Who do they think they are with their fancy suits and catered box lunches?

I mean, everyone already knows what you plan to say and do. The market already figured it out weeks ago.

They’d be better off writing a note on a post-it and sticking it on the door.

While commentators are busy losing their minds… the rest of us have a job to do.

The very confusion they sow cracks open opportunities if you know where to look.

Want a few hints?

The one… the only… Volatility!

It should come as no surprise that Fed announcements create uncertainty. I’m not talking about the uncertainty of their decision.

No, more the uncertainty around the reaction to what they do and say.

Take 20 minutes and tune into any financial network after the announcement. You’ll find commentators trying to parse every single word… hoping to uncover some clue to the future.

Volatility coming into this meeting sits near multi-month lows.

VIX daily chart

The VIX index itself is mean-reverting. Go too low and it snaps back up. Fly to high and it crashes down to earth.

What tells the tale here is the VVIX. I laid out for paid members of Total Alpha how the VVIX began to near a consolidation area. Just like stocks, these indices will find support and resistance.

VVIX daily chart

Here’s how the logic plays out:

- The VIX tends to rise as the market goes down, and visa versa.

- Normally the VVIX will lead the VIX

- When the VVIX rises, the VIX should follow

- So… if the VVIX is nearing a bottom, the VIX should be nearing a bottom

- That can (but doesn’t have to mean) the market should be nearing a top

From here there’s a couple of trades I look at:

- Buy call options on the VIX – Yes, you can actually buy options on the VIX (that’s actually what the VVIX measures). Timing here is the key. Premium will tend to rise going into Fed announcements when the VIX is near lows. This lets rises in the VVIX (IV for the VIX) improve your position.

- Sell call spreads on the SPY – When the VIX rises the major markets tend to drop. However, they don’t need to drop a lot. That’s why call spreads work great. You don’t have to be all-out bearish… just not bullish.

- Buy calls options on the UVXY – Leveraged ETFs like the UVXY rise very quickly when volatility expands. They’re risky bets with big payoffs.

These strategies work in low volatility environments. They don’t work nearly as well when the VIX already spiked.

Gimmie some shelter

At its core, a Fed decision changes the supply and demand against the U.S. dollar. That inherently impacts any dollar-based assets – stocks, oil, and Gold.

Investors like to use gold as a ‘safety’ trade. I mean, it’s been around for thousands of years.

In fact, before we let our currency float, the U.S. dollar was tied directly to the price of gold.

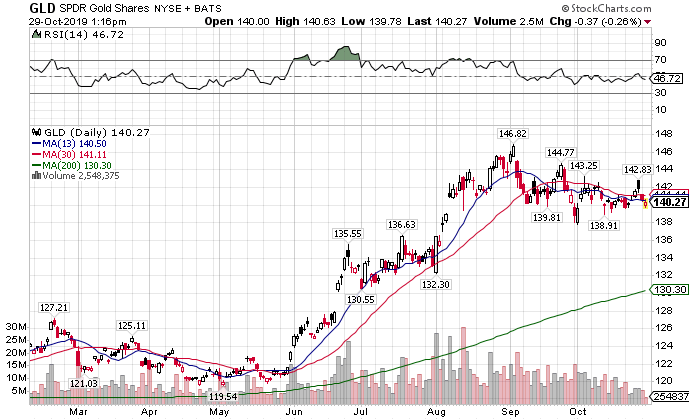

Gold continues to remain in an uptrend, despite recent price action.

GLD daily chart

One place I look to get a taste of the market’s read on Gold is the Gold VIX (GVZ).

Gold VIX daily chart

Notice how the Gold VIX elevated alongside the rise in Gold in June. Since then, it’s collapsed back down.

However, Gold still remains pricey.

That signals investors don’t expect gold to sell off anytime soon.

So how do I profit?

Quite simple… I get long gold.

Right after Fed announcements, the markets like to gyrate around. This gives me an opportunity to enter long positions at cheap prices.

I could sell put spreads in GLD under the recent lows or buy calls.

Put spreads define my risk. However, with the lower gold VIX, it’s a lot cheaper than normal to buy call options. So both have their pluses and minuses.

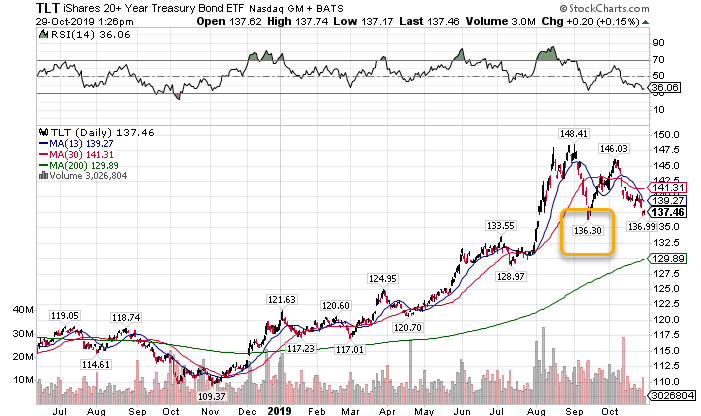

The bond bombshell

I want to see how the bond market performs this go around. Global bond yields dove as the demand for bonds shot up prices.

Coupled with easy money from central banks, and you’ve created a run in bonds not seen since the last crisis.

However, I see one opportunity here that stands out.

TLT daily chart

The recent swing low looks absolutely tantalizing. I want to see how bonds react once they’ve run the liquidity sitting below that point.

If they want to keep going, I’ll be looking towards the 200-day moving average. Otherwise, I’d be interested in selling put spreads on any signs of a reversal.

With put spreads at-the-money I want to collect 40c for every dollar risked. I won’t sell out-of-the money puts spreads. If bonds keep going, they will move hard.

Individual equity opportunities

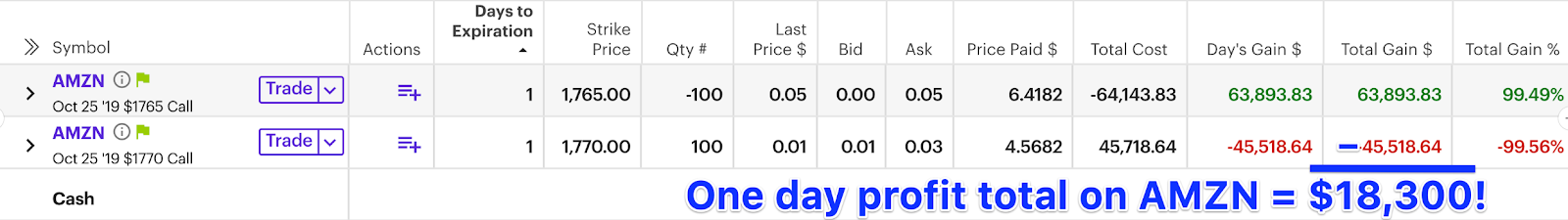

Despite all the nonsense, I found great opportunities in individual equities.

The other day I picked off AMZN on a major gap down for $18,300 profit in one day!

Right now I’m watching stocks like CGC, COST, DIS and more. I keep these stocks on my radar because I know how they trade.

Trust me, it’s much easier than scanning through every chart out there.

If you want to catch up on more of the trades I’m doing check out Total Alpha.

You get my entire portfolio streaming live. That lets you see every trade I make in real-time!