Second-guessing is a first-class ticket to Loserville. As traders, we grind it out day in and day out, no matter what the market holds for us.

And it’s my job to give you the map to guide these stormy seas.

Just the other day I sat down with Ben Sturgill for a WealthWise podcast interview and gave my outlook for the coming months, the sectors to go long, and potential pitfalls out there.

Listen to it here . It goes extremely well with a morning coffee or on your ride to work.

But before you do, I’d like to share with you some sectors I’m eyeballing for potential trades. Some will appear obvious, others not so much.

Travel & Leisure Are Great Bearish Bets

I’m a big fan of carrying a neutral portfolio where my bearish positions offset my bullish positions. That may sound counterintuitive. I make my money by picking the right charts at the right times to place my bets as well as profiting from option premium time decay.

The big issue on everyone’s mind is the Coronavirus. Pundits are talking about school closings, reduced travel, you name it…anything with a big gathering is on the chopping block. So, we’re seeing a lot of hotel companies, theme parks, and airlines get smashed.

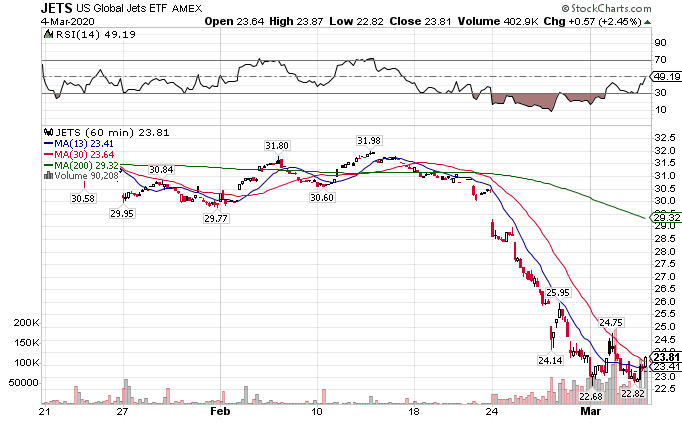

Take a look at the airlines ETF JETS. This ETF holds stocks like Southwest Airlines, Delta, United, etc.

JETS Hourly Chart

We’re talking almost a third of airline stocks’ values wiped out in a matter of weeks! The last time we saw this kind of pressure on travel was after 9/11.

But it’s not just the airlines getting hammered. Theme parks like Disney, Six Flags, even hotels are all feeling the crunch.

And this theme is just getting started. People love to overreact out of fear. At some point, these companies will be a great value. For now, until we know the extent of the pandemic, these are ones to sell into rallies.

The Fed’s Dead Baby…The Fed’s Dead

The last time the Federal Reserve came out with an emergency rate cut was the beginning of 2008. Can you guess what happened shortly thereafter?

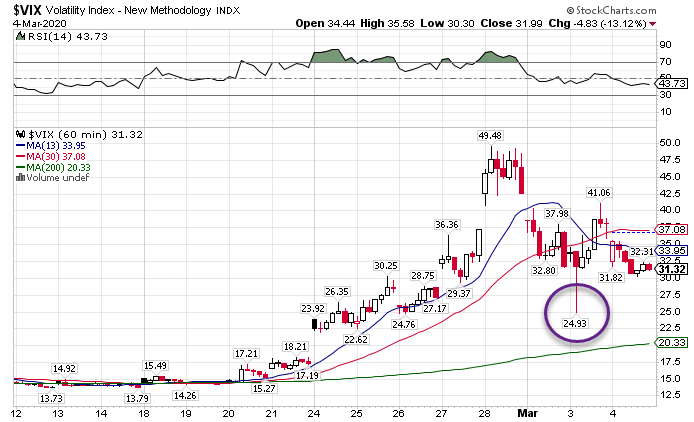

Initially, the market rallied off the news before plunging a thousand points. While everyone’s focused on the faceplant the market made, I saw something interesting in the VIX.

Take a look at the hourly chart for the VIX.

VIX Hourly Chart

I have a sneaking suspicion that level will be extremely important. That swing point is the furthest the option market could move before traders stepped back in and bought up puts. For the VIX that was nearly a 20% swing.

Guess what didn’t rally that much…the actual markets!

