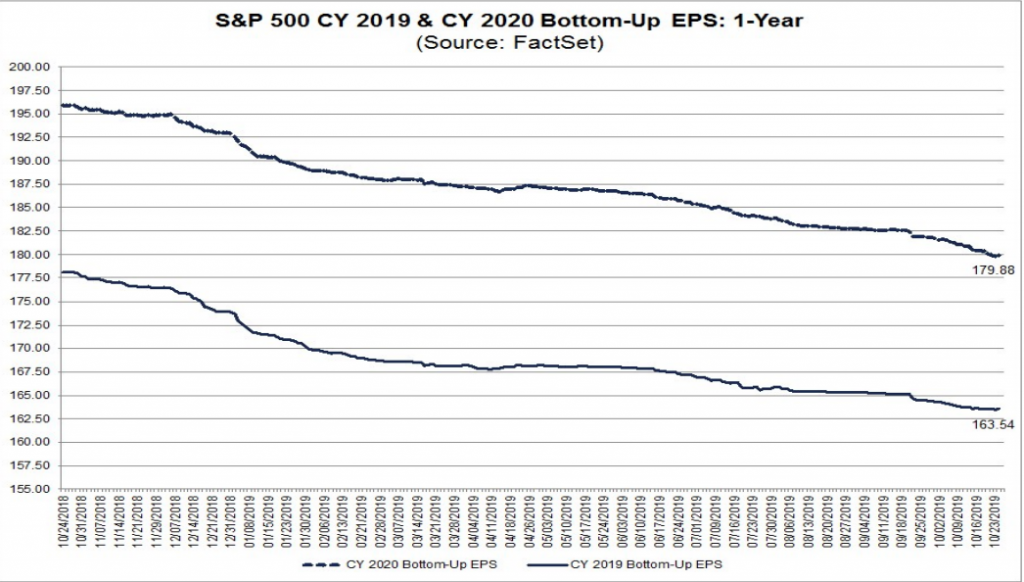

But how are we supposed to take them seriously when their earnings revisions graph out like this:

Source: Factset

What do real companies say?

Rather than listening to analysts who have as much sense as a 2-year olds piggy bank… let’s hear from the companies themselves.

Who better than the transport group?

Dow Theory relies on transports as a leading indicator. It makes sense when you think about it.

The U.S. economy heavily favors consumption. All the goods we purchase come through some mode of public transportation (at least until drones are approved and Skynet takes over).

Rail carrier CSX reported YOY declines in revenues for Q3. Their exact words for the Q4 peak season – somewhat muted.

That’s a confidence builder…

CSX didn’t sugar coat their outlook. They don’t know what 2020 will bring.

Even JB Hunt (JBHT) didn’t have a favorable outlook. In their conference call, they called the current market ‘sluggish’ on the supply side, with demand being uncertain.

On the flip side, banks came out warning of lower outlooks on the back of future rate cuts.

Nowhere in any of the commentary do companies look at the macroeconomic conditions helping them.

So if companies themselves aren’t bullish, why should the analysts be?

Sector by sector look

I find the earnings and revenues growth by sector rather interesting.

Source: Factset

Health care costs continue their meteoric rise and obliterate the American consumer. This directly reduces their discretionary income.

Energy got smoked as the temporary rise in oil and energy prices last year crumpled.

Materials continue to do worse and worse as manufacturing remains stagnant in the U.S along with slow growth in China.

What I find interesting is the decline in Consumer Staples earnings. This sector saw tons of interest the last few months as a ‘safety’ trade.

And yet they’re the first that bear the burden of higher input costs. They tend to be directly impacted by tariffs more than other consumer purchases.

In fact, utilities, real estate, and health care are really the only ones showing decent earnings growth.

We’re lapping the tax benefits, with little tailwinds left to push these companies forward.

My take

No one, including the companies have much of an idea what the macroeconomic environment will look like in 2020.

The uncertainty from Brexit, the U.S. election and trade wars sit at the top of everyone’s minds.

That’s a lot of the reason I choose defined option spread strategies. They let me limit my risk, and play individual equities or ETFs along different time frames.

Not everyone is familiar with option spreads… I got you covered.

Check out my free article where I discuss how I sell options.

Click here to read my free article

If you’d like more information on Total Alpha membership and all the amazing benefits, click the link below.