I created the Total Alpha Options Masterclass—to help shed some light on trading options.

If you haven’t checked it out yet, do so now.

Today I want to talk to you about some of the different players in the options market…

No, I’m not referring to speculators or hedgers.

I want to talk to you about market makers, what their role is and how they function.

Why?

Because there is plenty of money to be made if you know how they play the game.

The stock warehouse

Think of a market maker as a giant warehouse that sits at the end of a giant open-air market. They hold many different kinds of inventory on their shelves.

You show up at the market wanting to buy stock ABC or option EFG. Looking around, no one at the market seems to be interested.

So, you approach the market maker who’s happy to sell you the product off their shelf for a small fee (IE the spread).

On the whole, the market makers manage their inventory to ensure they have enough to buy or sell, but never too much or too little.

Without market makers, we’d be trying to match up buyers and sellers all over the place, which is much more difficult than you might think. It involves not just matching the stock, but the amount.

Market makers can be private firms like Citadel or specialists on the NYSE (although a specialist has slightly different responsibilities).

Nonetheless, they make sure that there’s always someone to buy or sell a security to for the average trader.

These companies make money through the spreads and other hedging activities on average. That doesn’t mean they profit off every trade. But, over numerous transactions, they come out on top.

Are market makers high-frequency traders?

They can be.

High-frequency traders buy and sell financial instruments at split-second speeds. This can be a market-making strategy, but doesn’t have to be.

Some market makers use high-frequency trading to bridge the gap between low-latency (slower) traders.

Interestingly, HFTs can create better spreads for the retail trader. In their constant search for profits, these companies compete with one another, driving out inefficiencies in the markets.

Now, they aren’t all upside either. In 2010, during the flash crash, when they were needed most to make a market, none of them were anywhere to be found.

Options market makers

I want to do a special focus on option market makers because of the slightly different way they operate.

As many of us know, options markets can show much wider bid/ask spreads than stocks.

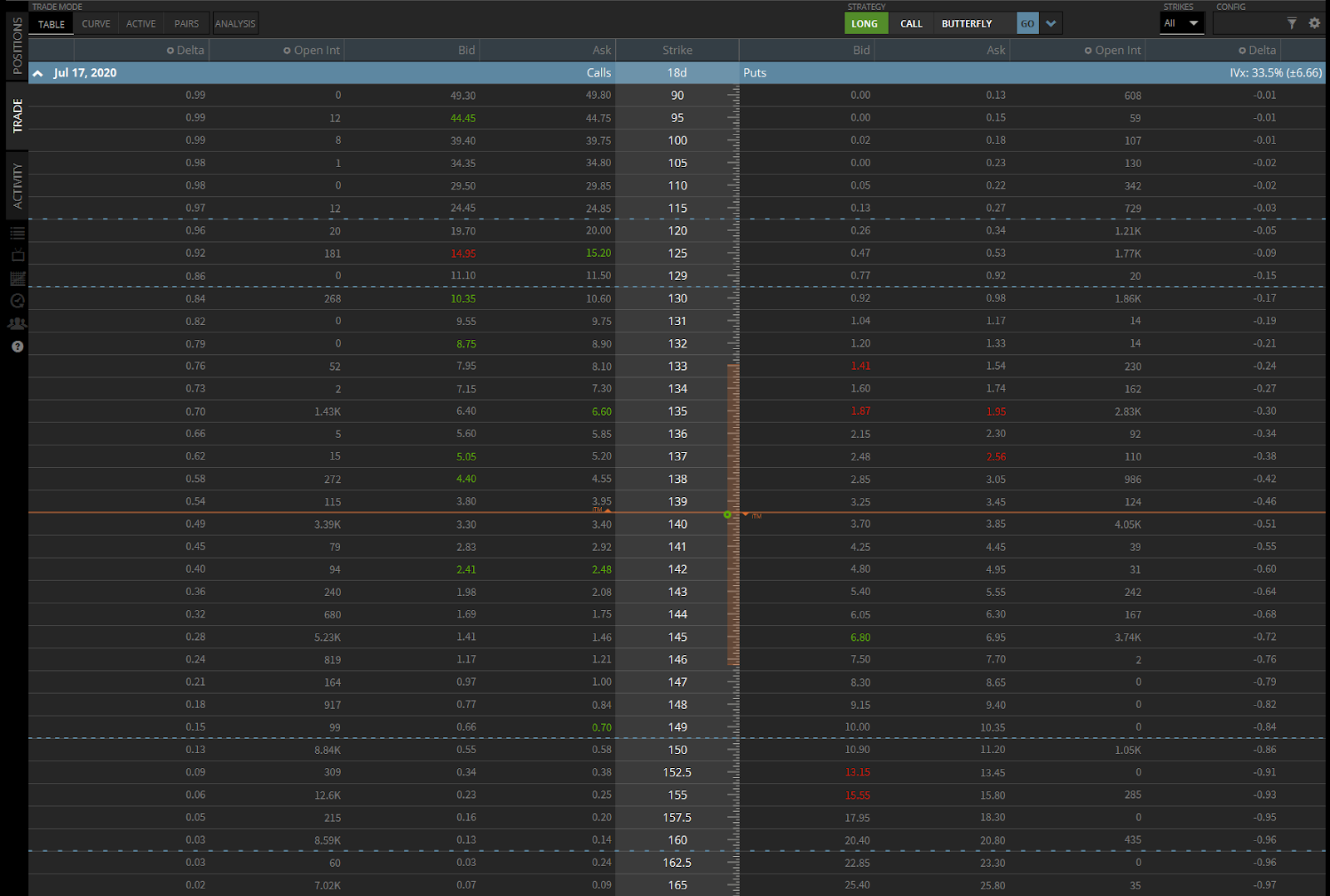

Here’s a snapshot of the option chain for Johnson & Johnson (JNJ).

You can see how the spreads on some of these can be more than 10% of the option’s price in some cases.

Next, I want to talk about how these firms manage risk.

Option market makers look to offset their risk as quickly as possible. They can do this a few different ways:

- Other options

- Futures

- Trading stocks

For example, if a market maker sells you a call option for the SPY, they may go out and immediately buy 100 shares of the SPY to offset the trade (they sell-short when they sell a put). Their profit is the bid/ask spread.

As more and more options trade, this forces more and more buying and selling of stocks in the open market.

Think about the major crash back in March. As traders bought puts on their favorite stocks, that forced market markers to short those same stocks to offset the risk.

Increases in options trading is a major part of why I believe we’ll see more volatility in the markets in the coming years.

But are they the ones running my stops?

Sometimes yes.

You have to understand, it’s nothing personal.

Their job is to provide liquidity for the markets. If they need to replenish their inventory, they’ll force a stock to trip stop orders so they pick up your forced selling.

Realize that many of these actions are done automatically by algorithms. They look for blocks of stop orders or other areas that traders likely keep their stops.

Now, I work my stop orders a little differently. Instead of putting in stop-loss orders, I actually wait for the close of a candle or the entire day before I exit the position.

And when I exit, I do it manually.

This topic is so important that I created a short video to dig into the topic a little deeper.

Click here to watch “How do I know where to put my stop-loss?”

Want to learn my favorite option techniques?

Then register for my upcoming Total Alpha Options Masterclass. You don’t want to miss this.

Click here to register for my Total Alpha Options Masterclass