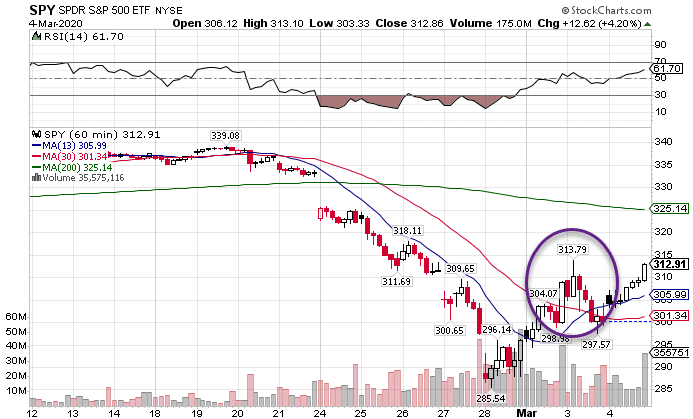

SPY Hourly Chart

Notice how the market had already moved up on the day. The Fed announcement barely moved the SPY.

Put these two clues together, and it tells me that as soon as they saw an opening, traders pounced on those put options as fast as they could. Shortly thereafter, the market tanked.

Yesterday’s market got close, but still didn’t close above that level. In fact, the VIX still hasn’t made it back below $30, which is an incredibly high price.

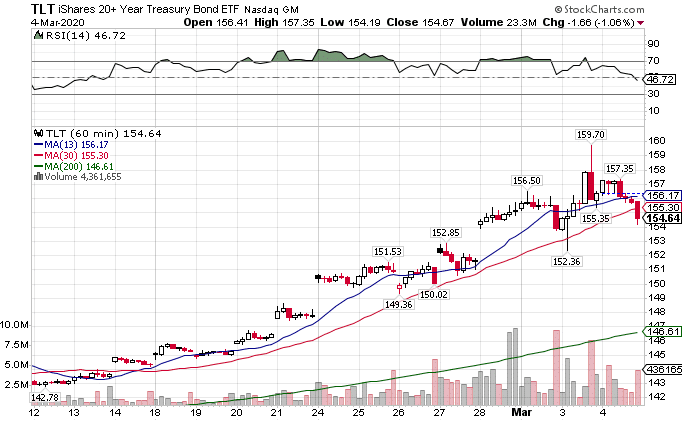

That’s why you can’t take these rallies as anything other than selling opportunities for the time being. We don’t have any signals the market is about to turnaround. And from the looks of the bond market, investors still want to hide their money in crappy yields.

TLT Hourly Chart

Not all stocks care what the market thinks

There’s a couple of stocks out there that like to dance to their own tune. Tesla’s been a great example where it’s not trading on the same wavelength as the broader market.

But my two favorites so far have been SPCE and NFLX. I’ve played SPCE almost every week for the past month and banked some big profits. I’ve done everything from a short strangle to a covered call (where I made an awesome video explaining my trade for you to check out.)

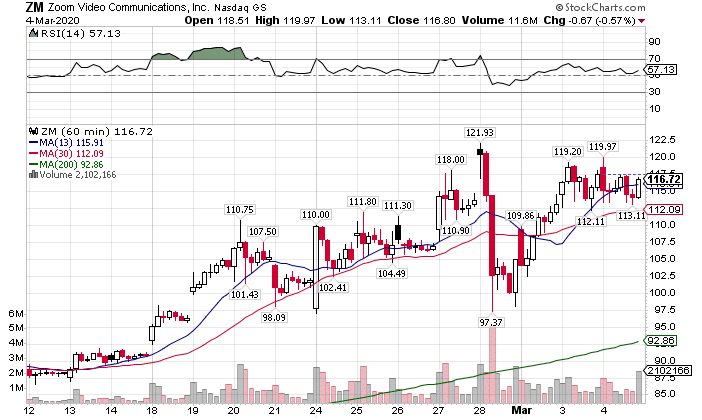

Zoom Media (ZM) has by far been the most disconnected to the broader market. Consider the chart from the SPY above and now look at this one from ZM.

ZM Hourly Chart

Looks a little different wouldn’t ya’ say?

The key to finding these disconnected stocks is to look for ones with high volume but aren’t part of major ETFs. IPOs are great ones like DOCU, DDOG, and ZM. They’re popular trading vehicles but aren’t part of any indexes, thus insulated from broad market selloffs.

So where do we go from here?

Great question! Probably better if I just tell you…