With equities plunging in and out of bear market territory, some exchange-traded products called it quits. As of March 23rd, 29 leveraged and inverse exchange-traded products have vanished off the face of the Earth.

You MUST understand the dangers these pose and learn alternative methods to trade them. Otherwise, you could be putting your capital at unnecessary risk.

Not all exchange-traded products are evil. Most of us know about the S&P 500 SPY ETF or the Nasdaq 100 QQQ ETF. Both of these are solid choices backed by asset ownership.

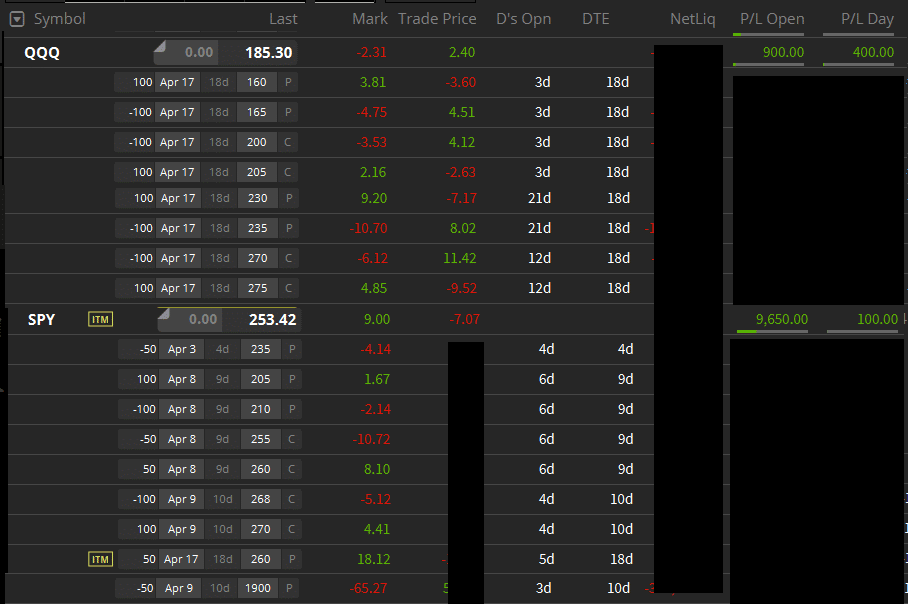

Heck, I’ve got plenty of positions of both in my Total Alpha Portfolio Right now!

The danger comes when you play with thinly traded ETPs (or ETN) that either don’t own the assets to back up their shares…

Or create hazardous amounts of leverage that put shareholders at risk.

Allow to me specifically explain to you where the danger lies, how to avoid it, and alternatives you can consider.

Tons of people have lost money trading some of these products, even firms have gone under because of them.

This is one lesson you can’t afford to miss.

How ETPs Operate

Exchange-Traded Products is a term that covers two types of stocks: Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs).

Exchange-Traded Funds work like mutual funds that trade like stocks. They own the underlying assets for whatever strategy they use. The SPY ETF holds all the stocks in the S&P 500 proportional to their weight, regularly rebalancing as a mutual fund would.

Exchange-Traded Notes are issued by banks and are promissory debt notes for whatever strategy they are tracking. The VXX is an ETN that tracks VIX short-term futures.

Both have their pros and cons. When an ETF liquidates, it sells all the assets and pays back the shareholders. If an ETN folds, they may not get squat. That all depends on the issuing institution. But, ETNs tend to have lower tracking errors. That means they’ll follow the asset more closely than an ETF.

Identifying Dangerous ETPs

Generally speaking, ETFs are less likely to fold than an ETN. However, that isn’t always the case.

You can look for a handful of clues that signal potential danger for an ETP’s future.

- Leverage – Any ETP that deploys leverage borrows money. If anything go wrong and they can’t cover their debts, they could be forced to liquidate. The higher the leverage, the more risk.

- Underlying Assets at Extreme Levels – In 2018, a well known short VIX ETN blew up overnight when volatility shot up. We see similar problems in VIX and oil products. When you get assets, especially ones that aren’t owned outright, at extreme levels, there’s a higher risk of the ETP folding.

- Low Volume – If there isn’t a lot of interest in the ETP, there’s probably a good reason. The lower the volume, the wider the spreads. That means more money to the market maker instead of you.

- Low Share Price – Once share prices start to dip below $10, the ETPs consider doing a reverse split to boost share prices. In theory, that shouldn’t hurt your holding, but it’s not seen as a sign of health. We just had the XOP ETF make this announcement recently.

- Small Amount of Assets Under Management (AUM) – When funds don’t have a lot of capital, they’re more likely to fold. You can easily see the difference when you compare the AUM for a popular ETF like the XLI to some random one out there.

Ratings agencies also do a decent job of letting you know which ETPs are riskier than others. They tell you not only how long they’ve been in business, but the expense ratio as well as overall health.

Dealing With ETPs

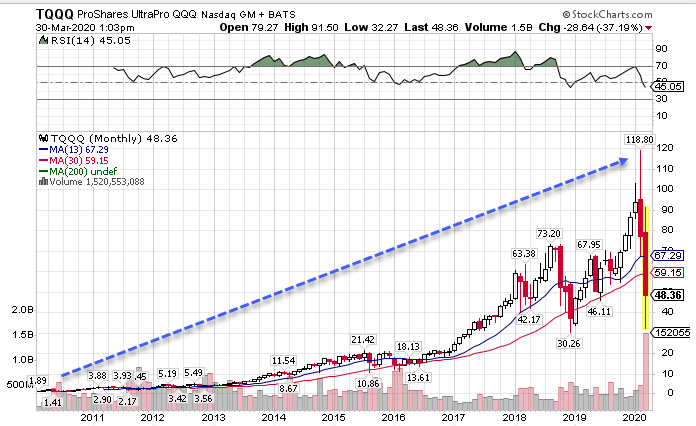

I can’t knock all ETPs. Prior to this recent landslide, the TQQQ Nasdaq 3x ETP returned a whopping 100x over a 10 year period.

TQQQ Monthly Chart

But, as you can see, the decline off that high has been fierce. Imagine putting in $10,000 initially. You would have had $1,000,000 and then watched that turn to $400,000 in a matter of weeks.

Personally, I’d rather do what I do best – play options.

One of the main reasons I prefer options is overnight risk. You hold any stock or ETP overnight, and there is always a risk of something catastrophic happening. It’s happened to me more than once.

Options let me define my risk before the trade gets underway. If an ETP blows up overnight, I’ll be alright. My losses are limited to the risk I determined ahead of time.

The best part about options are their flexibility. You can create trades that give you massive upside or downside potential, defined risk/rewards, or any other host of choices. When you use them right, they’re the best friend you never knew you had.

Learning How To Use Options

One of the best ways to get started with options is with my free masterclass. I’ll walk you not just through the basics, but how to employ option trading and strategies in today’s market.

Click here to sign up for my free masterclass.